Question: Calculate this using FIFO, LIFO, Weighted average. This will be my fourth time posting this so I hope someone can actually explain it. FIFO, LIFO,

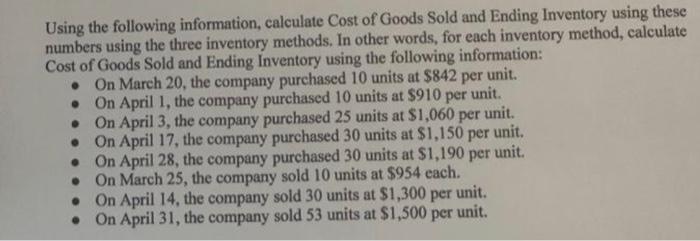

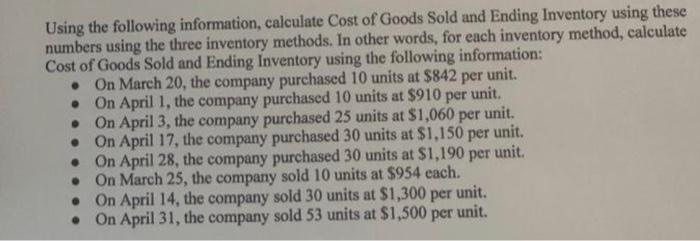

Using the following information, calculate Cost of Goods Sold and Ending Inventory using these numbers using the three inventory methods. In other words, for each inventory method, calculate Cost of Goods Sold and Ending Inventory using the following information: - On March 20, the company purchased 10 units at $842 per unit. - On April 1, the company purchased 10 units at $910 per unit. - On April 3, the company purchased 25 units at \$1,060 per unit. - On April 17, the company purchased 30 units at $1,150 per unit. - On April 28, the company purchased 30 units at $1,190 per unit. - On March 25, the company sold 10 units at $954 each. - On April 14, the company sold 30 units at $1,300 per unit. - On April 31, the company sold 53 units at \$1,500 per unit. Using the following information, calculate Cost of Goods Sold and Ending Inventory using these numbers using the three inventory methods. In other words, for each inventory method, calculate Cost of Goods Sold and Ending Inventory using the following information: - On March 20, the company purchased 10 units at $842 per unit. - On April 1, the company purchased 10 units at $910 per unit. - On April 3, the company purchased 25 units at \$1,060 per unit. - On April 17, the company purchased 30 units at \$1,150 per unit. - On April 28, the company purchased 30 units at $1,190 per unit. - On March 25, the company sold 10 units at $954 each. - On April 14, the company sold 30 units at $1,300 per unit. - On April 31, the company sold 53 units at \$1,500 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts