Question: calculate using straight line method, double declining and units of production Part B Depreciation (20 marks) West Point Lighthouse Corporation purchased equipment on September 1,

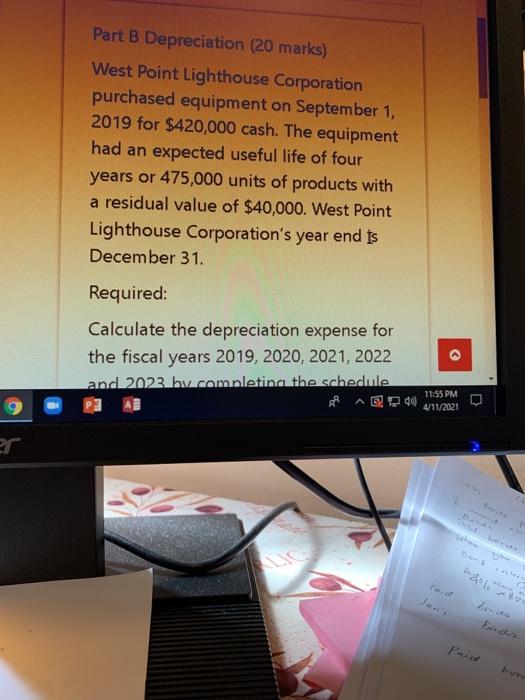

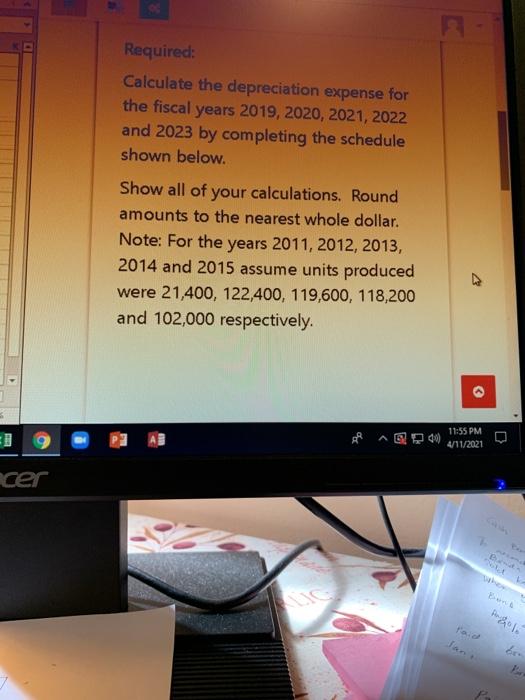

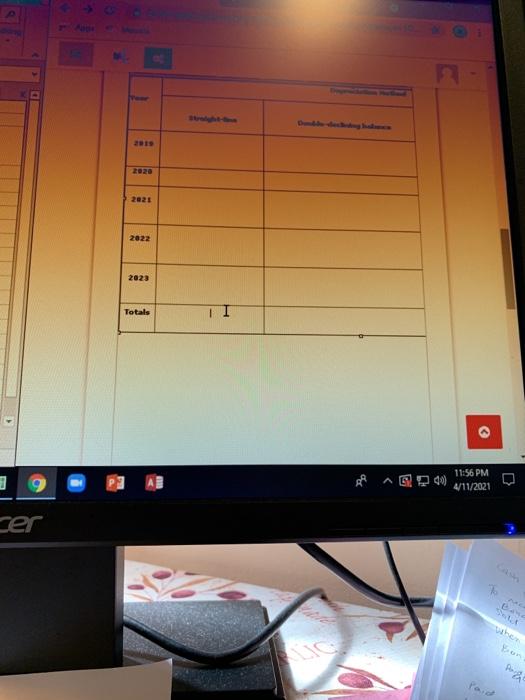

Part B Depreciation (20 marks) West Point Lighthouse Corporation purchased equipment on September 1, 2019 for $420,000 cash. The equipment had an expected useful life of four years or 475,000 units of products with a residual value of $40,000. West Point Lighthouse Corporation's year end is December 31. Required: Calculate the depreciation expense for the fiscal years 2019, 2020, 2021, 2022 and 2023 by completing the schedule AB 11:55 PM 4/11/2021 Bards Required: Calculate the depreciation expense for the fiscal years 2019, 2020, 2021, 2022 and 2023 by completing the schedule shown below. Show all of your calculations. Round amounts to the nearest whole dollar. Note: For the years 2011, 2012, 2013, 2014 and 2015 assume units produced were 21,400, 122,400, 119,600, 118,200 and 102,000 respectively. 11:55 PM 4/11/2021 cer Podols 2023 2022 2023 Totals 11:56 PM 4/11/2021 saigh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts