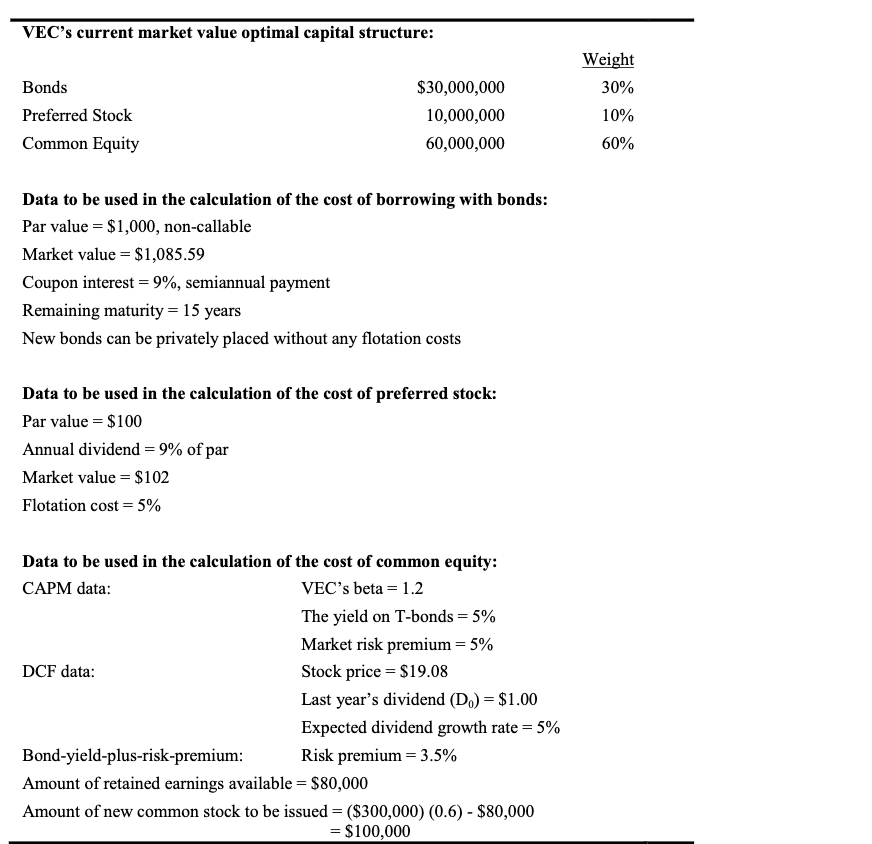

Question: Calculate VECs WACC using the data VEC's current market value optimal capital structure: Bonds Preferred Stock Common Equity $30,000,000 10,000,000 60,000,000 Weight 30% 10% 60%

Calculate VECs WACC using the data

VEC's current market value optimal capital structure: Bonds Preferred Stock Common Equity $30,000,000 10,000,000 60,000,000 Weight 30% 10% 60% Data to be used in the calculation of the cost of borrowing with bonds: Par value = $1,000, non-callable Market value = $1,085.59 Coupon interest = 9%, semiannual payment Remaining maturity = 15 years New bonds can be privately placed without any flotation costs Data to be used in the calculation of the cost of preferred stock: Par value = $100 Annual dividend = 9% of par Market value = $102 Flotation cost = 5% = Data to be used in the calculation of the cost of common equity: CAPM data: VEC's beta = 1.2 The yield on T-bonds = 5% Market risk premium = 5% DCF data: Stock price = $19.08 Last year's dividend (D.) = $1.00 Expected dividend growth rate = 5% Bond-yield-plus-risk-premium: Risk premium = 3.5% Amount of retained earnings available = $80,000 Amount of new common stock to be issued = ($300,000) (0.6) - $80,000 = $100,000 VEC's current market value optimal capital structure: Bonds Preferred Stock Common Equity $30,000,000 10,000,000 60,000,000 Weight 30% 10% 60% Data to be used in the calculation of the cost of borrowing with bonds: Par value = $1,000, non-callable Market value = $1,085.59 Coupon interest = 9%, semiannual payment Remaining maturity = 15 years New bonds can be privately placed without any flotation costs Data to be used in the calculation of the cost of preferred stock: Par value = $100 Annual dividend = 9% of par Market value = $102 Flotation cost = 5% = Data to be used in the calculation of the cost of common equity: CAPM data: VEC's beta = 1.2 The yield on T-bonds = 5% Market risk premium = 5% DCF data: Stock price = $19.08 Last year's dividend (D.) = $1.00 Expected dividend growth rate = 5% Bond-yield-plus-risk-premium: Risk premium = 3.5% Amount of retained earnings available = $80,000 Amount of new common stock to be issued = ($300,000) (0.6) - $80,000 = $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts