Question: ? Calculating a bond price - Excel FORMULAS DATA REVIEW FILE HOME INSERT PAGE LAYOUT VIEW Sign In Arial 12 10 M - A -A

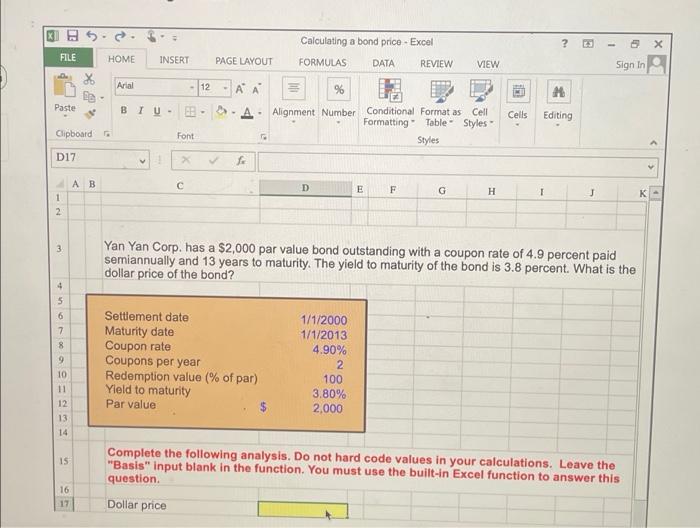

? Calculating a bond price - Excel FORMULAS DATA REVIEW FILE HOME INSERT PAGE LAYOUT VIEW Sign In Arial 12 10 M - A -A Paste BIU- AS- Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A D17 D E F G H K 1 2 3 Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 3.8 percent. What is the dollar price of the bond? 4 5 6 7 8 9 Settlement date Maturity date Coupon rate Coupons per year Redemption value (% of par) Yield to maturity Par value $ 1/1/2000 1/1/2013 4.90% 2 100 3.80% 2,000 10 11 12 13 14 15 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question 16 17 Dollar price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts