Question: calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of $315.000.

calculating changes in net operating

working capital) Duncan Motors is

introducing a new product and has an expected change in net operating

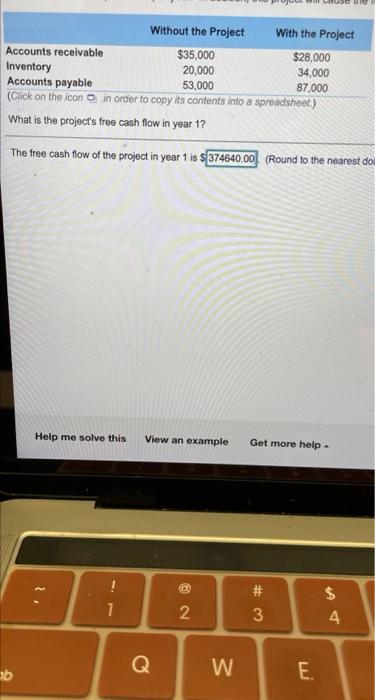

income of $315.000. Duncan Motors has a 32 percent marginal tax rate. This project will also produce $48,000 of depreciation per year. In addition, this project will cause the

following changes in year 1.

if 374640 is your answer that is incorrect.

if 374640 is your answer that is incorrect. Without the Project With the Project Accounts receivable $35,000 $28,000 Inventory 20,000 34.000 Accounts payable 53,000 87,000 (Click on the icon in order to copy its contents into a spreadsheet) What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is $ 374640.00 (Round to the nearest dom Help me solve this View an example Get more help * ! 1 N 2 $ 4 3 Q W E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock