Question: (Calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of

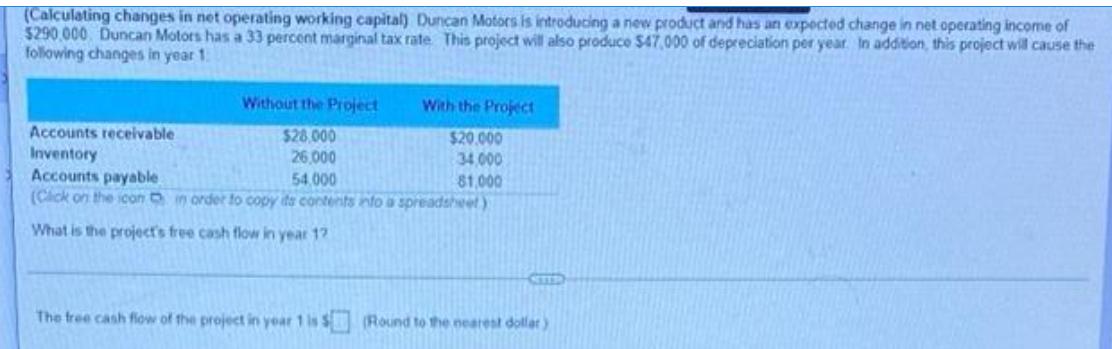

(Calculating changes in net operating working capital) Duncan Motors is introducing a new product and has an expected change in net operating income of $290.000 Duncan Motors has a 33 percent marginal tax rate. This project will also produce $47,000 of depreciation per year. In addition, this project will cause the following changes in year 1 Accounts receivable Inventory Accounts payable Without the Project With the Project $28,000 $20.000 26,000 34,000 54,000 81,000 (Click on the icon in order to copy its contents into a spreadsheet) What is the project's free cash flow in year 17 The free cash flow of the project in year 11 (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts