Question: calculation on Excel would be preferable Gemini Corp is a publicly traded corporation, with both its bonds and common equity shares traded in the open

calculation on Excel would be preferable

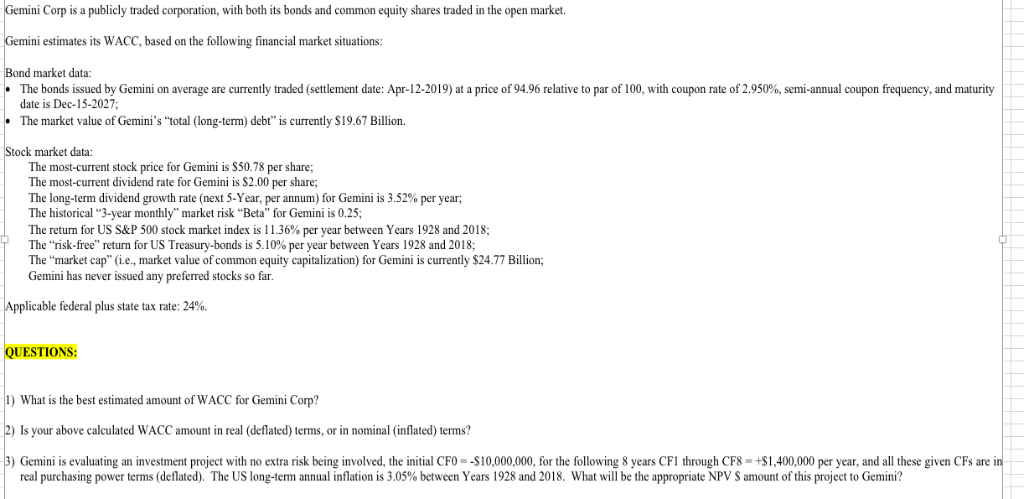

Gemini Corp is a publicly traded corporation, with both its bonds and common equity shares traded in the open market Gemini estimates its WACC, based on the following financial market situations Bond market data The bonds issued by Gemini on average are currently traded (settlement date: Apr-12-2019) at a price of 94.96 relative to par of 100, with coupon rate of 2.90%, semi-annual coupon frequency, and maturity date is Dec-15-2027 The market value of Gemini's "total (long-term) debt" is currently S19.67 Billion. Stock market data: The most-current stock price for Gemini is $50.78 per share; The most-current dividend rate for Gemini is $2.00 per share The long-term dividend growth rate (next 5-Year, per annum) for Gemini is 3.52% per year, The historical "3-year monthly" market risk "Beta" for Gemini is 0.25 The return for US S&P 500 stock market index is 1 1.36% per year between Years 1928 and 2018; The "risk-free" return for US Treasury-bonds is 5. 10% per year between Years 1928 and 2018; The "market cap" (i.e., market value of common equity capitalization) for Gemini is currently $24.77 Billion; Gemini has never issued any preferred stocks so far Applicable federal plus state tax rate: 24%. UESTIONS: 1 What is the best estimated amount of WACC for Gemini Corp? 2) Is your above calculated WACC amount in real (deflated) terms, or in nominal (inflated) terms? 3) Gemini is evaluating an investment project with no extra risk being involved, the initial CFO-S10,000,000, for the following 8 years CFI through CF8 1,400,000 per year, and all these given CFs are in The US long term annual inflations 30 % between Years l what will be he appropriate NP San unto hispr real purchasing power terms (deflated) 28 and 20 s to Gemini Gemini Corp is a publicly traded corporation, with both its bonds and common equity shares traded in the open market Gemini estimates its WACC, based on the following financial market situations Bond market data The bonds issued by Gemini on average are currently traded (settlement date: Apr-12-2019) at a price of 94.96 relative to par of 100, with coupon rate of 2.90%, semi-annual coupon frequency, and maturity date is Dec-15-2027 The market value of Gemini's "total (long-term) debt" is currently S19.67 Billion. Stock market data: The most-current stock price for Gemini is $50.78 per share; The most-current dividend rate for Gemini is $2.00 per share The long-term dividend growth rate (next 5-Year, per annum) for Gemini is 3.52% per year, The historical "3-year monthly" market risk "Beta" for Gemini is 0.25 The return for US S&P 500 stock market index is 1 1.36% per year between Years 1928 and 2018; The "risk-free" return for US Treasury-bonds is 5. 10% per year between Years 1928 and 2018; The "market cap" (i.e., market value of common equity capitalization) for Gemini is currently $24.77 Billion; Gemini has never issued any preferred stocks so far Applicable federal plus state tax rate: 24%. UESTIONS: 1 What is the best estimated amount of WACC for Gemini Corp? 2) Is your above calculated WACC amount in real (deflated) terms, or in nominal (inflated) terms? 3) Gemini is evaluating an investment project with no extra risk being involved, the initial CFO-S10,000,000, for the following 8 years CFI through CF8 1,400,000 per year, and all these given CFs are in The US long term annual inflations 30 % between Years l what will be he appropriate NP San unto hispr real purchasing power terms (deflated) 28 and 20 s to Gemini

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts