Question: CALCULATOR FULL SCREEN PRINTER VERSION A BACK NE Problem 9-07A a Pronghorn Corporation and Monty Corporation, two companies of roughly the same size, are both

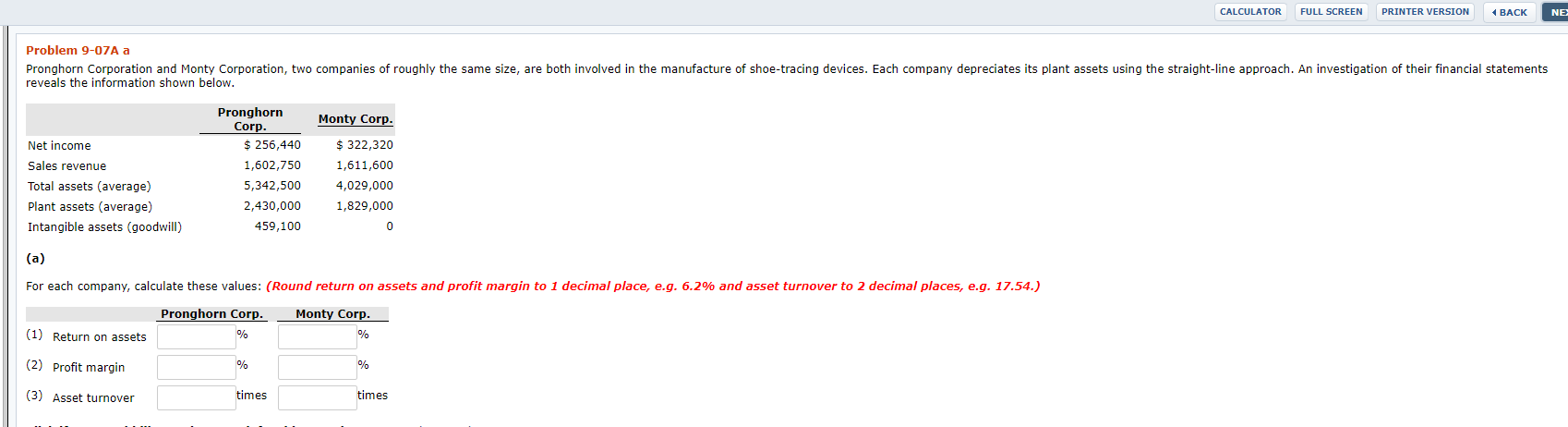

CALCULATOR FULL SCREEN PRINTER VERSION A BACK NE Problem 9-07A a Pronghorn Corporation and Monty Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. Monty Corp. Net income Sales revenue Total assets (average) Plant assets (average) Intangible assets (goodwill) Pronghorn Corp. $ 256,440 1,602,750 5,342,500 2,430,000 459,100 $ 322,320 1,611,600 4,029,000 1,829,000 0 (a) For each company, calculate these values: (Round return on assets and profit margin to 1 decimal place, e.g. 6.2% and asset turnover to 2 decimal places, e.g. 17.54.) Pronghorn Corp. % Monty Corp. % (1) Return on assets (2) Profit margin % % (3) Asset turnover times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts