Question: CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Problem 12-4 (Part Level Submission) Consider the following information for Speedway Electronics: Total assets Noninterest-bearing

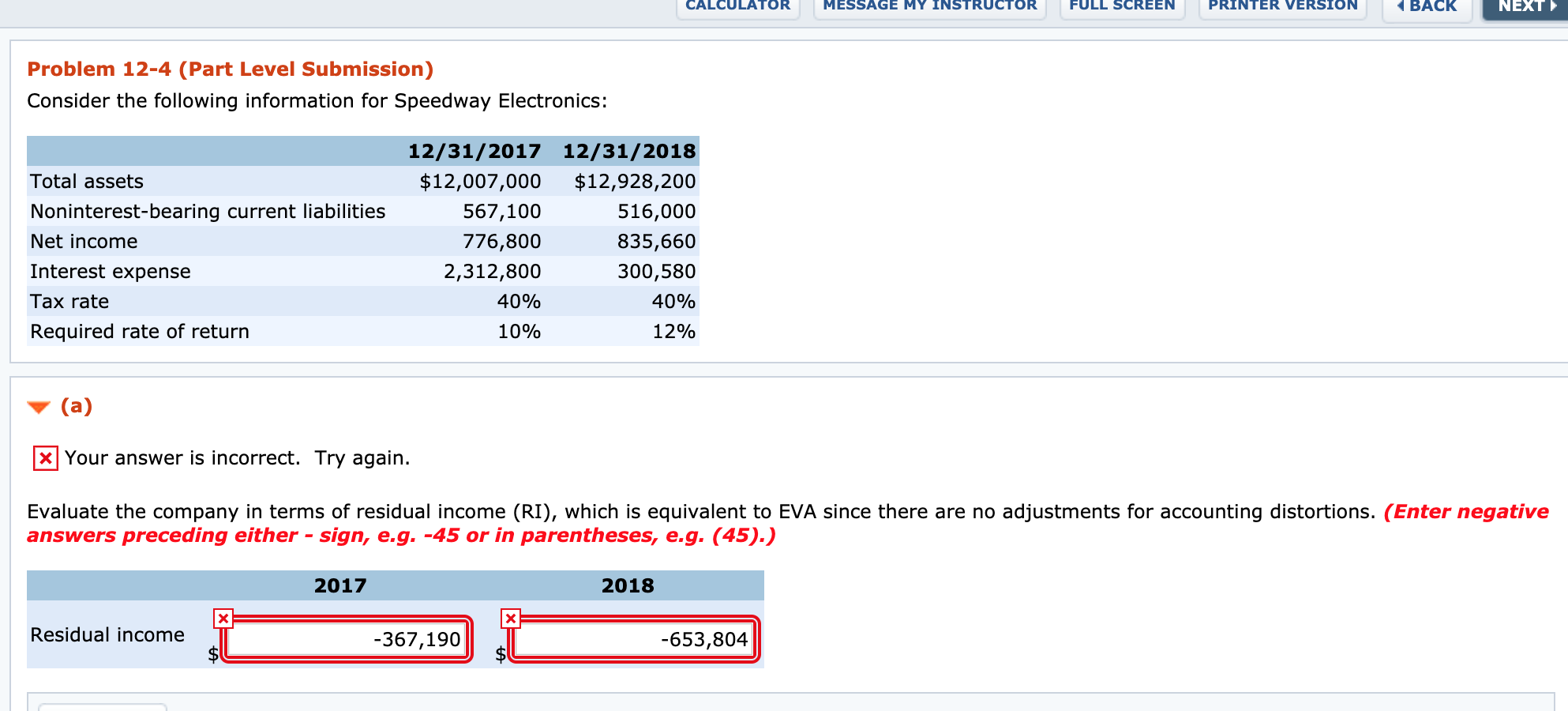

CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NEXT Problem 12-4 (Part Level Submission) Consider the following information for Speedway Electronics: Total assets Noninterest-bearing current liabilities Net income Interest expense Tax rate Required rate of return 12/31/2017 12/31/2018 $12,007,000 $12,928,200 567,100 516,000 776,800 835,660 2,312,800 300,580 40% 40% 10% 12% (a) * Your answer is incorrect. Try again. Evaluate the company in terms of residual income (RI), which is equivalent to EVA since there are no adjustments for accounting distortions. (Enter negative answers preceding either - sign, e.g. -45 or in parentheses, e.g. (45).) 2017 2018 Residual income -367,190 -653,804

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts