Question: CALCULATOR PRINTER VERSION 4 BACK NEXT Questions Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates

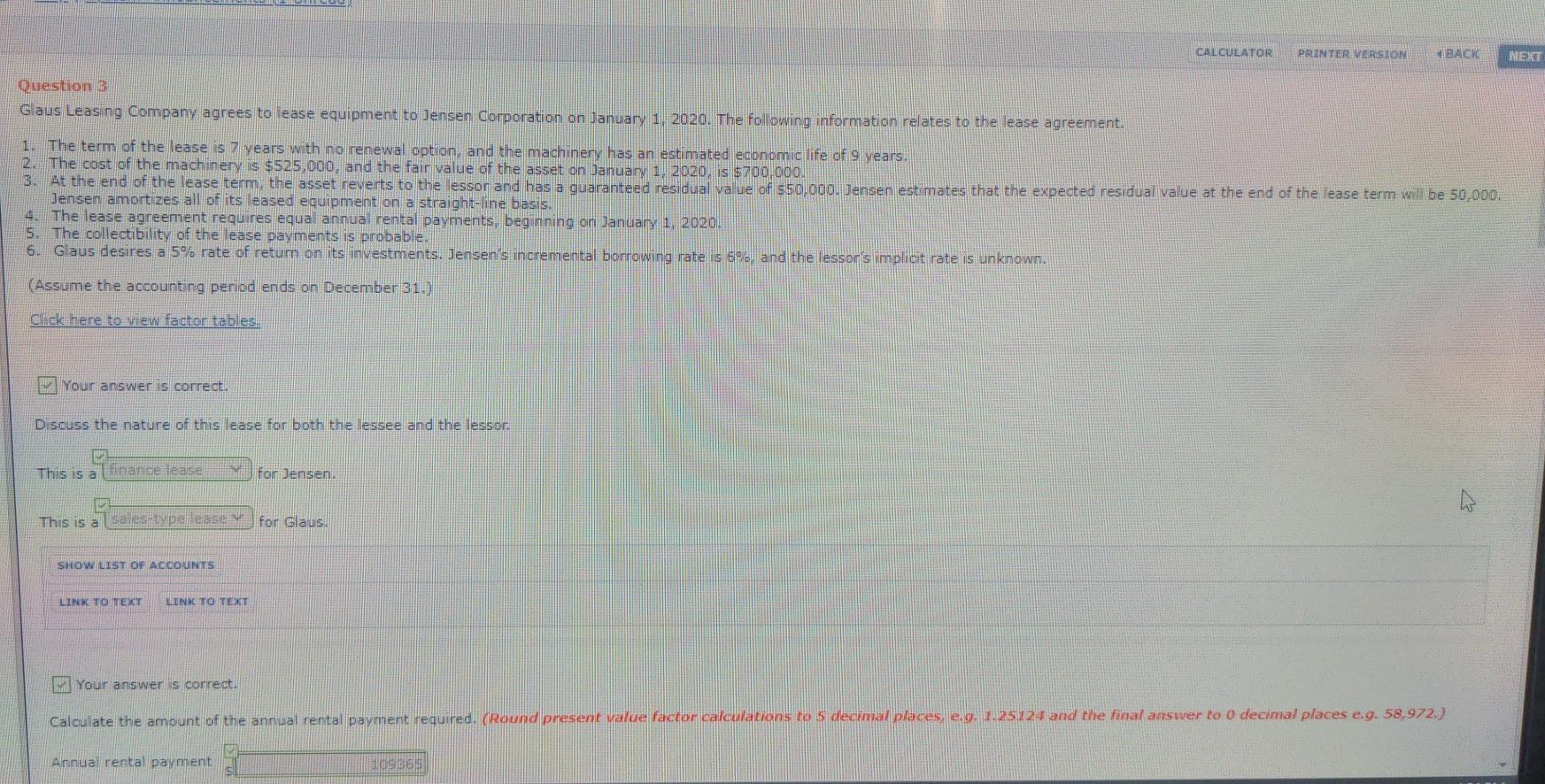

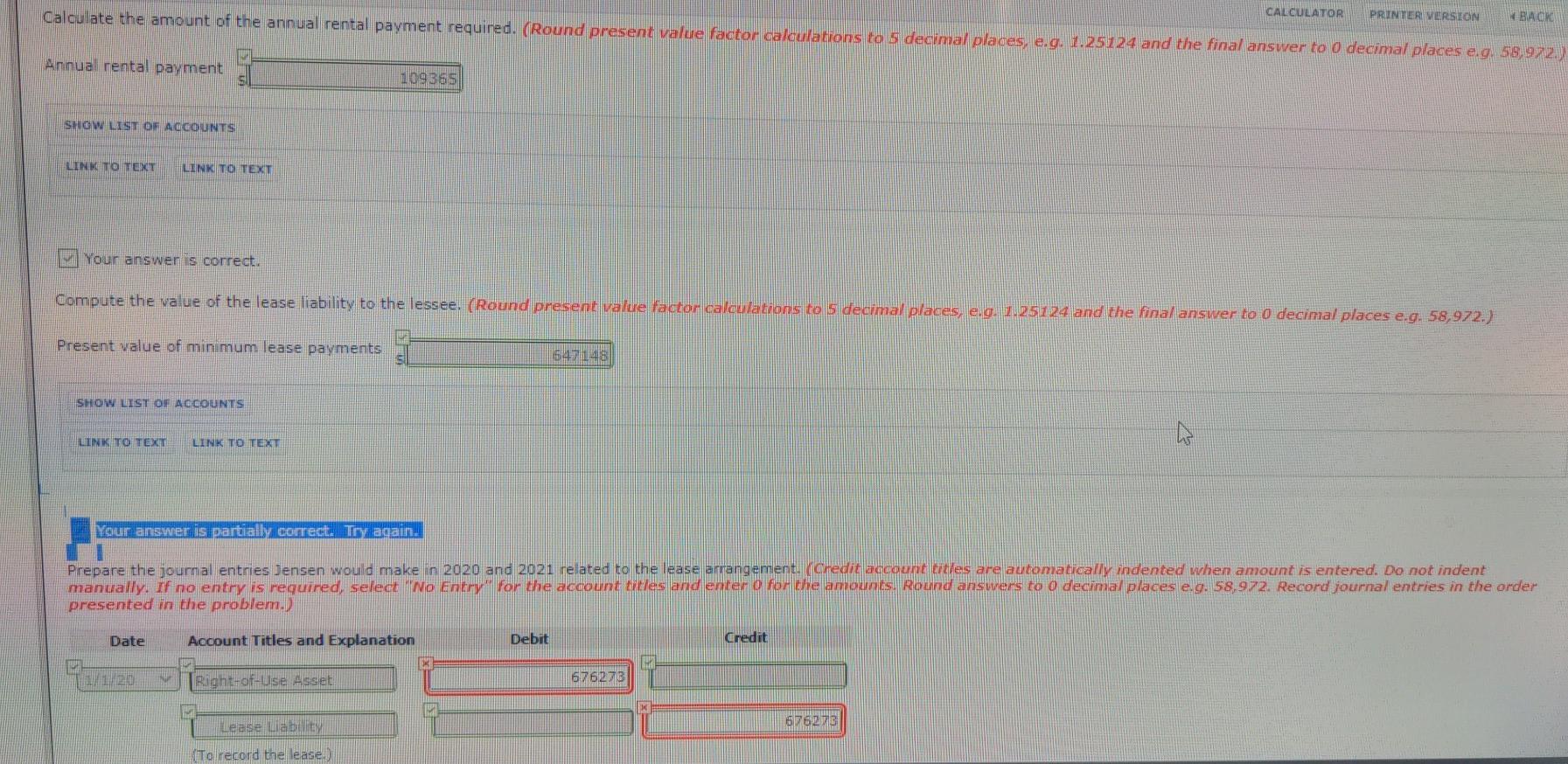

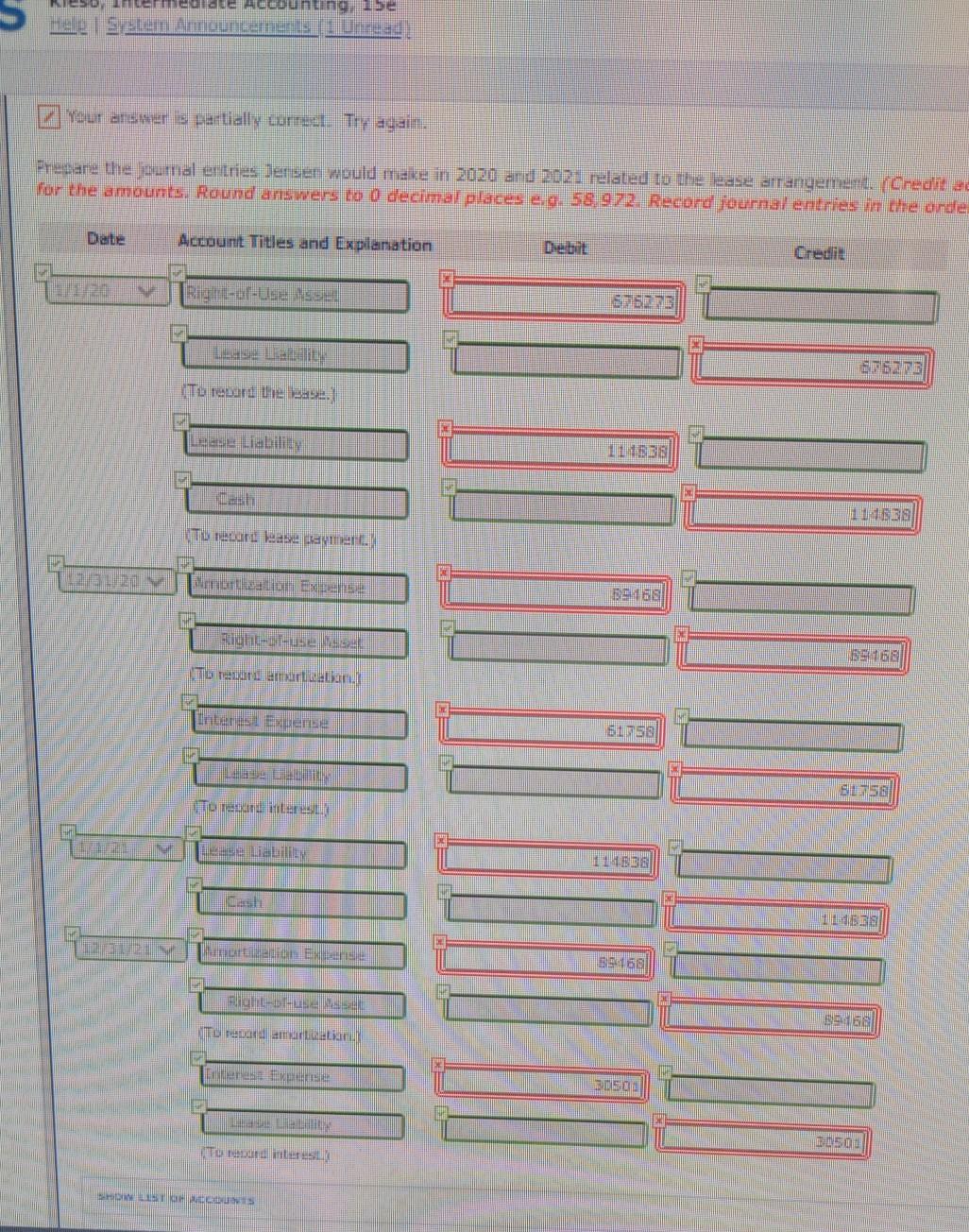

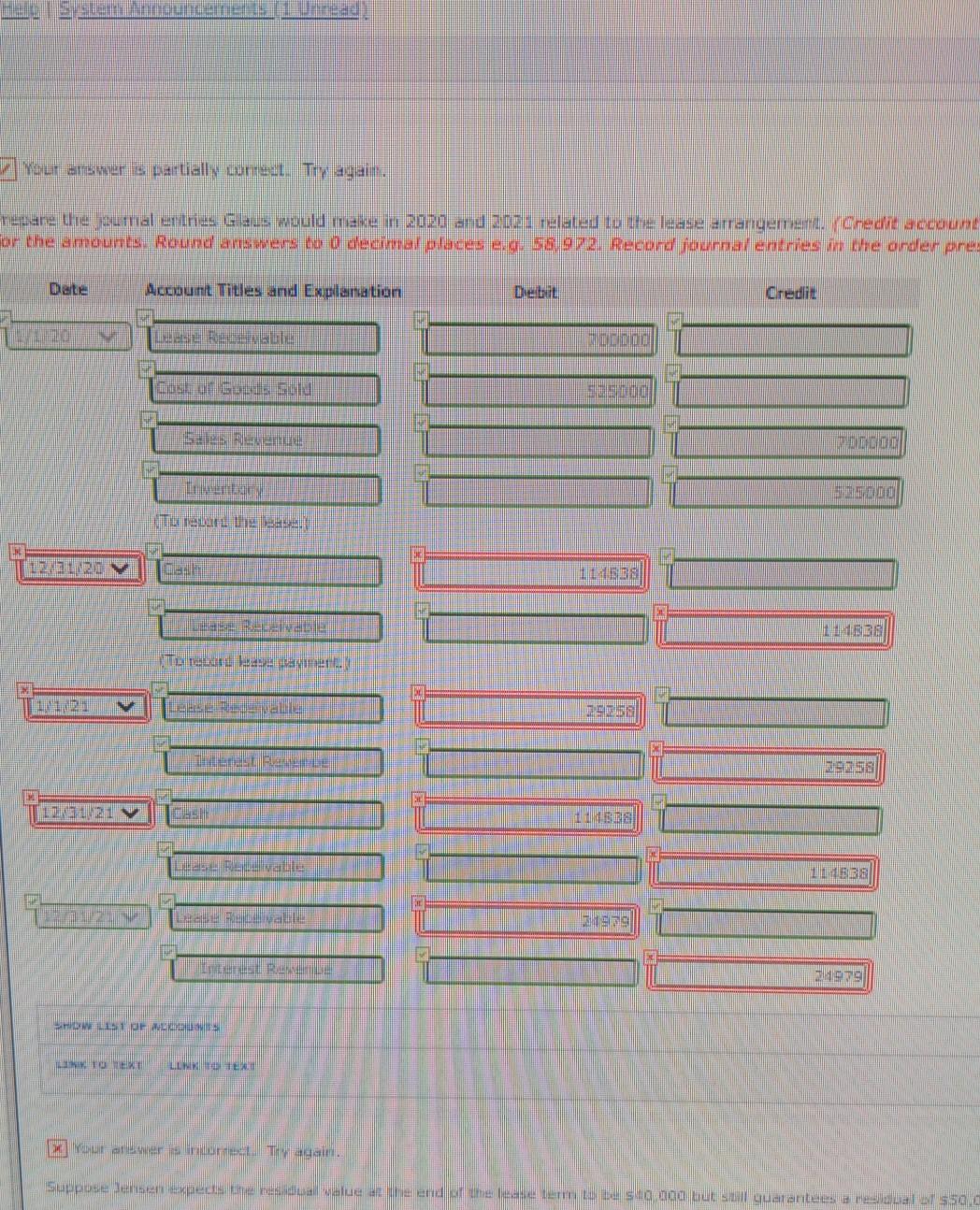

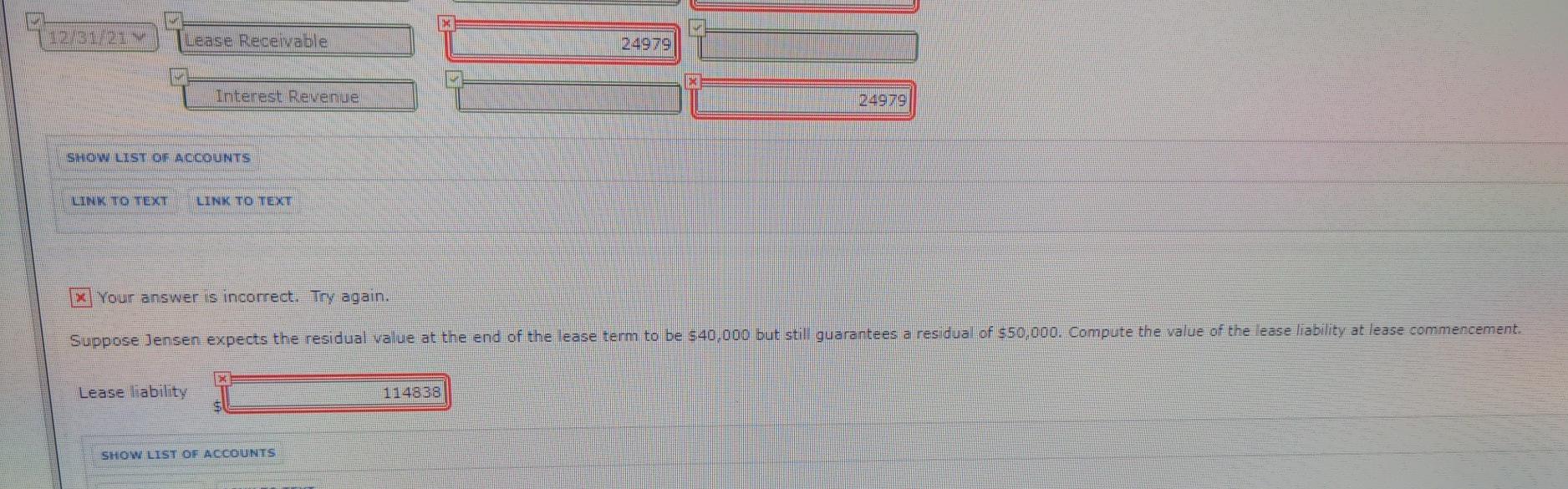

CALCULATOR PRINTER VERSION 4 BACK NEXT Questions Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years, 2. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2020, is $700.000, 3 At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of 550,000. Jensen estimates that the expected residual value at the end of the lease term will be 50,000, Jensen amortizes all of its leased equipment on a straight-line basis 4. The lease agreement requires equal annual rental payments beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Glaus desires a 5% rate of retum on its investments. Jensen's incremental borrowing rate s 5 and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31. Click here to view factor tables, Your answer is correct. Discuss the nature of this lease for both the lessee and the lesson This is a finance base for Jensen This is a sales type ease for Glaus! SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is correct. Calculate the amount of the annual rental payment required. (Round present value factor calculations to 5 decimal places .g. 25124 and the final answer to o decimal places e.g. 58,972) Annual rental payment 09365 CALCULATOR Calculate the amount of the annual rental payment required. (Round present value factor calculations to s decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,972) PRINTER VERSION MBAO Annual rental payment 139365 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is correct. Compute the value of the lease liability to the lessee. (Round present value factor calculations to s decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,972.) Present value of minimum lease payments 547 148 SHION LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT . Younanswer is partially correct. Try again. Prepare the journal entries Jensen would make in 2020 and 2021 related to the lease arrangement. (Credit account tres are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts. Round answers to o decimal places e.g. 58,972. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Right-of-use Asset 67 6273 Lease Liability 676273 To record the lease) ale accountin9-5e Your answer is partially correl. Try again. Prebare the ournal entries Jensen would make in 2020 and 2021 related to the case arrangement. Credit a for the amounts. Round answers to D decimal places e.: 58,972. Record journal entries in the unde Account Titles and Explanation Credit 596223 15. Batality 67623 To retard the ease. Led Liability To retard lease Bayment) 112120 Burnoration Extende 58 Righuset 3168 beri amartean, Interest Expense 695 Ho Tedes IS E- Interexpense 0502 To and interes TOONS your answer is partially correul. Try again. metane tre mal entries Gaus would make in 2020 and 2021 related to the lease arrangement, credit account or the amounts Round answers ou decimal places e 5892. Record rounnal entries we ander pres Date Account Titles and Explanation Debil Credit Vale . AND Tu Telur BB To revurden Route 100 ON DANN LE 1121 vales 11S va LE RE LLLLLS LE utan regar Supposedens bedste resudia alue one and the case er best ad uut a quals el SSC Lease Receivable 24979 Interest Revenue 24979 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is incorrect. Try again. Suppose Jensen expects the residual value at the end of the lease term to be $40,000 but still guarantees a residual of $50,000. Compute the value of the lease liability at lease commencement Lease liability 114838 SHOW LIST OF ACCOUNTS CALCULATOR PRINTER VERSION 4 BACK NEXT Questions Glaus Leasing Company agrees to lease equipment to Jensen Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years, 2. The cost of the machinery is $525,000, and the fair value of the asset on January 1, 2020, is $700.000, 3 At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of 550,000. Jensen estimates that the expected residual value at the end of the lease term will be 50,000, Jensen amortizes all of its leased equipment on a straight-line basis 4. The lease agreement requires equal annual rental payments beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Glaus desires a 5% rate of retum on its investments. Jensen's incremental borrowing rate s 5 and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31. Click here to view factor tables, Your answer is correct. Discuss the nature of this lease for both the lessee and the lesson This is a finance base for Jensen This is a sales type ease for Glaus! SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is correct. Calculate the amount of the annual rental payment required. (Round present value factor calculations to 5 decimal places .g. 25124 and the final answer to o decimal places e.g. 58,972) Annual rental payment 09365 CALCULATOR Calculate the amount of the annual rental payment required. (Round present value factor calculations to s decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,972) PRINTER VERSION MBAO Annual rental payment 139365 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is correct. Compute the value of the lease liability to the lessee. (Round present value factor calculations to s decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,972.) Present value of minimum lease payments 547 148 SHION LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT . Younanswer is partially correct. Try again. Prepare the journal entries Jensen would make in 2020 and 2021 related to the lease arrangement. (Credit account tres are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts. Round answers to o decimal places e.g. 58,972. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Right-of-use Asset 67 6273 Lease Liability 676273 To record the lease) ale accountin9-5e Your answer is partially correl. Try again. Prebare the ournal entries Jensen would make in 2020 and 2021 related to the case arrangement. Credit a for the amounts. Round answers to D decimal places e.: 58,972. Record journal entries in the unde Account Titles and Explanation Credit 596223 15. Batality 67623 To retard the ease. Led Liability To retard lease Bayment) 112120 Burnoration Extende 58 Righuset 3168 beri amartean, Interest Expense 695 Ho Tedes IS E- Interexpense 0502 To and interes TOONS your answer is partially correul. Try again. metane tre mal entries Gaus would make in 2020 and 2021 related to the lease arrangement, credit account or the amounts Round answers ou decimal places e 5892. Record rounnal entries we ander pres Date Account Titles and Explanation Debil Credit Vale . AND Tu Telur BB To revurden Route 100 ON DANN LE 1121 vales 11S va LE RE LLLLLS LE utan regar Supposedens bedste resudia alue one and the case er best ad uut a quals el SSC Lease Receivable 24979 Interest Revenue 24979 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Your answer is incorrect. Try again. Suppose Jensen expects the residual value at the end of the lease term to be $40,000 but still guarantees a residual of $50,000. Compute the value of the lease liability at lease commencement Lease liability 114838 SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts