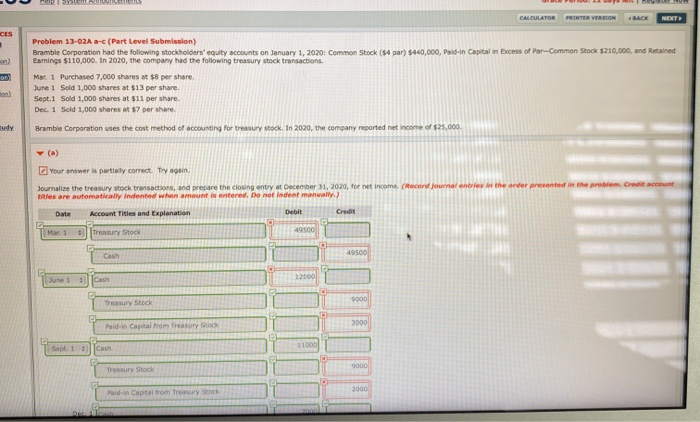

Question: CALCULATOR PRINTER VERSION BACK NEET CES Problem 13-02A a-c (Part Level Submission) Bramble Corporation had the following stockholders' equity accounts on January 1, 2020: Common

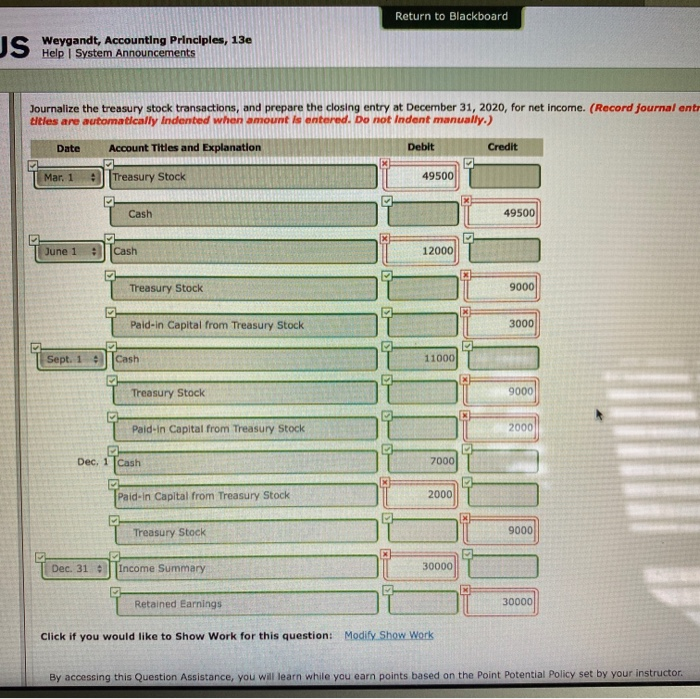

CALCULATOR PRINTER VERSION BACK NEET CES Problem 13-02A a-c (Part Level Submission) Bramble Corporation had the following stockholders' equity accounts on January 1, 2020: Common Stock (54 par) $40,000, Paid-in Capital in Excess of Par-Common Stock $210,000, and Retained Earnings $110,000. In 2020, the company had the following treasury stock transactions. Mar. 1 Purchased 7,000 shares at $8 per share. June 1 Sold 1,000 shares at $13 per share. Sept.1 Sold 1,000 shares at $11 per share. Dec. 1 Sold 1,000 shares at 57 per share. Bramble Corporation uses the cost method of accounting for treasury stock. In 2020, the company reported net income of $25,000 Your answer is partially correct. Try again. Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2020, for the income (Hecord journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 49500 Mar 1 Treasury Stock Cash 49500 # Cash 12000 9000 Treasury Stock 3000 Pald-in Capital Treasury Stock Sept.1 Cash 11000 9000 Treasury Stock 2000 Paldin Captal from Treasury Return to Blackboard JS Weygandt, Accounting Principles, 13e Help System Announcements Journalize the treasury stock transactions, and prepare the closing entry at December 31, 2020, for net income. (Record journal entr titles are automatically indented when amount is entered. Do not Indent manually.) Account Titles and Explanation Debit Credit Date Mar. 1 Treasury Stock 49500 Cash 49500 . June 1 Cash 12000 Treasury Stock 9000 Pald-in Capital from Treasury Stock 3000 Sept. 1 Cash 11000 Treasury Stock 9000 Paid-in Capital from Treasury Stock 2000 Dec. 1 Cash 7000 Paid-in Capital from Treasury Stock 2000 Treasury Stock 9000 Dec. 31 Income Summary 30000 Retained Earnings 30000 Click if you would like to Show Work for this question: Modify Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts