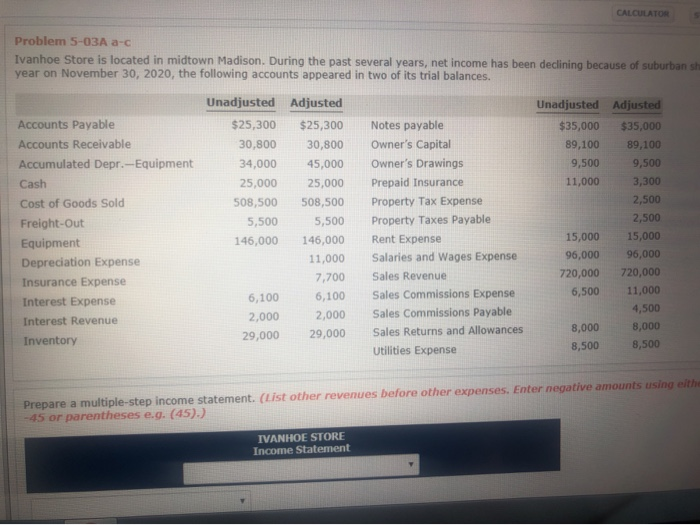

Question: CALCULATOR Problem 5-03A a-c Ivanhoe Store is located in midtown Madison. During the past several years, net income has been declining because of suburban sh

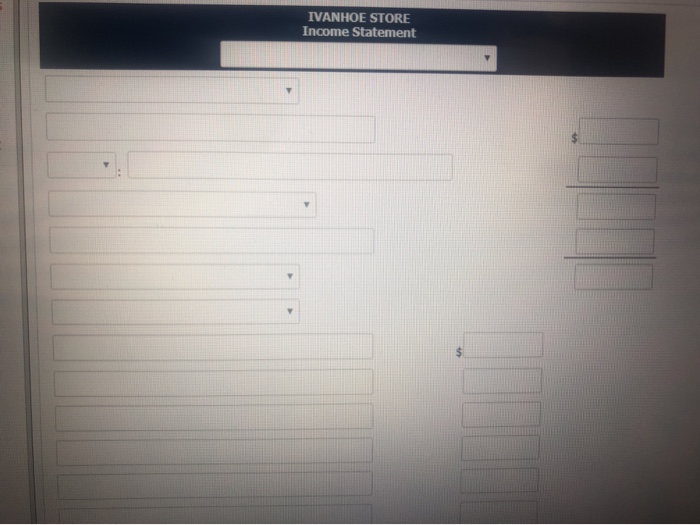

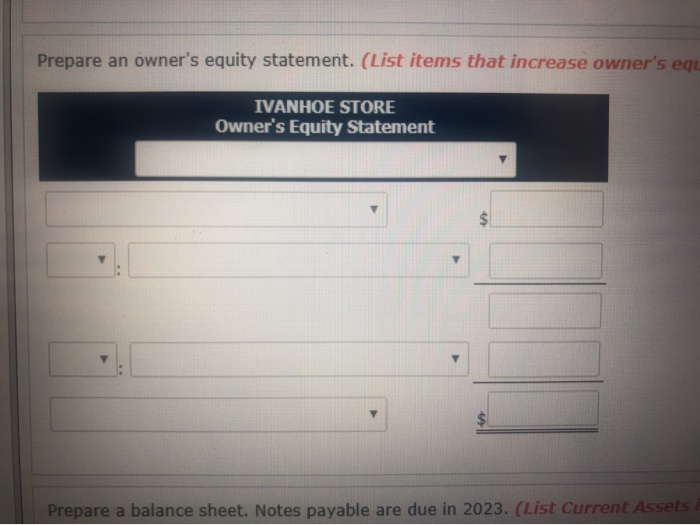

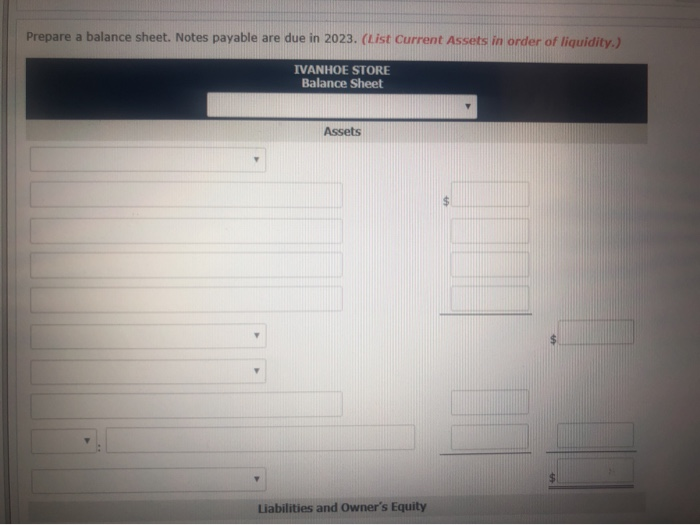

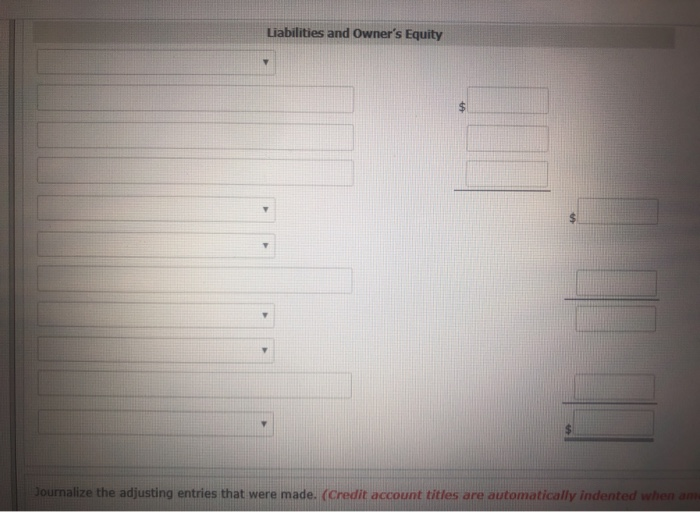

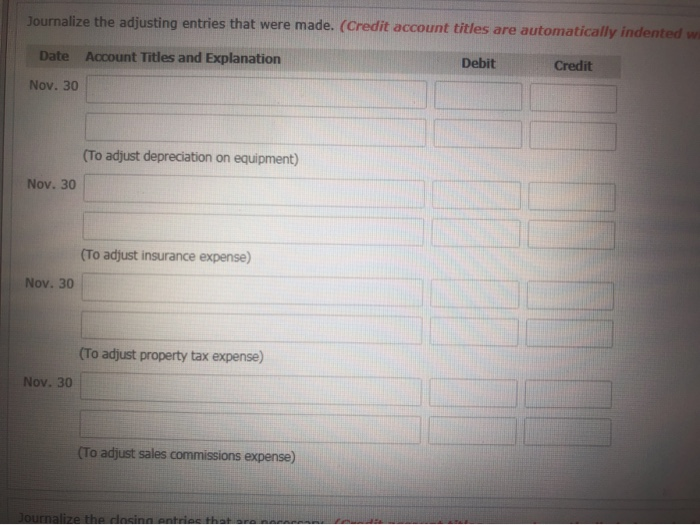

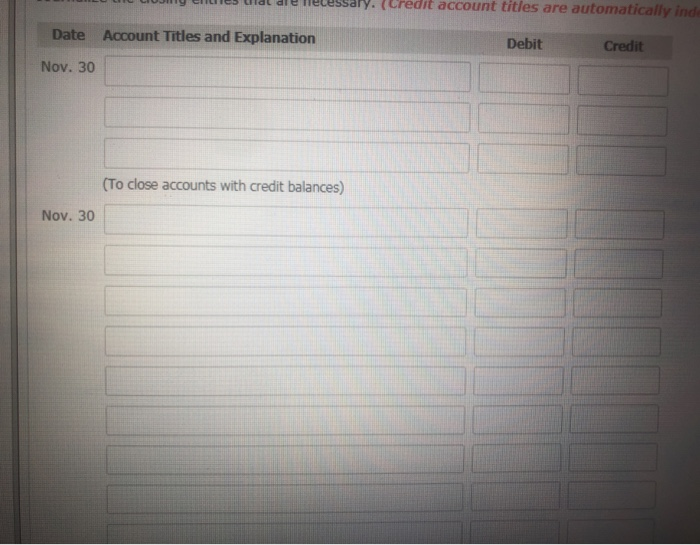

CALCULATOR Problem 5-03A a-c Ivanhoe Store is located in midtown Madison. During the past several years, net income has been declining because of suburban sh year on November 30, 2020, the following accounts appeared in two of its trial balances. Unadjusted Adjusted Unadjusted Adjusted Accounts Payable $25,300 $25,300 Notes payable $35,000 $35,000 Accounts Receivable 30,800 30,800 Owner's Capital 89,100 89,100 Accumulated Depr.--Equipment 34,000 45,000 Owner's Drawings 9,500 9,500 Cash 25,000 25,000 Prepaid Insurance 11,000 3,300 Cost of Goods Sold 508,500 508,500 Property Tax Expense 2,500 Freight-Out 5,500 5,500 Property Taxes Payable 2,500 Equipment 146,000 146,000 Rent Expense 15,000 15,000 Depreciation Expense 11,000 Salaries and Wages Expense 96,000 96,000 Insurance Expense 7,700 Sales Revenue 720,000 720,000 6,100 6,100 Interest Expense Sales Commissions Expense 6,500 11,000 2,000 Interest Revenue 2,000 4,500 Sales Commissions Payable 8,000 29,000 Inventory 8,000 Sales Returns and Allowances 29,000 Utilities Expense 8,500 8,500 Prepare a multiple-step income statement. (List other revenues before other expenses. Enter negative amounts using eithe -45 or parentheses e.g. (45).) IVANHOE STORE Income Statement IVANHOE STORE Income Statement Prepare an owner's equity statement. (List items that increase owner's equ IVANHOE STORE Owner's Equity Statement Prepare a balance sheet. Notes payable are due in 2023. (List Current Assets Prepare a balance sheet. Notes payable are due in 2023. (List Current Assets in order of liquidity.) IVANHOE STORE Balance Sheet Assets Liabilities and Owner's Equity Liabilities and Owner's Equity Journalize the adjusting entries that were made. (Credit account titles are automatically indented when am. Journalize the adjusting entries that were made. (Credit account titles are automatically indented w Date Account Titles and Explanation Debit Credit Nov. 30 (To adjust depreciation on equipment) Nov. 30 (To adjust insurance expense) Nov. 30 (To adjust property tax expense) Nov. 30 (To adjust sales commissions expense) Journalize the cincinn antrine that are al dry. (Credit account titles are automatically inde Date Account Titles and Explanation Debit Credit Nov. 30 (To close accounts with credit balances) Nov. 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts