Question: Can an expert please answer this question. Exercise 8-23 (Algorithmic) (LO. 2) Lopez acquired a building on June 1, 2013, for $42,831,100. Compute the depreciation

Can an expert please answer this question.

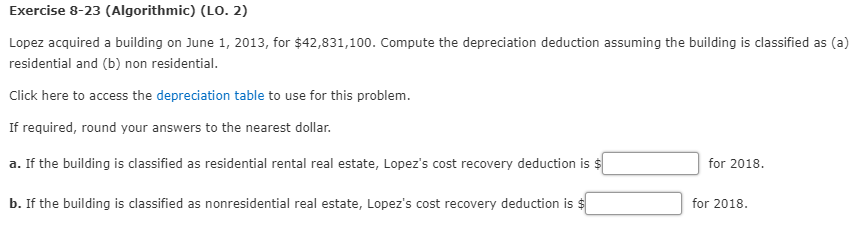

Exercise 8-23 (Algorithmic) (LO. 2) Lopez acquired a building on June 1, 2013, for $42,831,100. Compute the depreciation deduction assuming the building is classified as (a) residential and (b) non residential. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. a. If the building is classified as residential rental real estate, Lopez's cost recovery deduction is b. If the building is classified as nonresidential real estate, Lopez's cost recovery deduction is for 2018. for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts