Question: Can anyone answer the question and explain it thx alot The following statement is to be used in answering questions 29 and 30. Company X,

Can anyone answer the question and explain it thx alot

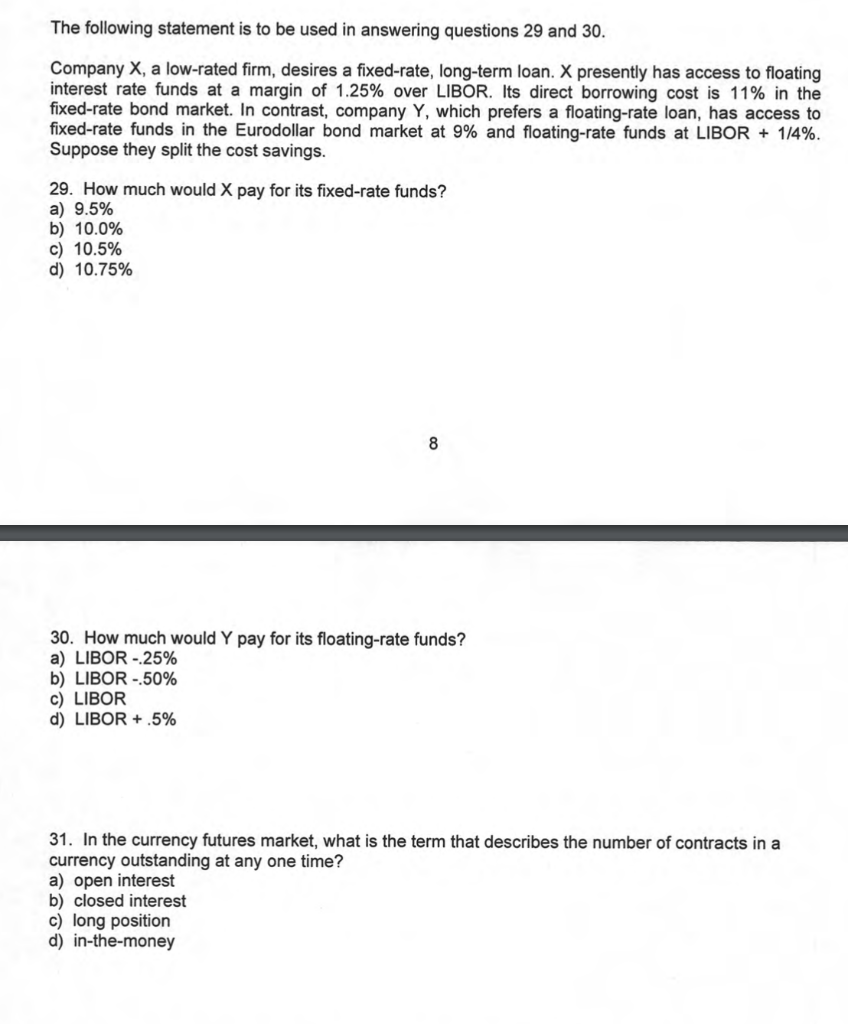

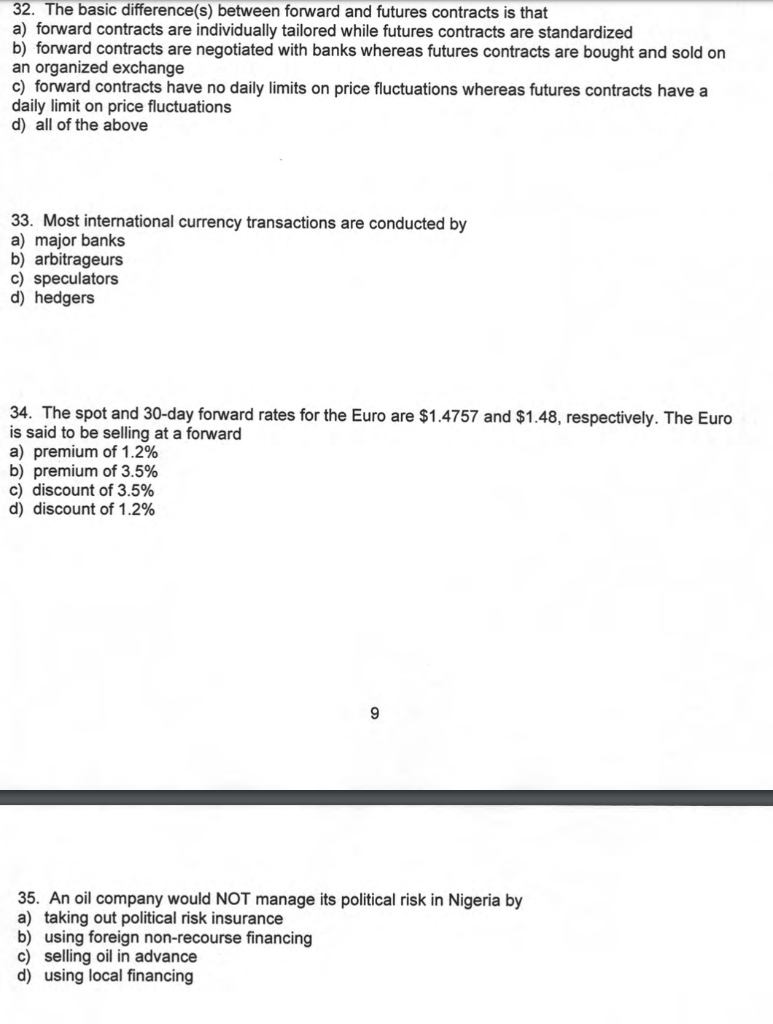

The following statement is to be used in answering questions 29 and 30. Company X, a low-rated firm, desires a fixed-rate, long-term loan. X presently has access to floating interest rate funds at a margin of 1.25% over LIBOR. Its direct borrowing cost is 11% in the fixed-rate bond market. In contrast, company Y, which prefers a floating-rate loan, has access to fixed-rate funds in the Eurodollar bond market at 9% and floating-rate funds at LIBOR + 1/4%. Suppose they split the cost savings. 29. How much would X pay for its fixed-rate funds? a) 9.5% b) 10.0% c) 10.5% d) 10.75% 8 30. How much would Y pay for its floating-rate funds? a) LIBOR -.25% b) LIBOR -.50% c) LIBOR d) LIBOR + .5% 31. In the currency futures market, what is the term that describes the number of contracts in a currency outstanding at any one time? a) open interest b) closed interest c) long position d) in-the-money 32. The basic difference(s) between forward and futures contracts is that a) forward contracts are individually tailored while futures contracts are standardized b) forward contracts are negotiated with banks whereas futures contracts are bought and sold on an organized exchange c) forward contracts have no daily limits on price fluctuations whereas futures contracts have a daily limit on price fluctuations d) all of the above 33. Most international currency transactions are conducted by a) major banks b) arbitrageurs c) speculators d) hedgers 34. The spot and 30-day forward rates for the Euro are $1.4757 and $1.48, respectively. The Euro is said to be selling at a forward a) premium of 1.2% b) premium of 3.5% c) discount of 3.5% d) discount of 1.2% 35. An oil company would NOT manage its political risk in Nigeria by a) taking out political risk insurance b) using foreign non-recourse financing c) selling oil in advance d) using local financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts