Question: can anyone explain present value to me? i dont undersrand how to solve that part! Current Attempt in Progress Wildhorse Inc. has issued three types

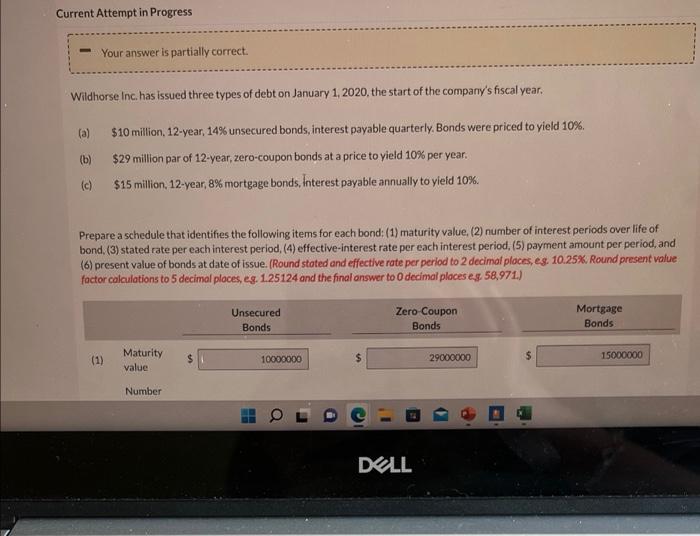

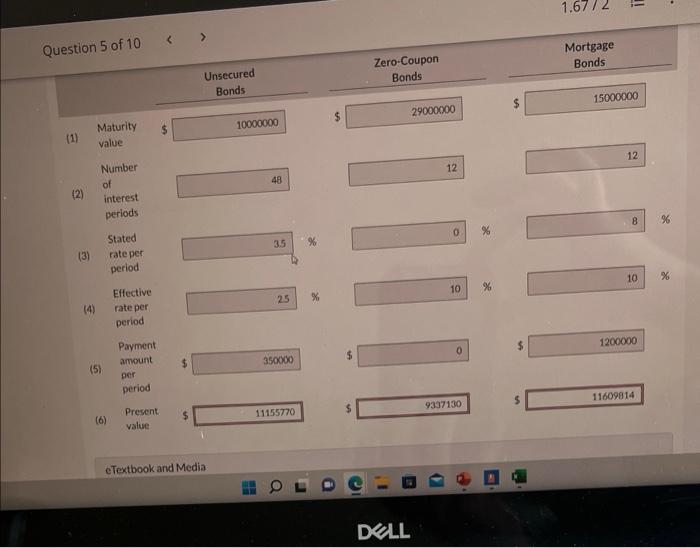

Current Attempt in Progress Wildhorse Inc. has issued three types of debt on January 1, 2020, the start of the company's fiscal year. $10 million, 12-year, 14% unsecured bonds, interest payable quarterly. Bonds were priced to yield 10%. $29 million par of 12-year, zero-coupon bonds at a price to yield 10% per year. $15 million, 12-year, 8% mortgage bonds, Interest payable annually to yield 10%. (a) Your answer is partially correct. (b) (c) Prepare a schedule that identifies the following items for each bond: (1) maturity value, (2) number of interest periods over life of bond, (3) stated rate per each interest period, (4) effective-interest rate per each interest period, (5) payment amount per period, and (6) present value of bonds at date of issue. (Round stated and effective rate per period to 2 decimal places, eg. 10.25%. Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answer to 0 decimal places eg. 58,971.) (1) Maturity value Number Unsecured Bonds 10000000 Zero-Coupon Bonds DELL 29000000 $ Mortgage Bonds 15000000 Question 5 of 10 (1) (2) (3) Maturity value Number of interest periods (5) (6) Stated rate per period Effective rate per period Payment amount per period Present: value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts