Question: can anyone help me solve this tax question Required information Problem 15-46 (LO 15-3) (Algo) [The following information applies to the questions displayed below] Mason

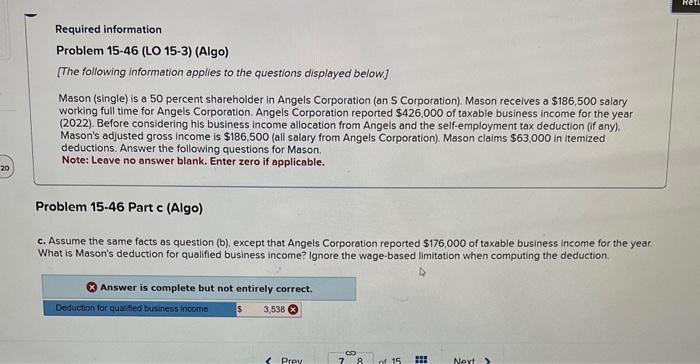

Required information Problem 15-46 (LO 15-3) (Algo) [The following information applies to the questions displayed below] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason recelves a $186,500 salary working full time for Angels Corporation. Angels Corporation reported $426,000 of taxable business income for the year (2022). Before considering his business income allocation from Angels and the self-employment tax deduction (ff any). Mason's adjusted gross income is $186,500 (all salary from Angels Corporation). Mason claims $63,000 in itemized deductions. Answer the following questions for Mason. Note: Leave no answer blank. Enter zero if applicable. Problem 15-46 Part c (Algo) c. Assume the same facts as question (b), except that Angels Corporation reported $176,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction. Required information Problem 15-46 (LO 15-3) (Algo) [The following information applies to the questions displayed below] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $186,500 salary working full time for Angels Corporation. Angels Corporation reported $426.000 of taxable business income for the year (2022). Before considering his business income allocation from Angels and the self-employment tax deduction (If any). Mason's adjusted gross income is $186,500 (all salary from Angels Corporation). Mason claims $63,000 in itemized deductions. Answer the following questions for Mason. Note: Leave no answer blank. Enter zero if applicable. Problem 15-46 Part d (Algo) Assuming the original facts, what is Mason's net investment income tax liability (ossume no investment expenses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts