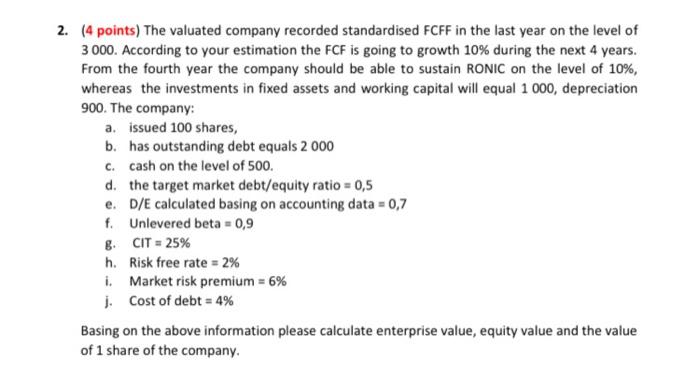

Question: Can anyone help me solving this exercise? 2. (4 points) The valuated company recorded standardised FCFF in the last year on the level of 3000.

2. (4 points) The valuated company recorded standardised FCFF in the last year on the level of 3000. According to your estimation the FCF is going to growth 10% during the next 4 years. From the fourth year the company should be able to sustain RONIC on the level of 10%, whereas the investments in fixed assets and working capital will equal 1 000, depreciation 900. The company: a. issued 100 shares, b. has outstanding debt equals 2 000 C. cash on the level of 500. d. the target market debt/equity ratio = 0,5 e. D/E calculated basing on accounting data = 0,7 f. Unlevered beta = 0,9 8. CIT = 25% h. Risk free rate = 2% i. Market risk premium = 6% 1. Cost of debt = 4% Basing on the above information please calculate enterprise value, equity value and the value of 1 share of the company. 2. (4 points) The valuated company recorded standardised FCFF in the last year on the level of 3000. According to your estimation the FCF is going to growth 10% during the next 4 years. From the fourth year the company should be able to sustain RONIC on the level of 10%, whereas the investments in fixed assets and working capital will equal 1 000, depreciation 900. The company: a. issued 100 shares, b. has outstanding debt equals 2 000 C. cash on the level of 500. d. the target market debt/equity ratio = 0,5 e. D/E calculated basing on accounting data = 0,7 f. Unlevered beta = 0,9 8. CIT = 25% h. Risk free rate = 2% i. Market risk premium = 6% 1. Cost of debt = 4% Basing on the above information please calculate enterprise value, equity value and the value of 1 share of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts