Question: Can anyone help with the boxes highlighted in green? Some are done but I am not sure if they're right. Can you show formulas too?

Can anyone help with the boxes highlighted in green? Some are done but I am not sure if they're right. Can you show formulas too?

Thanks!

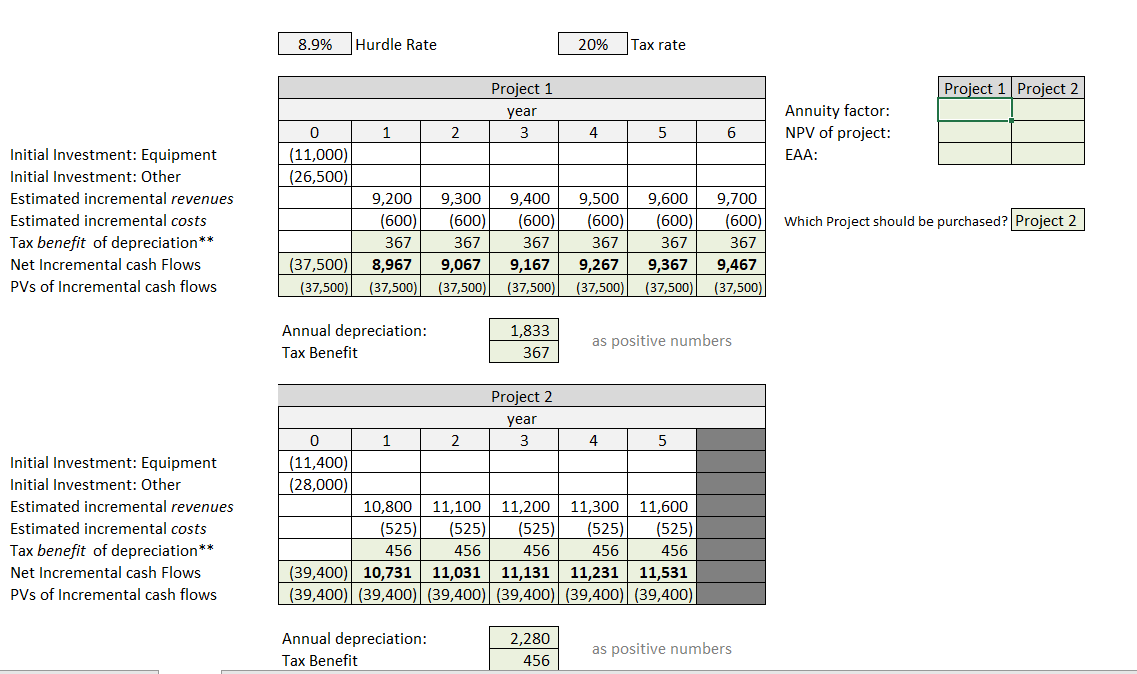

8.9% Hurdle Rate 20% Tax rate Project 1 Project 2 Project 1 year 3 0 1 2 4 5 6 Annuity factor: NPV of project: EAA: (11,000) (26,500) Initial Investment: Equipment Initial Investment: Other Estimated incremental revenues Estimated incremental costs Tax benefit of depreciation ** Net Incremental cash Flows PVs of Incremental cash flows Which Project should be purchased? Project 2 9,200 (600) 367 8,967 (37,500) 9,300 (600) 367 9,067 (37,500)| 9,400 (600) 367 9,167 (37,500) 9,500 (600) 367 9,267 (37,500) 9,600 (600) 367 9,367 (37,500) 9,700 (600) 367 9,467 (37,500) (37,500) (37,500) Annual depreciation: Tax Benefit 1,833 367 as positive numbers Initial Investr Equipment Initial Investment: Other Estimated incremental revenues Estimated incremental costs Tax benefit of depreciation ** Net Incremental cash Flows PVs of Incremental cash flows Project 2 year 0 1 2 3 4 5 (11,400) (28,000) 10,800 11,100 11,200 11,300 11,600 (525 (525) (525 (525) (525) 456 456 456 456 456 (39,400) 10,731 11,031 11,131 11,231 11,531 (39,400) (39,400)|(39,400) (39,400)|(39,400)|(39,400) Annual depreciation: Tax Benefit 2,280 456 as positive numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts