Question: Can anyone help with this, please? 2. (10 marks) An asset costs $50,000 to purchase and install. The asset has a resale value of $40,000

Can anyone help with this, please?

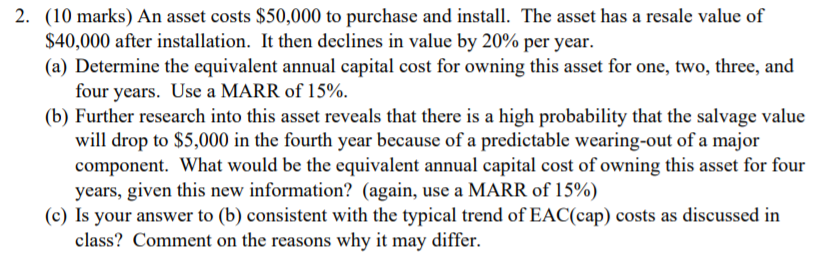

2. (10 marks) An asset costs $50,000 to purchase and install. The asset has a resale value of $40,000 after installation. It then declines in value by 20% per year. (a) Determine the equivalent annual capital cost for owning this asset for one, two, three, and four years. Use a MARR of 15%. (b) Further research into this asset reveals that there is a high probability that the salvage value will drop to $5,000 in the fourth year because of a predictable wearing-out of a major component. What would be the equivalent annual capital cost of owning this asset for four years, given this new information? (again, use a MARR of 15%) (c) Is your answer to (b) consistent with the typical trend of EAC(cap) costs as discussed in class? Comment on the reasons why it may differ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts