Question: Can anyone please help? FIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June

Can anyone please help?

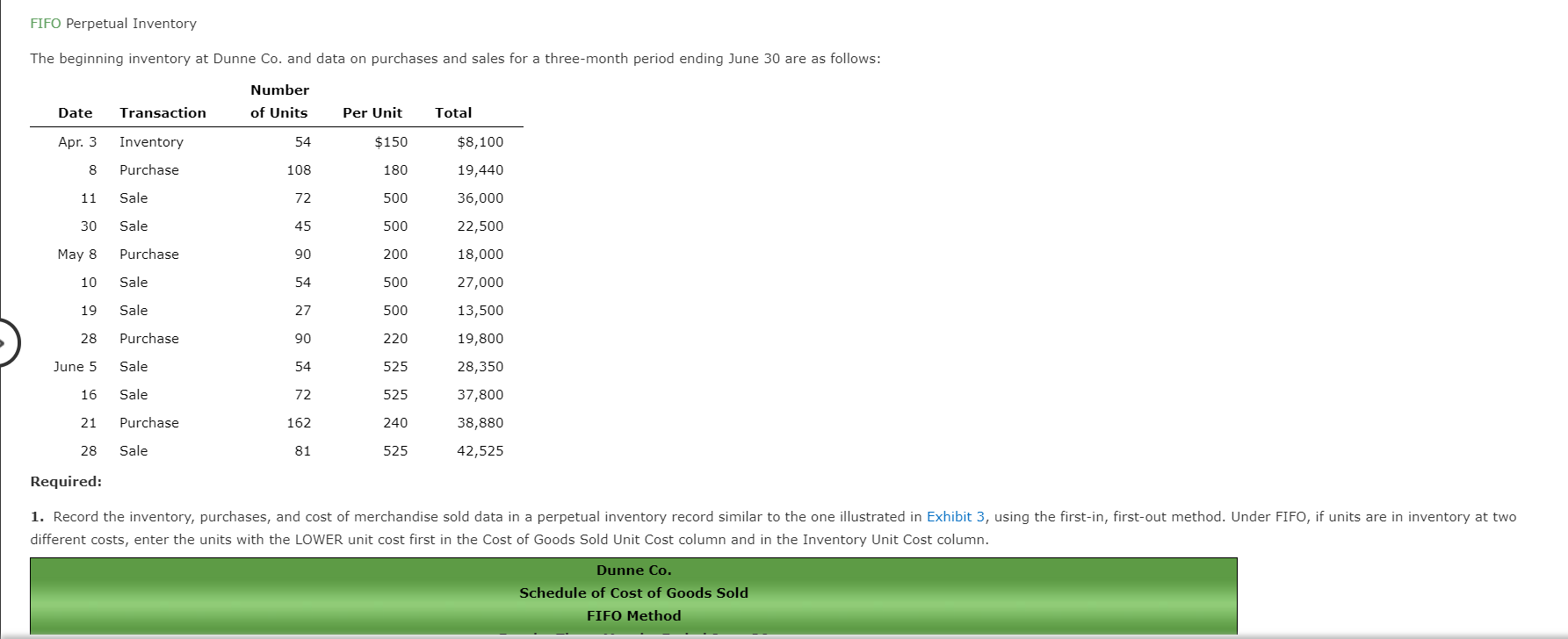

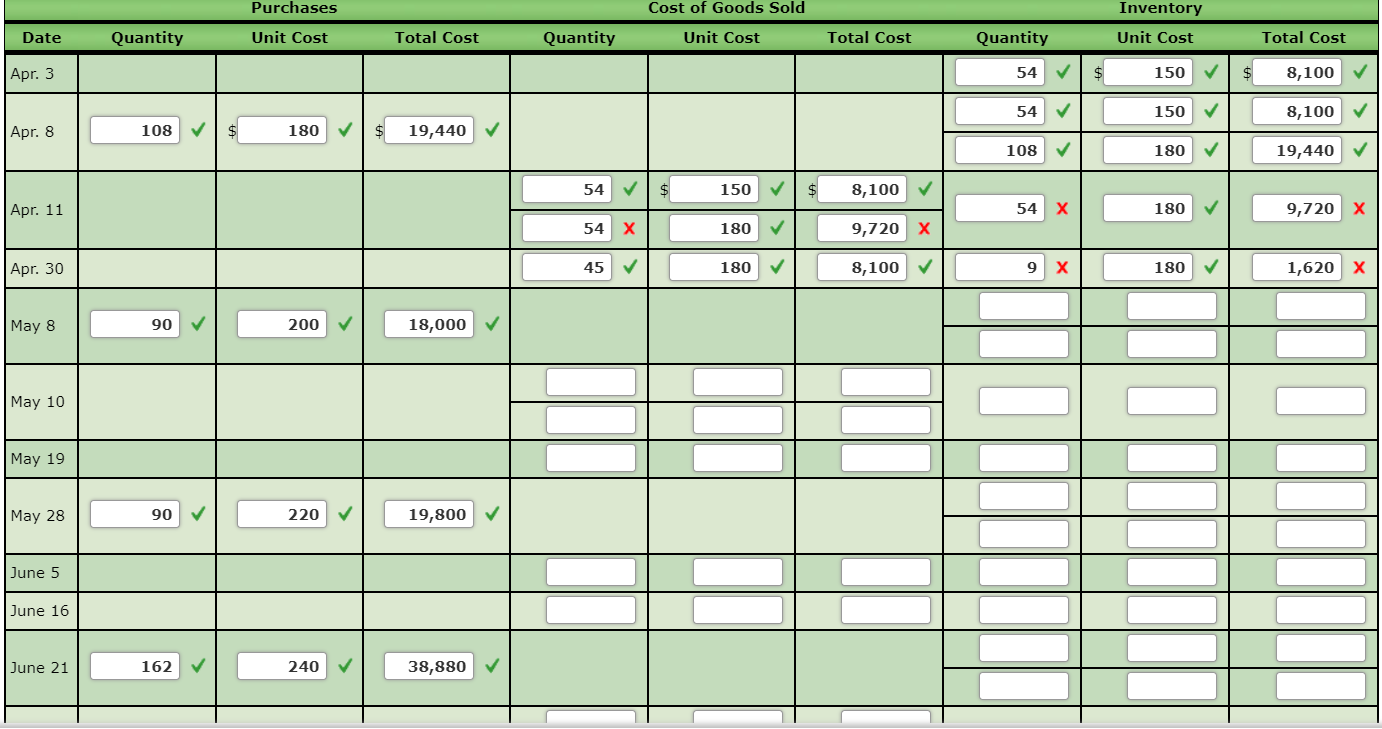

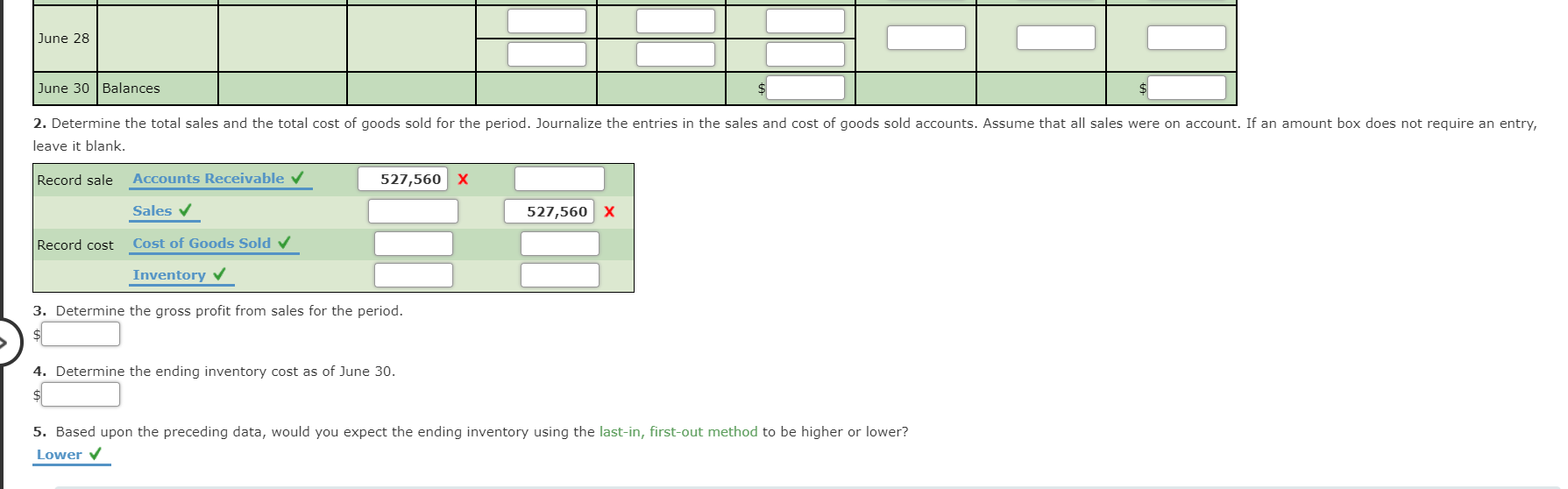

FIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Number of Units Date Transaction Per Unit Total Apr. 3 54 $150 $8,100 Inventory Purchase 8 108 180 19,440 11 Sale 72 500 36,000 30 Sale 45 500 22,500 May 8 Purchase 90 200 18,000 10 Sale 54 500 27,000 19 Sale 27 500 13,500 28 Purchase 90 220 19,800 June 5 Sale 54 525 28,350 16 Sale 72 525 37,800 21 Purchase 162 240 38,880 28 Sale 81 525 42,525 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Dunne Co. Schedule of Cost of Goods Sold FIFO Method Purchases Cost of Goods Sold Inventory Date Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Apr. 3 54 150 8,100 54 150 8,100 Apr. 8 108 180 19,440 108 180 19,440 54 $ 150 $ 8,100 Apr. 11 54 180 9,720 X 54 x 180 9,720 X Apr. 30 45 180 8,100 9 180 1,620 x May 8 90 200 18,000 May 10 May 19 May 28 90 220 19,800 June 5 June 16 June 21 162 240 38,880 June 28 June 30 Balances 2. Determine the total sales and the total cost of goods sold for the period. Journalize the entries in the sales and cost of goods sold accounts. Assume that all sales were on account. If an amount box does not require an entry, leave it blank. Record sale Accounts Receivable 527,560 x Sales 527,560 x Record cost Cost of Goods Sold Inventory 3. Determine the gross profit from sales for the period. $ 4. Determine the ending inventory cost as of June 30. 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower? Lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts