Question: Can anyone please help me with this question? Since its zero coupon, I know its going to be 1/1.065^1 1/1.07^2 1/1.073^3 1/1.075^4 1/1.075^4 Could you

Can anyone please help me with this question?

Can anyone please help me with this question?

Since its zero coupon, I know its going to be 1/1.065^1 1/1.07^2 1/1.073^3 1/1.075^4 1/1.075^4

Could you please describe the detailed solution?

I just have no idea with CPN and CNP what ever.

I would really appreciate your help!!

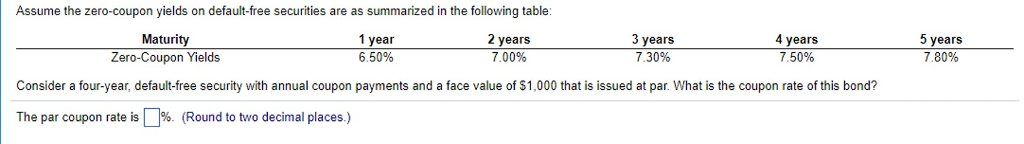

Assume the zero-coupon yields on default-free securities are as summarized in the following table Maturity Zero-Coupon Yields 1 year 6.50% 2 years 7.00% 4 years 7.50% 5 years 7 80% 3 years scull 7 30% Consider a four-year, default-free security with annual coupon payments and a face value of $1,000 that is issued at par. What is the coupon rate of this bond? The par coupon rate is%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts