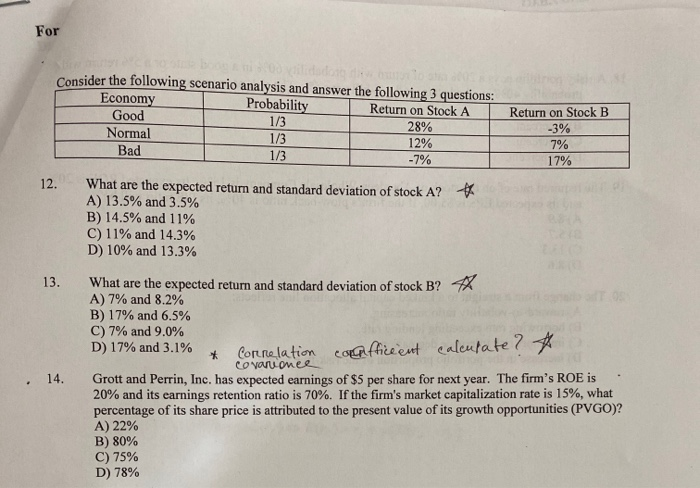

Question: can anyone solve the answer with exolanation ? For Consider the following scenario analysis and answer the following 3 questions: Economy Probability Return on Stock

For Consider the following scenario analysis and answer the following 3 questions: Economy Probability Return on Stock A Good 1/3 28% Normal 1/3 12% Bad 1/3 -7% Return on Stock B -3% 7% 17% 12. What are the expected return and standard deviation of stock A? A) 13.5% and 3.5% B) 14.5% and 11% C) 11% and 14.3% D) 10% and 13.3% 13. . 14. What are the expected return and standard deviation of stock B? 4 A) 7% and 8.2% B) 17% and 6.5% C) 7% and 9.0% to * Correlation colofficient calculate ? Covaru oner Grott and Perrin, Inc. has expected earnings of $5 per share for next year. The firm's ROE is 20% and its earnings retention ratio is 70%. If the firm's market capitalization rate is 15%, what percentage of its share price is attributed to the present value of its growth opportunities (PVGO)? A) 22% B) 80% C) 75% D) 78%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts