Question: Can anyone work these two problems out for me? thank you Seneca Enterprises is considering a working capital investment and financing policy that requires Seneca

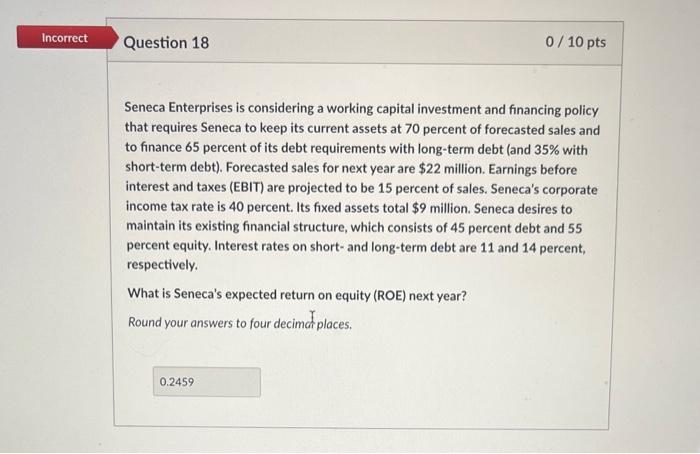

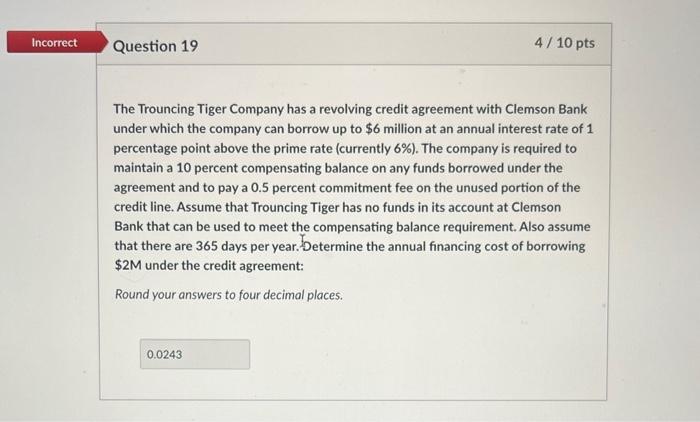

Seneca Enterprises is considering a working capital investment and financing policy that requires Seneca to keep its current assets at 70 percent of forecasted sales and to finance 65 percent of its debt requirements with long-term debt (and 35% with short-term debt). Forecasted sales for next year are $22 million. Earnings before interest and taxes (EBIT) are projected to be 15 percent of sales. Seneca's corporate income tax rate is 40 percent. Its fixed assets total $9 million. Seneca desires to maintain its existing financial structure, which consists of 45 percent debt and 55 percent equity. Interest rates on short- and long-term debt are 11 and 14 percent, respectively. What is Seneca's expected return on equity (ROE) next year? Round your answers to four decimat places. The Trouncing Tiger Company has a revolving credit agreement with Clemson Bank under which the company can borrow up to $6 million at an annual interest rate of 1 percentage point above the prime rate (currently 6% ). The company is required to maintain a 10 percent compensating balance on any funds borrowed under the agreement and to pay a 0.5 percent commitment fee on the unused portion of the credit line. Assume that Trouncing Tiger has no funds in its account at Clemson Bank that can be used to meet the compensating balance requirement. Also assume that there are 365 days per year. Determine the annual financing cost of borrowing $2M under the credit agreement: Round your answers to four decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts