Question: can help to solve this question? Beatrice (aged 41) and Doris (aged 44) are friends from Victoria Junior College and have been doing fashion designing

can help to solve this question?

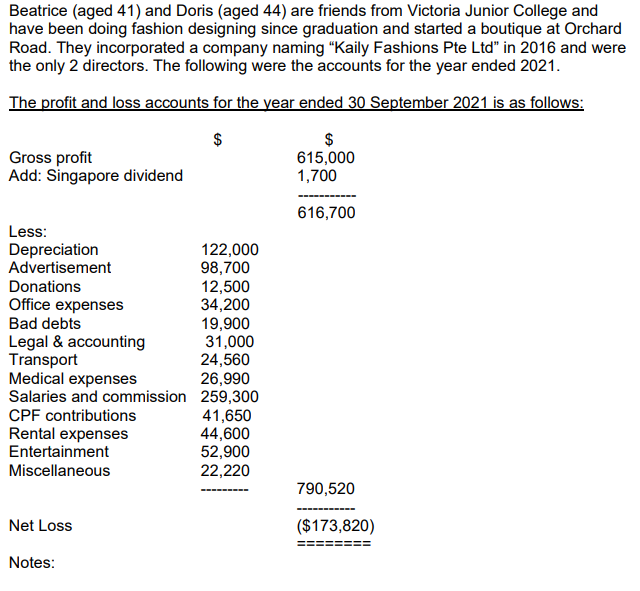

Beatrice (aged 41) and Doris (aged 44) are friends from Victoria Junior College and have been doing fashion designing since graduation and started a boutique at Orchard Road. They incorporated a company naming Kaily Fashions Pte Ltd in 2016 and were the only 2 directors. The following were the accounts for the year ended 2021.

The profit and loss accounts for the year ended 30 September 2021 is as follows

Gross profit 615,000

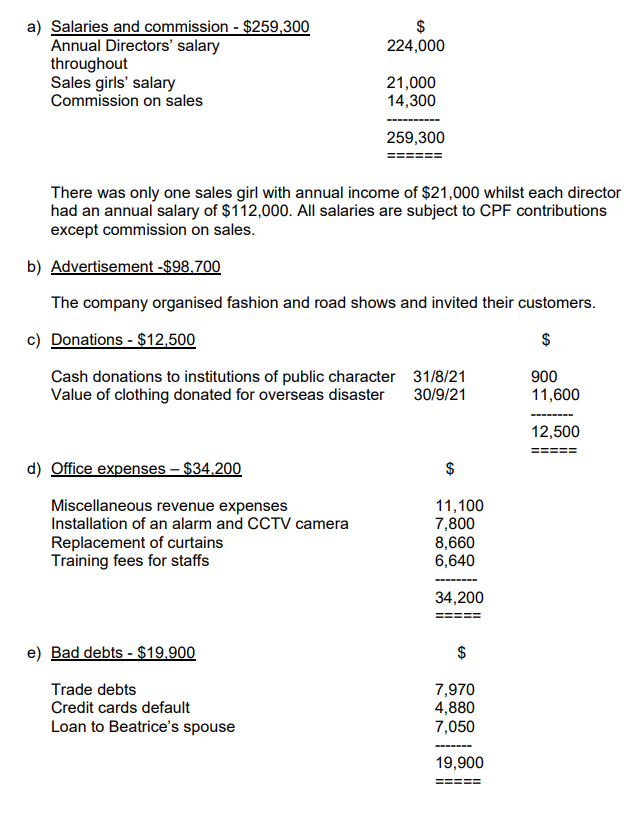

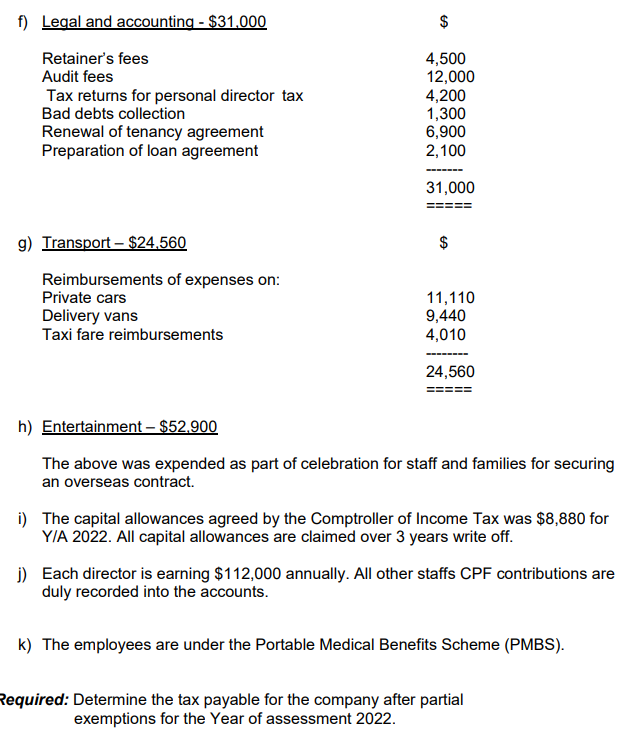

Beatrice (aged 41) and Doris (aged 44) are friends from Victoria Junior College and have been doing fashion designing since graduation and started a boutique at Orchard Road. They incorporated a company naming Kaily Fashions Pte Ltd in 2016 and were the only 2 directors. The following were the accounts for the year ended 2021. The profit and loss accounts for the year ended 30 September 2021 is as follows: $ Gross profit Add: Singapore dividend $ 615,000 1,700 616,700 Less: Depreciation 122,000 Advertisement 98,700 Donations 12,500 Office expenses 34,200 Bad debts 19,900 Legal & accounting 31,000 Transport 24,560 Medical expenses 26,990 Salaries and commission 259,300 CPF contributions 41,650 Rental expenses 44,600 Entertainment 52,900 Miscellaneous 22,220 790,520 Net Loss ($173,820) Notes: $ 224,000 a) Salaries and commission - $259,300 Annual Directors' salary throughout Sales girls' salary Commission on sales 21,000 14,300 259,300 There was only one sales girl with annual income of $21,000 whilst each director had an annual salary of $112,000. All salaries are subject to CPF contributions except commission on sales. b) Advertisement -$98,700 The company organised fashion and road shows and invited their customers. c) Donations - $12,500 $ Cash donations to institutions of public character 31/8/21 Value of clothing donated for overseas disaster 30/9/21 900 11,600 12,500 $ d) Office expenses - $34.200 Miscellaneous revenue expenses Installation of an alarm and CCTV camera Replacement of curtains Training fees for staffs 11,100 7,800 8,660 6,640 34,200 e) Bad debts - $19.900 $ $ Trade debts Credit cards default Loan to Beatrice's spouse 7,970 4,880 7,050 19,900 f) Legal and accounting - $31,000 $ $ Retainer's fees Audit fees Tax returns for personal director tax Bad debts collection Renewal of tenancy agreement Preparation of loan agreement 4,500 12,000 4,200 1,300 6,900 2,100 31,000 $ g) Transport - $24,560 Reimbursements of expenses on: Private cars Delivery vans Taxi fare reimbursements 11,110 9,440 4,010 24,560 h) Entertainment - $52,900 The above was expended as part of celebration for staff and families for securing an overseas contract. i) The capital allowances agreed by the Comptroller of Income Tax was $8,880 for YIA 2022. All capital allowances are claimed over 3 years write off. ) Each director is earning $112,000 annually. All other staffs CPF contributions are duly recorded into the accounts. k) The employees are under the Portable Medical Benefits Scheme (PMBS). Required: Determine the tax payable for the company after partial exemptions for the Year of assessment 2022. Beatrice (aged 41) and Doris (aged 44) are friends from Victoria Junior College and have been doing fashion designing since graduation and started a boutique at Orchard Road. They incorporated a company naming Kaily Fashions Pte Ltd in 2016 and were the only 2 directors. The following were the accounts for the year ended 2021. The profit and loss accounts for the year ended 30 September 2021 is as follows: $ Gross profit Add: Singapore dividend $ 615,000 1,700 616,700 Less: Depreciation 122,000 Advertisement 98,700 Donations 12,500 Office expenses 34,200 Bad debts 19,900 Legal & accounting 31,000 Transport 24,560 Medical expenses 26,990 Salaries and commission 259,300 CPF contributions 41,650 Rental expenses 44,600 Entertainment 52,900 Miscellaneous 22,220 790,520 Net Loss ($173,820) Notes: $ 224,000 a) Salaries and commission - $259,300 Annual Directors' salary throughout Sales girls' salary Commission on sales 21,000 14,300 259,300 There was only one sales girl with annual income of $21,000 whilst each director had an annual salary of $112,000. All salaries are subject to CPF contributions except commission on sales. b) Advertisement -$98,700 The company organised fashion and road shows and invited their customers. c) Donations - $12,500 $ Cash donations to institutions of public character 31/8/21 Value of clothing donated for overseas disaster 30/9/21 900 11,600 12,500 $ d) Office expenses - $34.200 Miscellaneous revenue expenses Installation of an alarm and CCTV camera Replacement of curtains Training fees for staffs 11,100 7,800 8,660 6,640 34,200 e) Bad debts - $19.900 $ $ Trade debts Credit cards default Loan to Beatrice's spouse 7,970 4,880 7,050 19,900 f) Legal and accounting - $31,000 $ $ Retainer's fees Audit fees Tax returns for personal director tax Bad debts collection Renewal of tenancy agreement Preparation of loan agreement 4,500 12,000 4,200 1,300 6,900 2,100 31,000 $ g) Transport - $24,560 Reimbursements of expenses on: Private cars Delivery vans Taxi fare reimbursements 11,110 9,440 4,010 24,560 h) Entertainment - $52,900 The above was expended as part of celebration for staff and families for securing an overseas contract. i) The capital allowances agreed by the Comptroller of Income Tax was $8,880 for YIA 2022. All capital allowances are claimed over 3 years write off. ) Each director is earning $112,000 annually. All other staffs CPF contributions are duly recorded into the accounts. k) The employees are under the Portable Medical Benefits Scheme (PMBS). Required: Determine the tax payable for the company after partial exemptions for the Year of assessment 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts