Question: Can i get a,b,and c done step by step (no excel please) 16. For this problem, use the Bloomberg screen below. (20 points) GRAB 6GActions3Settings

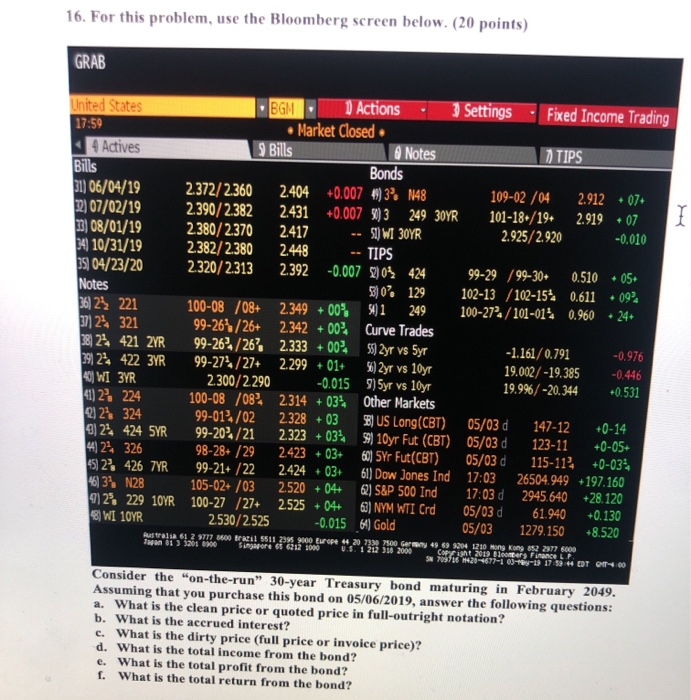

16. For this problem, use the Bloomberg screen below. (20 points) GRAB 6GActions3Settings Fixed Income Trading Market Closed. 9 Bills ons . Settings . Fixed Income Trading ted S 17:59 Notes 4 Actives Bills n06/04/19 2.372/2.360 2.404 +0.0074) 3.148 07/02/19 2.390/2.382 2.431 +0.0079)3249 30YR 3)08/01/19 2380/2370 2417 4 10/31/19 2382/2380 2448 35) 04/23/20 2320/2.313 2.392-0.007 os 424 Notes Bonds 109-02 /04 2.91207 101-18./19. 2.925/2.920 2.919.07 -0.010 TIPS 99-29/99-30. 102-13/102-15% 100-274/101-014 0.510.05. 5,0% 129 0.611.092 212221 100-08/08+ 2349 +00% 249 7) 24 321 24 421 2YR 99-264/267 2333+00% ar vs5yr 92 422 3YR 99-27/27+ 229901+ 2r vs 10yr 0.960.24- 99-26%/26+ 2342 +00, Curve Trades -0.976 -1.161/0.791 19.002/-19.385 19.9%/-20.344 -0.446 300/2290 0.015 )5yr vs 10yr +0.531 2 224 100-08 /08 2314 +03 Other Markets 2% 324 2 424 5YR 99-202/21 2323+03 9) 10yr Fut (CBT) 05/03 d 123-11 +0-05- 44124 326 5) 23 426 7YR 99-21+ /22 2.424 03+ 61 Dow Jones Ind 17:03 26504949 197.160 N28105-02+/03 2.520 04+ ) S&P 500 Ind 17:03 d 2945.640 +28.120 2% 229 10YR 100-27/27+ 2.525 + 04+ 63) NYMITICrd 05/03d 61.940 +0.130 WI 10YR 99-014/02 2.328 +03 US Long(CBT) 05/03d 147-12 +0-14 98-28+ /29 24233 60] 5Yr Fut(CBT) 05/03 d 115-11 +0-03 2530/2525 0.015 Gold 05/03 1279.150 +8.520 awn 613 5201 0nor6 6212 300112 318 2009 int 2019 lioomer, Finance L, C SOSTE 42048771 17 Consider the "on-the-run" 30-year Treasury bond maturing in February 2049. Assuming that you purchase this bond on 05/06/2019, answer the following questions: a. What is the clean price or quoted price in full-outright notation? b. What is the accrued interest? c. What is the dirty price (full price or invoice price)? d. What is the total income from the bond? e. What is the total profit from the bond? f. What is the total return from the bond? 16. For this problem, use the Bloomberg screen below. (20 points) GRAB 6GActions3Settings Fixed Income Trading Market Closed. 9 Bills ons . Settings . Fixed Income Trading ted S 17:59 Notes 4 Actives Bills n06/04/19 2.372/2.360 2.404 +0.0074) 3.148 07/02/19 2.390/2.382 2.431 +0.0079)3249 30YR 3)08/01/19 2380/2370 2417 4 10/31/19 2382/2380 2448 35) 04/23/20 2320/2.313 2.392-0.007 os 424 Notes Bonds 109-02 /04 2.91207 101-18./19. 2.925/2.920 2.919.07 -0.010 TIPS 99-29/99-30. 102-13/102-15% 100-274/101-014 0.510.05. 5,0% 129 0.611.092 212221 100-08/08+ 2349 +00% 249 7) 24 321 24 421 2YR 99-264/267 2333+00% ar vs5yr 92 422 3YR 99-27/27+ 229901+ 2r vs 10yr 0.960.24- 99-26%/26+ 2342 +00, Curve Trades -0.976 -1.161/0.791 19.002/-19.385 19.9%/-20.344 -0.446 300/2290 0.015 )5yr vs 10yr +0.531 2 224 100-08 /08 2314 +03 Other Markets 2% 324 2 424 5YR 99-202/21 2323+03 9) 10yr Fut (CBT) 05/03 d 123-11 +0-05- 44124 326 5) 23 426 7YR 99-21+ /22 2.424 03+ 61 Dow Jones Ind 17:03 26504949 197.160 N28105-02+/03 2.520 04+ ) S&P 500 Ind 17:03 d 2945.640 +28.120 2% 229 10YR 100-27/27+ 2.525 + 04+ 63) NYMITICrd 05/03d 61.940 +0.130 WI 10YR 99-014/02 2.328 +03 US Long(CBT) 05/03d 147-12 +0-14 98-28+ /29 24233 60] 5Yr Fut(CBT) 05/03 d 115-11 +0-03 2530/2525 0.015 Gold 05/03 1279.150 +8.520 awn 613 5201 0nor6 6212 300112 318 2009 int 2019 lioomer, Finance L, C SOSTE 42048771 17 Consider the "on-the-run" 30-year Treasury bond maturing in February 2049. Assuming that you purchase this bond on 05/06/2019, answer the following questions: a. What is the clean price or quoted price in full-outright notation? b. What is the accrued interest? c. What is the dirty price (full price or invoice price)? d. What is the total income from the bond? e. What is the total profit from the bond? f. What is the total return from the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts