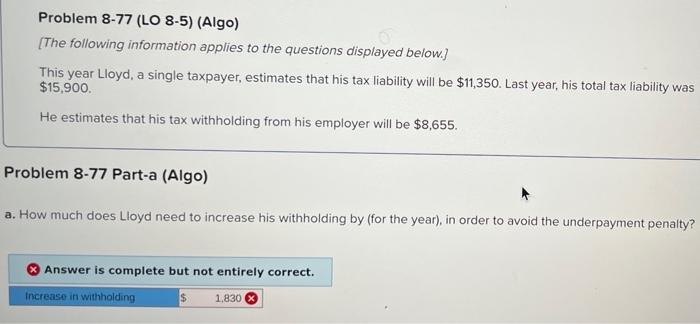

Question: can I get help Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates

![applies to the questions displayed below.] This year Lloyd, a single taxpayer,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbc8a218881_92966fbc8a1abea6.jpg)

Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates that his tax liability will be $11,350. Last year, his total tax liability was $15,900. He estimates that his tax withholding from his employer will be $8,655. Problem 8-77 Part-a (Algo) a. How much does Lloyd need to increase his withholding by (for the year), in order to avoid the underpayment penalty? Answer is complete but not entirely correct. Increase in withholding $ 1,830 Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates that his tax liability will be $11,350. Last year, his total tax liability was $15,900. He estimates that his tax withholding from his employer will be $8,655. Problem 8-77 Part-b (Algo) b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the feder short-term rate is 5 percent. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Dates April 15th June 15th September 15th January 15th Total Actual Withholding Required Withholding Prev Over (Under) Withheld 2 of N Penalty Per Quarter $ Next 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts