Question: PROBLEMS - SERIES B Problem 1 0 - 1 6 B Using present value techniques to evaluate alternative investment opportunities Perry Automobile Repair Inc. currently

PROBLEMSSERIES B

Problem B Using present value techniques to evaluate alternative investment opportunities

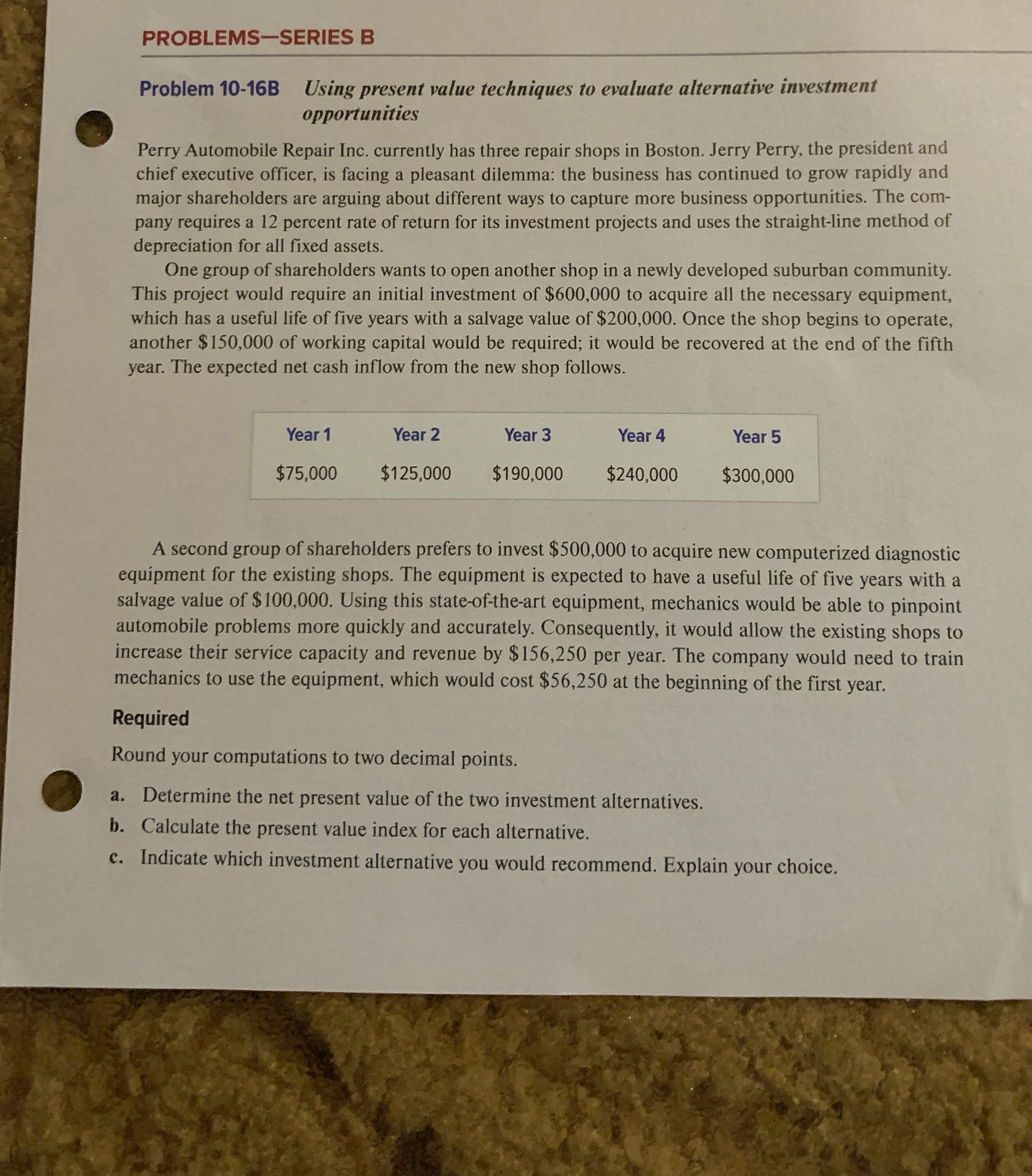

Perry Automobile Repair Inc. currently has three repair shops in Boston. Jerry Perry, the president and chief executive officer, is facing a pleasant dilemma: the business has continued to grow rapidly and major shareholders are arguing about different ways to capture more business opportunities. The company requires a percent rate of return for its investment projects and uses the straightline method of depreciation for all fixed assets.

One group of shareholders wants to open another shop in a newly developed suburban community. This project would require an initial investment of $ to acquire all the necessary equipment, which has a useful life of five years with a salvage value of $ Once the shop begins to operate, another $ of working capital would be required; it would be recovered at the end of the fifth year. The expected net cash inflow from the new shop follows.

tableYear Year Year Year Year $$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock