Question: can i get help with both pls Given the historical cost of product Dominoe is $15, the selling price of product Dominoe is $20, costs

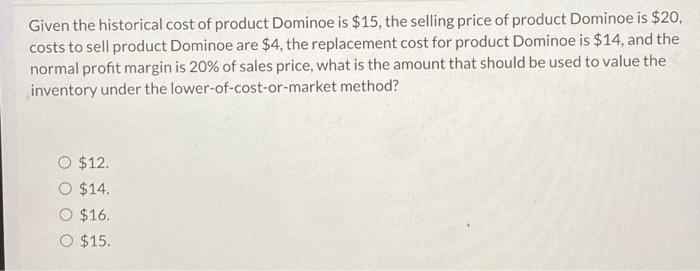

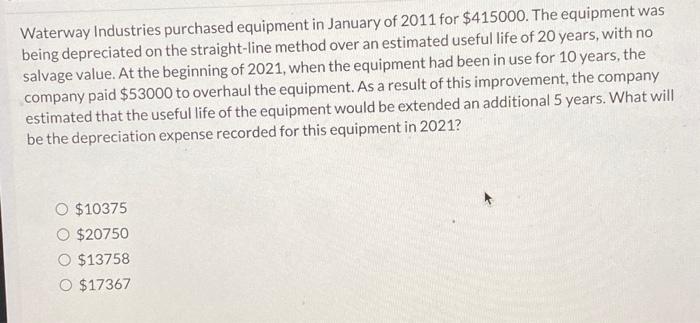

Given the historical cost of product Dominoe is $15, the selling price of product Dominoe is $20, costs to sell product Dominoe are $4, the replacement cost for product Dominoe is $14, and the normal profit margin is 20% of sales price, what is the amount that should be used to value the inventory under the lower-of-cost-or-market method? O $12. $14. O $16. O $15. Waterway Industries purchased equipment in January of 2011 for $415000. The equipment was being depreciated on the straight-line method over an estimated useful life of 20 years, with no salvage value. At the beginning of 2021, when the equipment had been in use for 10 years, the company paid $53000 to overhaul the equipment. As a result of this improvement, the company estimated that the useful life of the equipment would be extended an additional 5 years. What will be the depreciation expense recorded for this equipment in 2021? O $10375 O $20750 O $13758 O $17367

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts