Question: Can I get help with these homeworks questions ? QUESTION 4 A borrower takes out a 30-year 5/1 Hybrid ARM for $500,000 with an initial

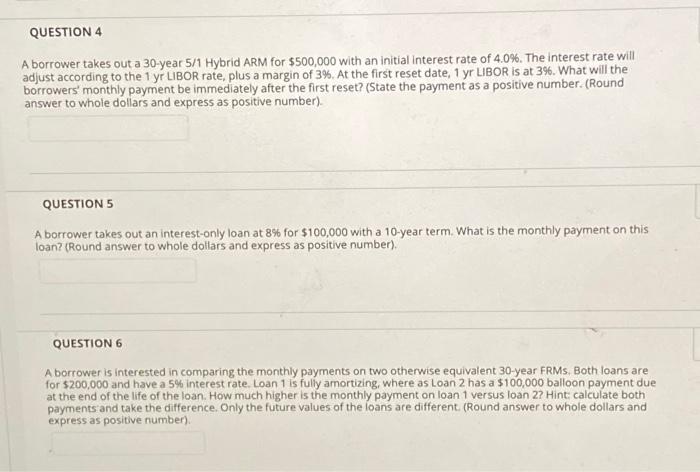

QUESTION 4 A borrower takes out a 30-year 5/1 Hybrid ARM for $500,000 with an initial interest rate of 4.0%. The interest rate will adjust according to the 1 yr LIBOR rate, plus a margin of 3%. At the first reset date, 1 yr LIBOR is at 3%. What will the borrowers' monthly payment be immediately after the first reset? (State the payment as a positive number. (Round answer to whole dollars and express as positive number) QUESTION 5 A borrower takes out an interest-only loan at 8% for $100,000 with a 10-year term What is the monthly payment on this loan? (Round answer to whole dollars and express as positive number). QUESTION 6 A borrower is interested in comparing the monthly payments on two otherwise equivalent 30-year FRMs. Both loans are for $200,000 and have a 5% interest rate. Loan 1 is fully amortizing, where as Loan 2 has a $100,000 balloon payment due at the end of the life of the loan. How much higher is the monthly payment on loan 1 versus loan 22 Hint calculate both payments and take the difference. Only the future values of the loans are different. (Round answer to whole dollars and express as positive number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts