Question: Can I get help with this project? I am working on Express Inc. and I am stuck on using the formulas in Excel. Can you

Can I get help with this project? I am working on Express Inc. and I am stuck on using the formulas in Excel. Can you please show me what formulas to use in excel?

Can I get help with this project? I am working on Express Inc. and I am stuck on using the formulas in Excel. Can you please show me what formulas to use in excel?

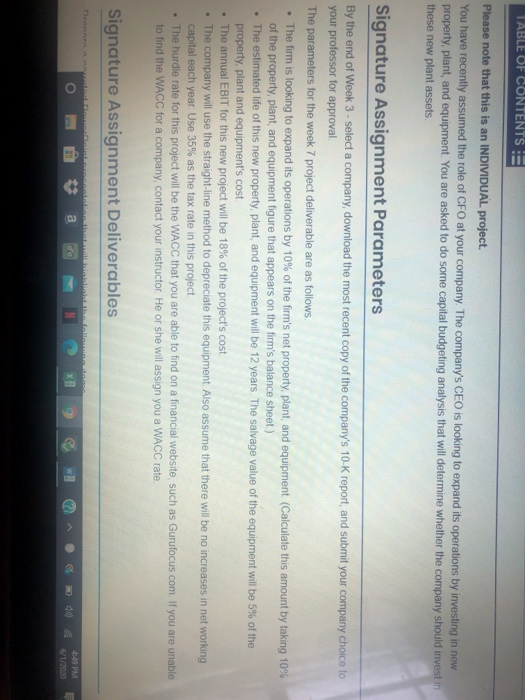

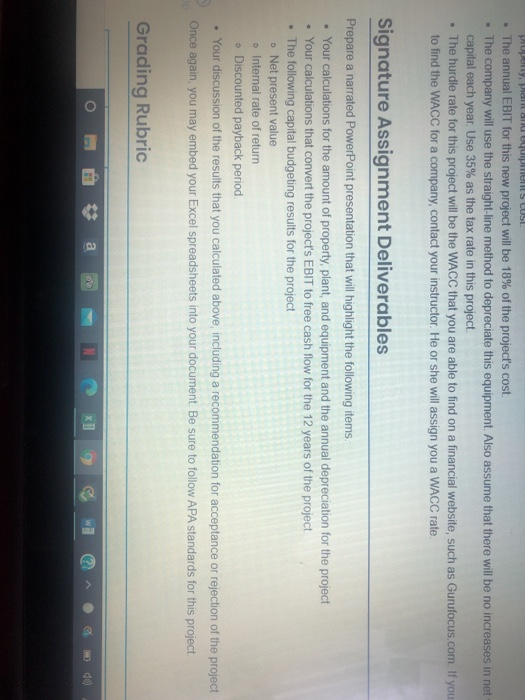

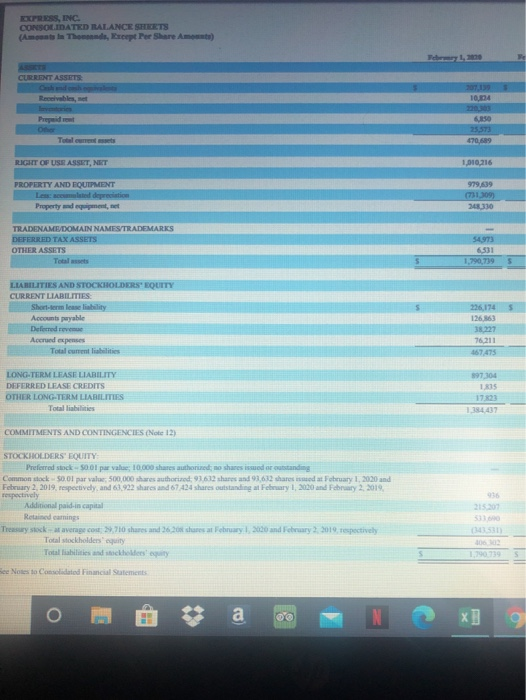

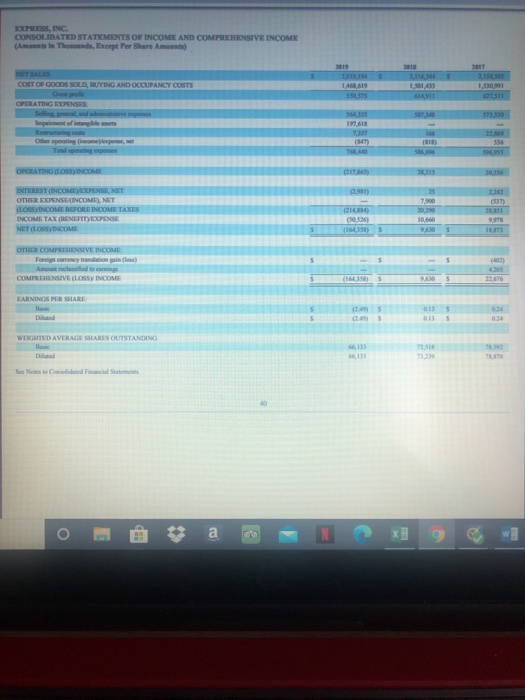

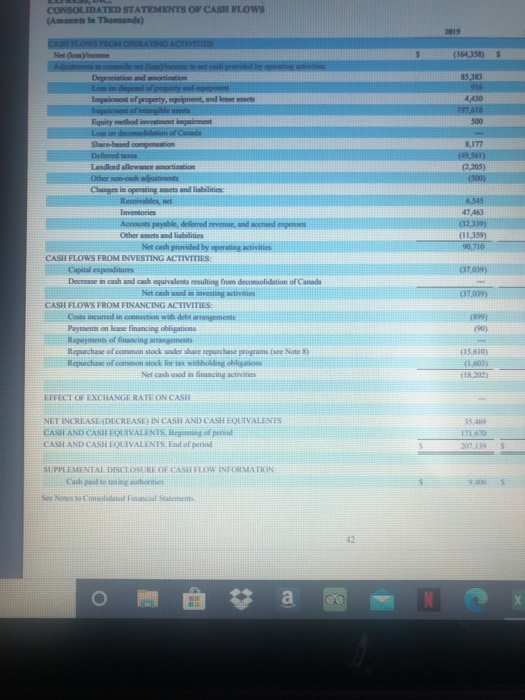

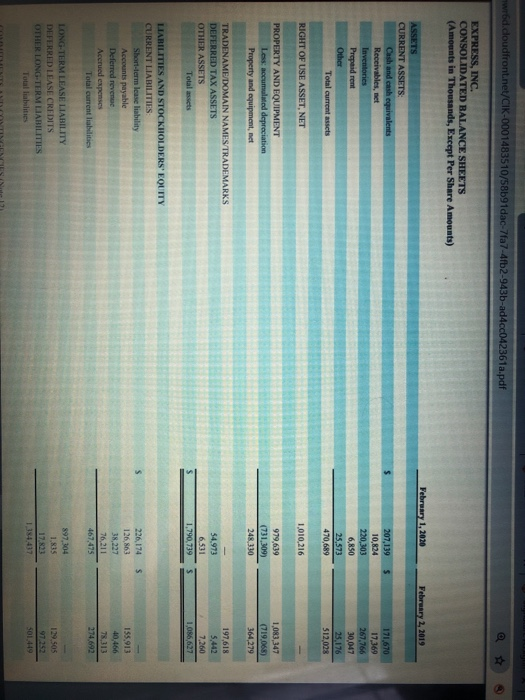

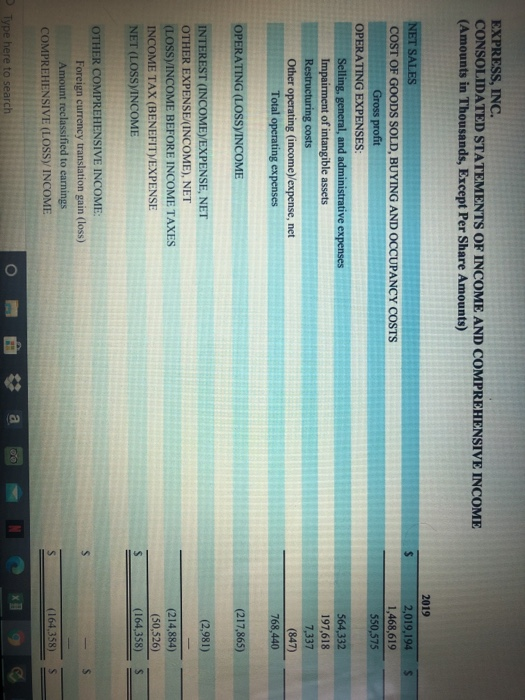

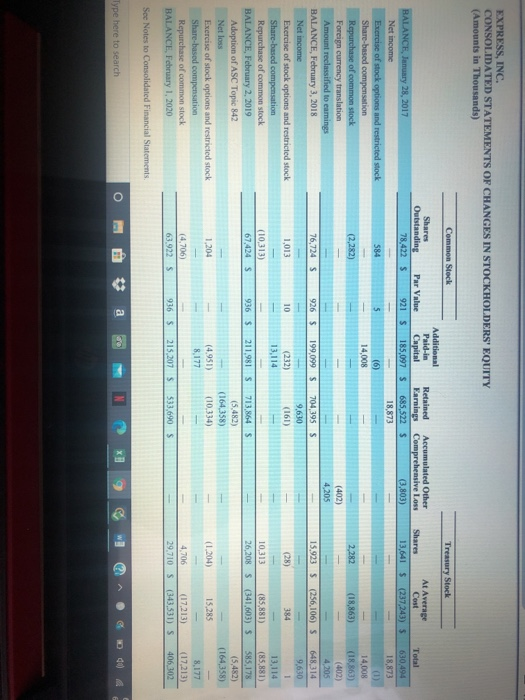

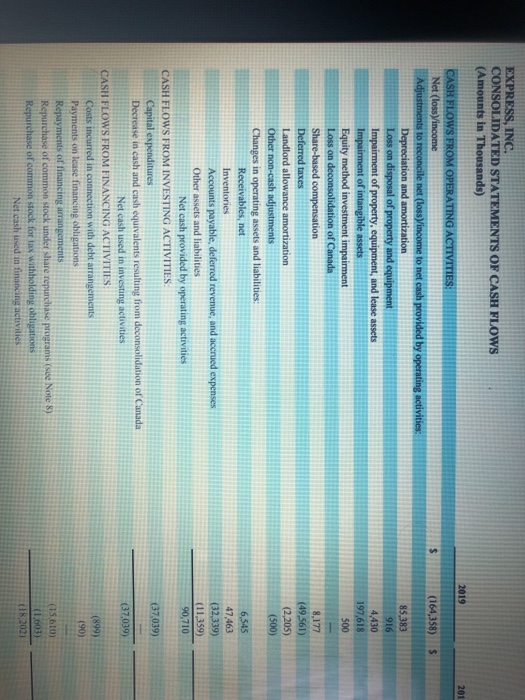

TABLE OF CONTENTS Please note that this is an INDIVIDUAL project. You have recently assumed the role of CFO at your company. The company's CEO is looking to expand its operations by investing in new property, plant, and equipment. You are asked to do some capital budgeting analysis that will determine whether the company should invest in these new plant assets. Signature Assignment Parameters By the end of Week 3 - select a company, download the most recent copy of the company's 10-K report, and submit your company choice to your professor for approval. The parameters for the week 7 project deliverable are as follows. The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet) The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost The annual EBIT for this new project will be 18% of the project's cost. The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project . The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. Signature Assignment Deliverables Dennom a napot Hotels 4:49 PM 6/1/2020 propoly, para uyup S CUSL . The annual EBIT for this new project will be 18% of the project's cost. . The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net capital each year. Use 35% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. Signature Assignment Deliverables Prepare a narrated PowerPoint presentation that will highlight the following items. . Your calculations for the amount of property, plant, and equipment and the annual depreciation for the project Your calculations that convert the project's EBIT to free cash flow for the 12 years of the project. The following capital budgeting results for the project Net present value Internal rate of return Discounted payback period, . Your discussion of the results that you calculated above, including a recommendation for acceptance or rejection of the project Once again, you may embed your Excel spreadsheets into your document. Be sure to follow APA standards for this project. Grading Rubric . a 8 DRIES, INC CONSOLIDATED ILALANCE SHEETS (Amount Thornds, Except Pet Share Amt) CURRENT ASSETS 1004 6850 25573 470,689 RIGHT OF USE ASSET, NIET 1,010,216 PROPERTY AND EQUIPMENT 979,99 731309 248330 Property det, at TRADENAME/DOMAIN NAMES/TRADEMARKS DEFERRED TAX ASSETS OTHER ASSETS 54973 6.531 1.790,719 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Short-term lease by Accounts payable Defend roveme Accrued expenses Total current liabilities 236.174 126853 76,211 167,475 LONG-TERM LEASE LIABILITY DEFERRED LEASE CREDITS OTHER LONG-TERM LIABILITIES Total liabilities 897,304 1815 1,384437 COMMITMENTS AND CONTINGENCIES (Note 12) STOCKHOLDERS' EQUITY Preferred stock - $0.01 par value: 10.000 shares authorised, no share issued or outstanding Common stock $0.01 par value 500,000 shares authorized 93612 shares and 93,632 shares is at February 1, 2020 and February 2, 2019, respectively, and 63.922 shares and 67 424 shares outstanding at February 1, 2020 and February 2, 2019, respectively Additional paid.in capital Retained camnings Treasury stock a average cost: 710 shares and 26. shares at ebruary , 2020 and February 2, 2019 respectively Total stockholders' equity Total abilities and stehty 215.20 See Notes to Consolidated Financial Sutements a EXPRESS, INC CONSOLIDATED STATEMENTS OW INCOME AND COMPREHENSIVE INCOME (Ametle Threept Per Share Amm) 2017 3 COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS 1.5014 1,330,901 14619 350575 OPERATING OPENSES Impairment of cible et 564332 197.618 7337 (HT 166 Toalep OPERATING (LOSSINCOME INTEREST (INCOMEXPENSIE MET OTHER EXPENSE/INCOME), NET (LOSSYINCOME BEFORE INCOME TAXES INCOME TAX (BENEFITY EXPENSE NET (LOSSY INCOME 25 7500 300 1060 630 (50,536) (1645) 5 5 5 5 OTHER COMPREHENSIVE INCOME Fariyaana Amountain COMPREHENSIVE (LOSSY INCOME 43 3266 $ $ 9530 EARNINGS PER SHARE 95 5 5 03 0.30 5 13 WEIGHTED AVERAGE SHARES OUTSTANDING 12.513 732 De Soe Notes Cadeau o 8 CONSOLIDATED STATEMENTS OF CASH FLOWS (Amo la Thornende) $ (164,358) CASH FLOWS FROM OPERATING ACTIVITIES Net (low Adres to reconcile et comme vided by openie Depreciation and mention 8533 916 4,430 Impairment of property, equipment, and 500 8,177 23.205) (500) Equity method went pairment Los on deconsolidation of Canada Share based compensation Defend Landlord allowance amortination Other non-cash adjustments Changes in operating sets and liabilita Receivables et Inventories Accounts payable deferred revenue, despeses Other assets and liabilities Nel cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures Decrease in cash and cash equivalents resulting from deconsolidation of Canada Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Costs incurred in connection with dewagement Payments on lease financing obligations Repynt of financing agents Repurchase of common stock under share purchase programs (see Note 8 Repurchase of common stock for tax withholding obligi Net cash used in financing activities 6545 47.463 (2399) (11.359) 90,710 07.019) 37039 29 (90) 15,610) 00 EFFECT OF EXCHANGE RATE ON CASH NET INCREASE DECREASE IN CASH AND CASH FOLIVALENTS CASILAND CASHUVALINTS, Being opened CASILAND CASTRELIVALENTS. End of period 17160 $ SUPPLEMENTAL DISCLOSURE OF CASHFLOW INFORMATION Casted to an auto See Nonsolidated Financial Statements a wrd doudfront.net/CIK-0001483510/58b91dac-7fa7-4fb2-943b-ad4cc042361a.pdf EXPRESS, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Per Share Amounts) February 1, 2020 February 2, 2019 ASSETS CURRENT ASSETS: Cash and cash equivalents Receivables, net Inventories Prepaid rent Other Total current assets 207,139 10,824 220,303 6,850 25,573 470,689 171,670 17,369 267,766 30.047 25.176 512,028 RIGHT OF USE ASSET, NET 1,010,216 PROPERTY AND EQUIPMENT Less: accumulated depreciation Property and equipment, net 979,639 (731,309) 248 330 1,083,347 (719,065) 364,279 TRADENAME/DOMAIN NAMES/TRADEMARKS DEFERRED TAX ASSETS OTHER ASSETS Total assets 54,973 6,531 1,790,739 197,618 5,442 7,260 1,086,627 S LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Short-term lease liability Accounts payable Deferred revenue Accrued expenses Total current liabilities 226, 174 126,863 38,227 76,211 467,475 155,913 40,466 78,313 274.692 LONG-TERM LEASE LIABILITY DEFERRED LEASE CREDITS OTHER LONG-TERM LIABILITIES Total liabilities 897,304 1.815 17,823 1 384.417 129.505 97.252 EXPRESS, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in Thousands, Except Per Share Amounts) 2019 2,019,194 1,468,619 550,575 NET SALES COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS Gross profit OPERATING EXPENSES: Selling, general, and administrative expenses Impairment of intangible assets Restructuring costs Other operating (income)/expense, net Total operating expenses 564,332 197,618 7,337 (847) 768,440 OPERATING (LOSSYINCOME (217,865) (2,981) INTEREST (INCOME/EXPENSE, NET OTHER EXPENSE/(INCOME), NET (LOSS)/INCOME BEFORE INCOME TAXES INCOME TAX (BENEFIT)EXPENSE NET (LOSS/INCOME (214,884) (50,526) (164,358) s OTHER COMPREHENSIVE INCOME: Foreign currency translation gain (loss) Amount reclassified to earnings COMPREHENSIVE (LOSSY INCOME (164,358) Type here to search o EXPRESS, INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (Amounts in Thousands) Treasury Stock Common Stock Additional Shares Paid in Outstanding Par Value Capital 78,422 S 921 $ 185,097 $ Total Retained Accumulated Other Earnings Comprehensive Loss 685,522 $ (3,803) 18,873 At Average Shares Cost 13,6415 (237,243) 5 584 5 (6) 14,008 (2,282) 2.282 (18,863) 630,494 18,873 (1) 14.008 (18.863) (402) 4205 648,314 9,630 (402) 4,205 76,724 S 926 $ 199 099 $ 15.923 $ (256,106) S BALANCE, January 28, 2017 Net income Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock Foreign currency translation Amount reclassified to carings BALANCE, February 3, 2018 Net income Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock BALANCE, February 2, 2019 Adoption of ASC Topic 842 Net loss Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock BALANCE, February 1, 2020 704,395 S 9,630 (161) 1,013 10 (28) 384 (232) 13,114 (10,313) 67.424S 10,313 26,208 S (85,881) (341,603) 5 936 $ 211.981 S 713,864 $ (5.482) (164,358) (10,334) 13,114 (85,881) 585,178 (5,482) (164,358) 1,204 (1.204) 15,285 (4.951) 8.177 - (4,706) 63.922S 4,706 (17,213) 29.710 S (343,531) S 8,177 (17.213) 406302 936 $ 215.207 533,690 S See Notes to Consolidated Financial Statements Type here to search o 8 a EXPRESS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) 2019 201 $ (164,358) $ 85.383 916 4,430 197,618 500 8,177 (49,561) (2,205) (500) CASH FLOWS FROM OPERATING ACTIVITIES: Net (lossVincome Adjustments to reconcile net (lossy income to net cash provided by operating activities: Depreciation and amortization Loss on disposal of property and equipment Impairment of property, equipment, and lease assets Impairment of intangible assets Equity method investment impairment Loss on deconsolidation of Canada Share-based compensation Deferred taxes Landlord allowance amortization Other non-cash adjustments Changes in operating assets and liabilities: Receivables, net Inventories Accounts payable, deferred revenue, and accrued expenses Other assets and liabilities Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures Decrease in cash and cash equivalents resulting from deconsolidation of Canada Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Costs incurred in connection with debt arrangements Payments on lease financing obligations Repayments of financing arrangements Repurchase of common stock under share repurchase programs (se Note 8) Repurchase of common stock for tax withholding obligations Net cash used in financing activities 6,545 47,463 (32,339) (11,359) 90,710 (37,039) (37,039) (899) (90) (15,610) (1.603) (18,2021 TABLE OF CONTENTS Please note that this is an INDIVIDUAL project. You have recently assumed the role of CFO at your company. The company's CEO is looking to expand its operations by investing in new property, plant, and equipment. You are asked to do some capital budgeting analysis that will determine whether the company should invest in these new plant assets. Signature Assignment Parameters By the end of Week 3 - select a company, download the most recent copy of the company's 10-K report, and submit your company choice to your professor for approval. The parameters for the week 7 project deliverable are as follows. The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet) The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost The annual EBIT for this new project will be 18% of the project's cost. The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 35% as the tax rate in this project . The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. Signature Assignment Deliverables Dennom a napot Hotels 4:49 PM 6/1/2020 propoly, para uyup S CUSL . The annual EBIT for this new project will be 18% of the project's cost. . The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net capital each year. Use 35% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. Signature Assignment Deliverables Prepare a narrated PowerPoint presentation that will highlight the following items. . Your calculations for the amount of property, plant, and equipment and the annual depreciation for the project Your calculations that convert the project's EBIT to free cash flow for the 12 years of the project. The following capital budgeting results for the project Net present value Internal rate of return Discounted payback period, . Your discussion of the results that you calculated above, including a recommendation for acceptance or rejection of the project Once again, you may embed your Excel spreadsheets into your document. Be sure to follow APA standards for this project. Grading Rubric . a 8 DRIES, INC CONSOLIDATED ILALANCE SHEETS (Amount Thornds, Except Pet Share Amt) CURRENT ASSETS 1004 6850 25573 470,689 RIGHT OF USE ASSET, NIET 1,010,216 PROPERTY AND EQUIPMENT 979,99 731309 248330 Property det, at TRADENAME/DOMAIN NAMES/TRADEMARKS DEFERRED TAX ASSETS OTHER ASSETS 54973 6.531 1.790,719 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Short-term lease by Accounts payable Defend roveme Accrued expenses Total current liabilities 236.174 126853 76,211 167,475 LONG-TERM LEASE LIABILITY DEFERRED LEASE CREDITS OTHER LONG-TERM LIABILITIES Total liabilities 897,304 1815 1,384437 COMMITMENTS AND CONTINGENCIES (Note 12) STOCKHOLDERS' EQUITY Preferred stock - $0.01 par value: 10.000 shares authorised, no share issued or outstanding Common stock $0.01 par value 500,000 shares authorized 93612 shares and 93,632 shares is at February 1, 2020 and February 2, 2019, respectively, and 63.922 shares and 67 424 shares outstanding at February 1, 2020 and February 2, 2019, respectively Additional paid.in capital Retained camnings Treasury stock a average cost: 710 shares and 26. shares at ebruary , 2020 and February 2, 2019 respectively Total stockholders' equity Total abilities and stehty 215.20 See Notes to Consolidated Financial Sutements a EXPRESS, INC CONSOLIDATED STATEMENTS OW INCOME AND COMPREHENSIVE INCOME (Ametle Threept Per Share Amm) 2017 3 COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS 1.5014 1,330,901 14619 350575 OPERATING OPENSES Impairment of cible et 564332 197.618 7337 (HT 166 Toalep OPERATING (LOSSINCOME INTEREST (INCOMEXPENSIE MET OTHER EXPENSE/INCOME), NET (LOSSYINCOME BEFORE INCOME TAXES INCOME TAX (BENEFITY EXPENSE NET (LOSSY INCOME 25 7500 300 1060 630 (50,536) (1645) 5 5 5 5 OTHER COMPREHENSIVE INCOME Fariyaana Amountain COMPREHENSIVE (LOSSY INCOME 43 3266 $ $ 9530 EARNINGS PER SHARE 95 5 5 03 0.30 5 13 WEIGHTED AVERAGE SHARES OUTSTANDING 12.513 732 De Soe Notes Cadeau o 8 CONSOLIDATED STATEMENTS OF CASH FLOWS (Amo la Thornende) $ (164,358) CASH FLOWS FROM OPERATING ACTIVITIES Net (low Adres to reconcile et comme vided by openie Depreciation and mention 8533 916 4,430 Impairment of property, equipment, and 500 8,177 23.205) (500) Equity method went pairment Los on deconsolidation of Canada Share based compensation Defend Landlord allowance amortination Other non-cash adjustments Changes in operating sets and liabilita Receivables et Inventories Accounts payable deferred revenue, despeses Other assets and liabilities Nel cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures Decrease in cash and cash equivalents resulting from deconsolidation of Canada Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Costs incurred in connection with dewagement Payments on lease financing obligations Repynt of financing agents Repurchase of common stock under share purchase programs (see Note 8 Repurchase of common stock for tax withholding obligi Net cash used in financing activities 6545 47.463 (2399) (11.359) 90,710 07.019) 37039 29 (90) 15,610) 00 EFFECT OF EXCHANGE RATE ON CASH NET INCREASE DECREASE IN CASH AND CASH FOLIVALENTS CASILAND CASHUVALINTS, Being opened CASILAND CASTRELIVALENTS. End of period 17160 $ SUPPLEMENTAL DISCLOSURE OF CASHFLOW INFORMATION Casted to an auto See Nonsolidated Financial Statements a wrd doudfront.net/CIK-0001483510/58b91dac-7fa7-4fb2-943b-ad4cc042361a.pdf EXPRESS, INC. CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Per Share Amounts) February 1, 2020 February 2, 2019 ASSETS CURRENT ASSETS: Cash and cash equivalents Receivables, net Inventories Prepaid rent Other Total current assets 207,139 10,824 220,303 6,850 25,573 470,689 171,670 17,369 267,766 30.047 25.176 512,028 RIGHT OF USE ASSET, NET 1,010,216 PROPERTY AND EQUIPMENT Less: accumulated depreciation Property and equipment, net 979,639 (731,309) 248 330 1,083,347 (719,065) 364,279 TRADENAME/DOMAIN NAMES/TRADEMARKS DEFERRED TAX ASSETS OTHER ASSETS Total assets 54,973 6,531 1,790,739 197,618 5,442 7,260 1,086,627 S LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Short-term lease liability Accounts payable Deferred revenue Accrued expenses Total current liabilities 226, 174 126,863 38,227 76,211 467,475 155,913 40,466 78,313 274.692 LONG-TERM LEASE LIABILITY DEFERRED LEASE CREDITS OTHER LONG-TERM LIABILITIES Total liabilities 897,304 1.815 17,823 1 384.417 129.505 97.252 EXPRESS, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (Amounts in Thousands, Except Per Share Amounts) 2019 2,019,194 1,468,619 550,575 NET SALES COST OF GOODS SOLD, BUYING AND OCCUPANCY COSTS Gross profit OPERATING EXPENSES: Selling, general, and administrative expenses Impairment of intangible assets Restructuring costs Other operating (income)/expense, net Total operating expenses 564,332 197,618 7,337 (847) 768,440 OPERATING (LOSSYINCOME (217,865) (2,981) INTEREST (INCOME/EXPENSE, NET OTHER EXPENSE/(INCOME), NET (LOSS)/INCOME BEFORE INCOME TAXES INCOME TAX (BENEFIT)EXPENSE NET (LOSS/INCOME (214,884) (50,526) (164,358) s OTHER COMPREHENSIVE INCOME: Foreign currency translation gain (loss) Amount reclassified to earnings COMPREHENSIVE (LOSSY INCOME (164,358) Type here to search o EXPRESS, INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (Amounts in Thousands) Treasury Stock Common Stock Additional Shares Paid in Outstanding Par Value Capital 78,422 S 921 $ 185,097 $ Total Retained Accumulated Other Earnings Comprehensive Loss 685,522 $ (3,803) 18,873 At Average Shares Cost 13,6415 (237,243) 5 584 5 (6) 14,008 (2,282) 2.282 (18,863) 630,494 18,873 (1) 14.008 (18.863) (402) 4205 648,314 9,630 (402) 4,205 76,724 S 926 $ 199 099 $ 15.923 $ (256,106) S BALANCE, January 28, 2017 Net income Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock Foreign currency translation Amount reclassified to carings BALANCE, February 3, 2018 Net income Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock BALANCE, February 2, 2019 Adoption of ASC Topic 842 Net loss Exercise of stock options and restricted stock Share-based compensation Repurchase of common stock BALANCE, February 1, 2020 704,395 S 9,630 (161) 1,013 10 (28) 384 (232) 13,114 (10,313) 67.424S 10,313 26,208 S (85,881) (341,603) 5 936 $ 211.981 S 713,864 $ (5.482) (164,358) (10,334) 13,114 (85,881) 585,178 (5,482) (164,358) 1,204 (1.204) 15,285 (4.951) 8.177 - (4,706) 63.922S 4,706 (17,213) 29.710 S (343,531) S 8,177 (17.213) 406302 936 $ 215.207 533,690 S See Notes to Consolidated Financial Statements Type here to search o 8 a EXPRESS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) 2019 201 $ (164,358) $ 85.383 916 4,430 197,618 500 8,177 (49,561) (2,205) (500) CASH FLOWS FROM OPERATING ACTIVITIES: Net (lossVincome Adjustments to reconcile net (lossy income to net cash provided by operating activities: Depreciation and amortization Loss on disposal of property and equipment Impairment of property, equipment, and lease assets Impairment of intangible assets Equity method investment impairment Loss on deconsolidation of Canada Share-based compensation Deferred taxes Landlord allowance amortization Other non-cash adjustments Changes in operating assets and liabilities: Receivables, net Inventories Accounts payable, deferred revenue, and accrued expenses Other assets and liabilities Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures Decrease in cash and cash equivalents resulting from deconsolidation of Canada Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Costs incurred in connection with debt arrangements Payments on lease financing obligations Repayments of financing arrangements Repurchase of common stock under share repurchase programs (se Note 8) Repurchase of common stock for tax withholding obligations Net cash used in financing activities 6,545 47,463 (32,339) (11,359) 90,710 (37,039) (37,039) (899) (90) (15,610) (1.603) (18,2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts