Question: Can I get some help, I need to show all work Use the following to answer question 9: Wilson Co. purchased land as a factory

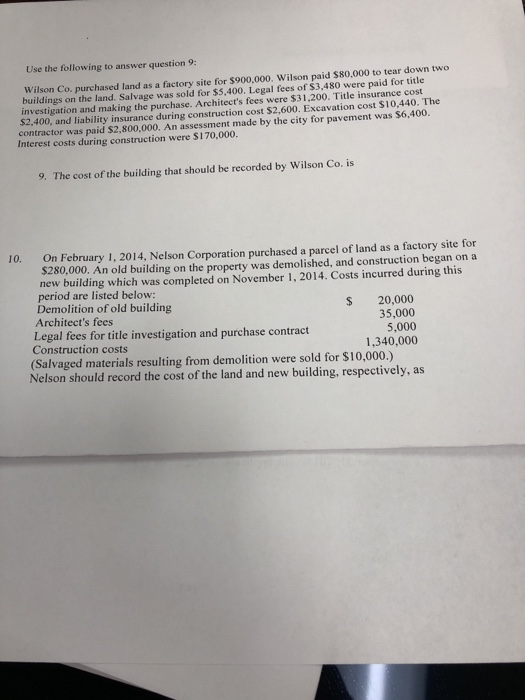

Use the following to answer question 9: Wilson Co. purchased land as a factory site for $900,000. Wilson paid $80,000 to tear down two buildings on the land. Salvage was sold for $5,400. Legal fees of $3,480 were paid for title investigation and making the purchase. Architect's fees were $31,200. Title insurance cost $2,400, and liability insurance during construction cost $2,600. Excavation cost $10,440. The contractor was paid $2,800,000. An assessment made by the city for pavement was $6,400. Interest costs during construction were S170,000. 9. The cost of the building that should be recorded by Wilson Co. is 10. On February 1, 2014, Nelson Corporation purchased a parcel of land as a factory site for $280,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2014. Costs incurred during this period are listed below: Demolition of old building Architect's fees $ 20,000 35,000 5,000 1,340,000 Legal fees for title investigation and purchase contract Construction costs (Salvaged materials resulting from demolition were sold for $10,000.) elson should record the cost of the land and new building, respectively, as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts