Question: Will someone help with this? I also need to show all work Use the following to answer question 5: Wilson Co. purchased land as a

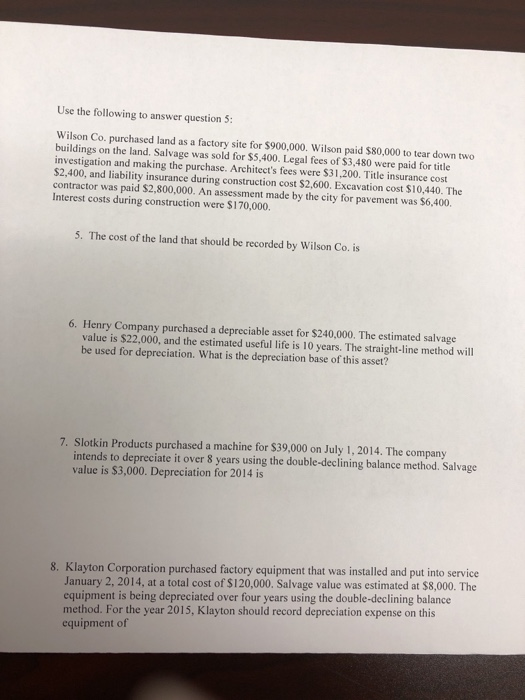

Use the following to answer question 5: Wilson Co. purchased land as a factory site for $900,000. Wilson paid $80,000 to tear down two buildings on the land. Salvage was sold for $5,400. Legal fees of $3,480 were paid for title investigation and making the purchase. Architect's fees were $31,200. Title insurance cost $2,400, and liability insurance during construction cost $2,600. Excavation cost $10,440. The contractor was paid $2,800,000. An assessment made by the city for pavement was $6,400. Interest costs during construction were $170,000. 5. The cost of the land that should be recorded by Wilson Co. is 6. Henry Company purchased a depreciable asset for $240,000. The estimated salvage value is $22,000, and the estimated useful life is 10 years. The straight-line method will be used for depreciation. What is the depreciation base of this asset? 7. Slotkin Products purchased a machine for $39,000 on July 1, 2014. The company intends to depreciate it over 8 years using the double-declining balance method. Salvage value is $3,000. Depreciation for 2014 is 8. Klayton Corporation purchased factory equipment that was installed and put into service January 2, 2014, at a total cost of $120,000. Salvage value was estimated at $8,000. The equipment is being depreciated over four years using the double-declining balance method. For the year 2015, Klayton should record depreciation expense on this equipment of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts