Question: can I have the answer pls . IF A NUMBER IS IN BRACKET IT'S NEGATINVE Cash Flow A Investment 1 2 3 4 $(58,000) $22,000

can I have the answer pls .

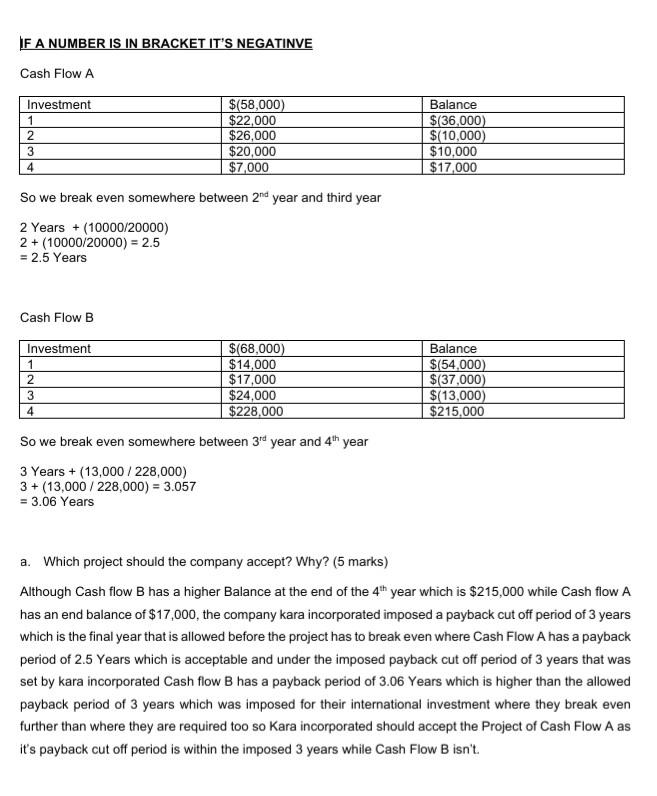

IF A NUMBER IS IN BRACKET IT'S NEGATINVE Cash Flow A Investment 1 2 3 4 $(58,000) $22,000 $26,000 $20,000 $7,000 Balance $(36,000) $(10,000) $10,000 $17,000 So we break even somewhere between 2nd year and third year 2 Years + (10000/20000) 2 + (10000/20000) = 2.5 = 2.5 Years Cash Flow B Investment 1 2 3 4 $(68,000) $14,000 $17,000 $24,000 $228,000 Balance $(54,000) $(37,000) $(13,000) $215,000 So we break even somewhere between 3rd year and 4th year 3 Years + (13,000 / 228,000) 3+ (13,000 / 228,000) = 3.057 = 3.06 Years a. Which project should the company accept? Why? (5 marks) Although Cash flow B has a higher Balance at the end of the 4th year which is $215,000 while Cash flow A has an end balance of $17,000, the company kara incorporated imposed a payback cut off period of 3 years which is the final year that is allowed before the project has to break even where Cash Flow A has a payback period of 2.5 Years which is acceptable and under the imposed payback cut off period of 3 years that was set by kara incorporated Cash flow B has a payback period of 3.06 Years which is higher than the allowed payback period of 3 years which was imposed for their international investment where they break even further than where they are required too so Kara incorporated should accept the Project of Cash Flow A as it's payback cut off period is within the imposed 3 years while Cash Flow B isn't

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts