Question: Can I please get a solution to question 6, using a financial calculator ? Capital Budgeting LN2 (problems only) 1. Williams Inc. is planning on

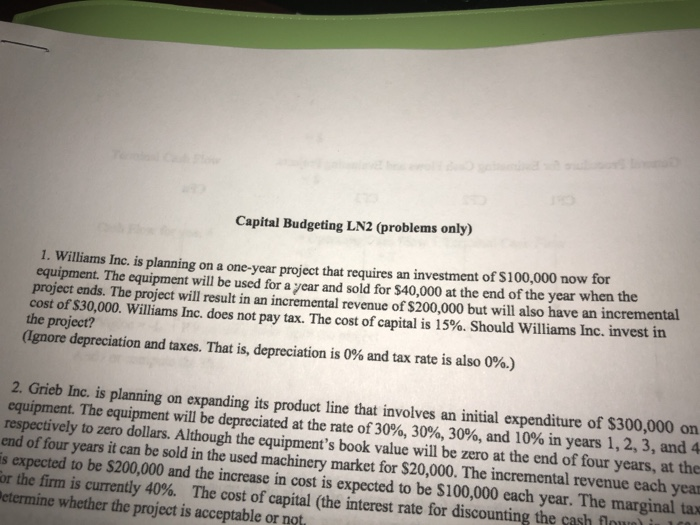

Capital Budgeting LN2 (problems only) 1. Williams Inc. is planning on a one-year project that requires an investment of $100,000 now for equipment. The equipment will be used for a year and sold for $40,000 at the end of the year when the project ends. The project will result in an incremental revenue of $200,000 but will also have an incremental cost of$30,000. Williams Inc. does not pay tax. The cost of capital is 15%. Should Williams Inc. invest in the project? (Ignore depreciation and taxes. That is, depreciation is 0% and tax rate is also 0%.) 2. Grieb Inc. is planning on expanding its product line that involves an initial expenditure of s300,000 on equipment. The equipment will be depreciated at the rate of 30% 30% 30% and 10% in years 1, 2, 3, and 4 tively to zero dollars. Although the equipment's book value will be zero at the end of four years, at the end of four years it can be sold in the used machinery market for $20,000. The incremental revenue each yea s expected to be $200,000 and the increase in cost is expected to be S100,000 each year. The marginal or the firm is currently 40%. The cost of capital (the interest rate for discounting the cash etermine whether the project is acceptable or notu fore

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts