Question: can i please get help from someone who can do this type of stuff. last person who did this gave me a zero and i

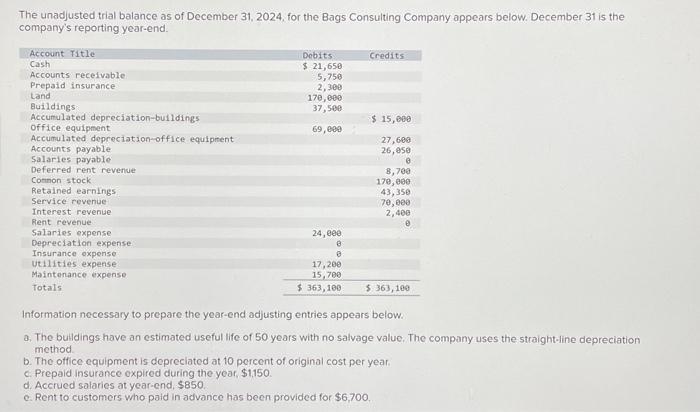

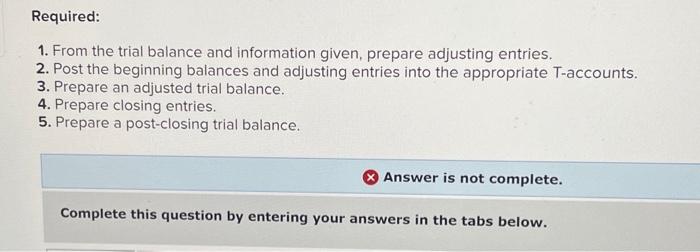

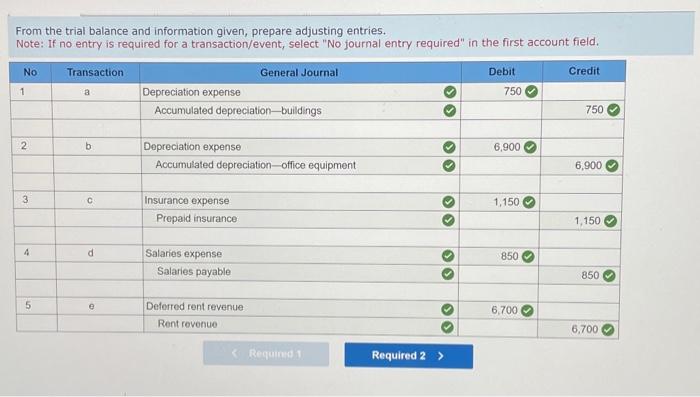

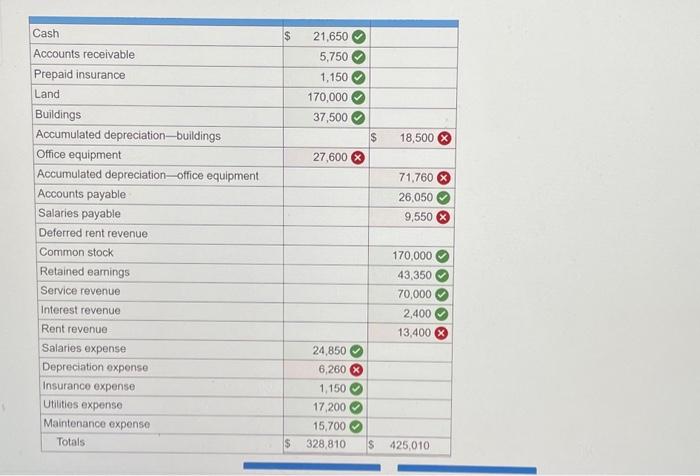

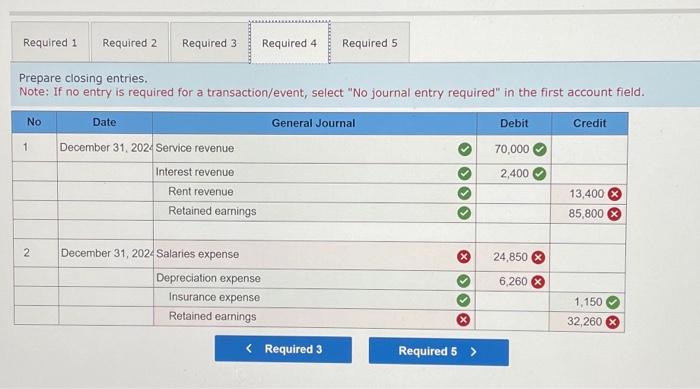

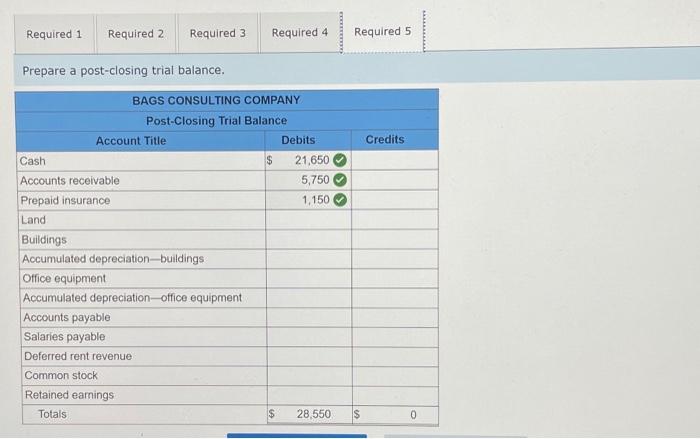

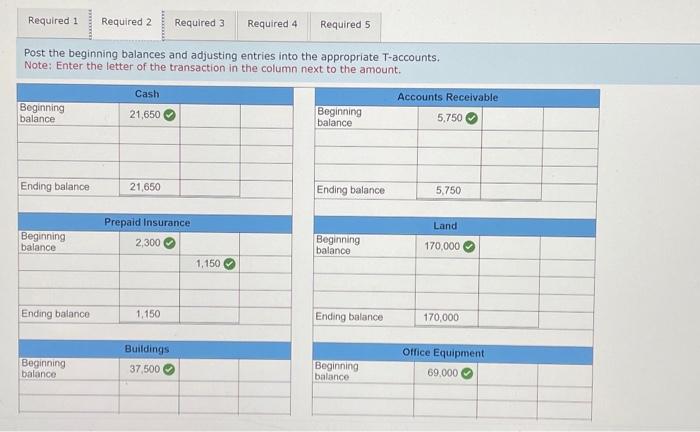

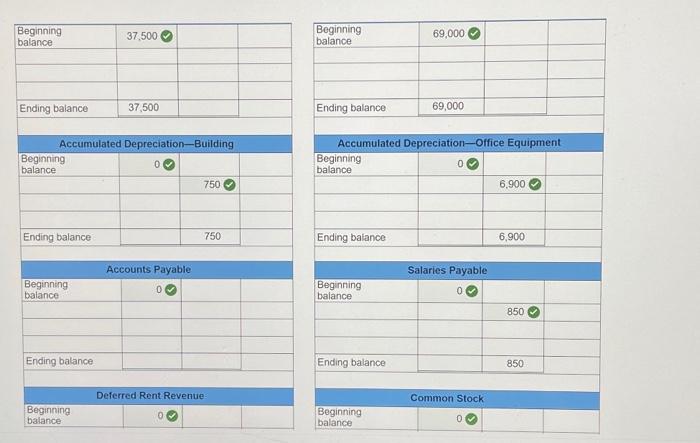

The unadjusted trial balance as of December 31, 2024, for the Bags Consulting Company appears below. December 31 is the company's reporting year-end. Information necessary to prepare the year-end adjusting entries appears below. a. The bulldings have an estimated useful life of 50 years with no salvage value. The company uses the straight-line depreciation method. b. The otfice equipment is depreciated at 10 percent of original cost per year. c. Prepaid insurance expired during the year, $1,150. d. Accrued salaries at year-end, $850. e. Rent to customers who pald in advance has been provided for $6,700, Required: 1. From the trial balance and information given, prepare adjusting entries. 2. Post the beginning balances and adjusting entries into the appropriate T-accounts. 3. Prepare an adjusted trial balance. 4. Prepare closing entries. 5. Prepare a post-closing trial balance. Answer is not complete. Complete this question by entering your answers in the tabs below. From the trial balance and information given, prepare adjusting entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. repare closing entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fielc Prepare a post-closing trial balance. Post the beginning balances and adjusting entries into the appropriate T-accounts. Note: Enter the letter of the transaction in the column next to the amount. \begin{tabular}{|l|l|l|l|} \hline Beginningbalance & 37,500 & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending balance & 37,500 & & \\ \hline & \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Beginningbalance & 69,000 & & \\ \hline & & & \\ \hline & & & \\ \hline Ending balance & 69,000 & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline \multicolumn{3}{|c|}{ Accumulated Depreciation-Building } \\ \hline Beginningbalance & 0 & \\ \hline & & 750 \\ \hline & & \\ \hline & & \\ \hline Ending balance & & 750 \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|c|}{ Accounts Payable } \\ \begin{tabular}{|l|l|} \hline Beginning \\ balance \end{tabular} & 0 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Ending balance & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline \multicolumn{3}{|c|}{ Deferred Rent Revenue- } \\ Beginningbalance & 0 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts