Question: can I please get help with my round 2 practice simulation on capsim. how do I fix the errors I made in the first round?

can I please get help with my round 2 practice simulation on capsim. how do I fix the errors I made in the first round?

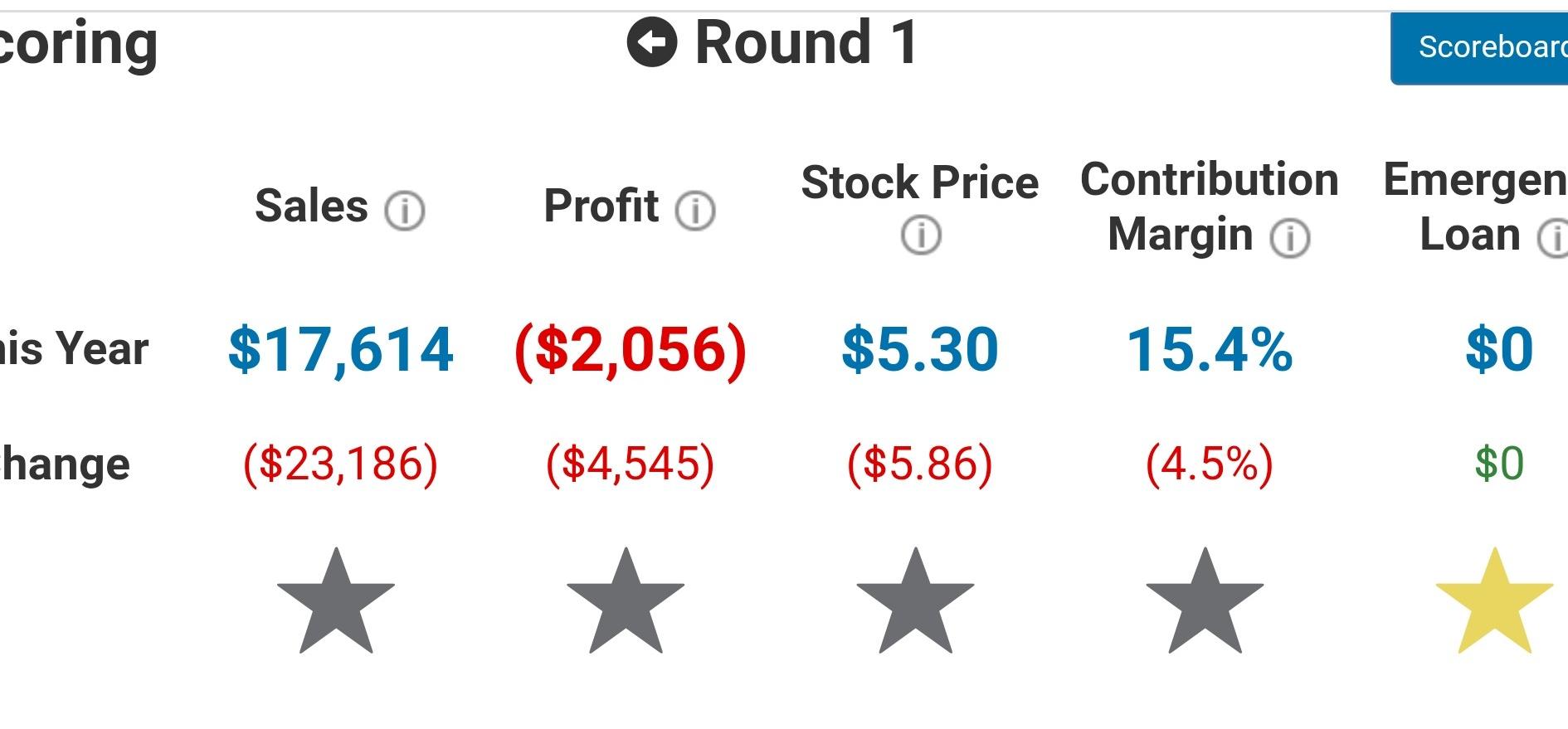

My score from the first round is posted.

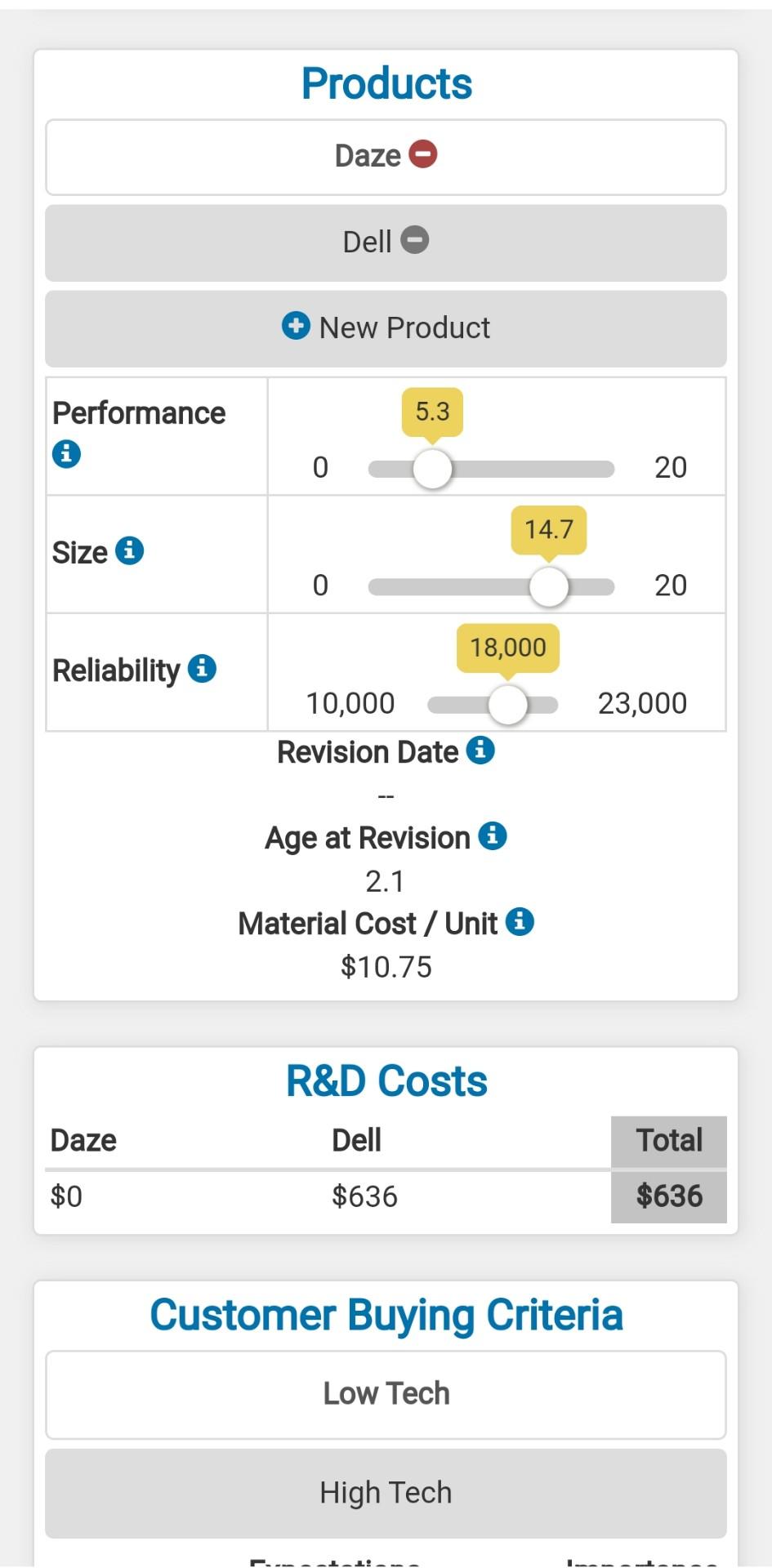

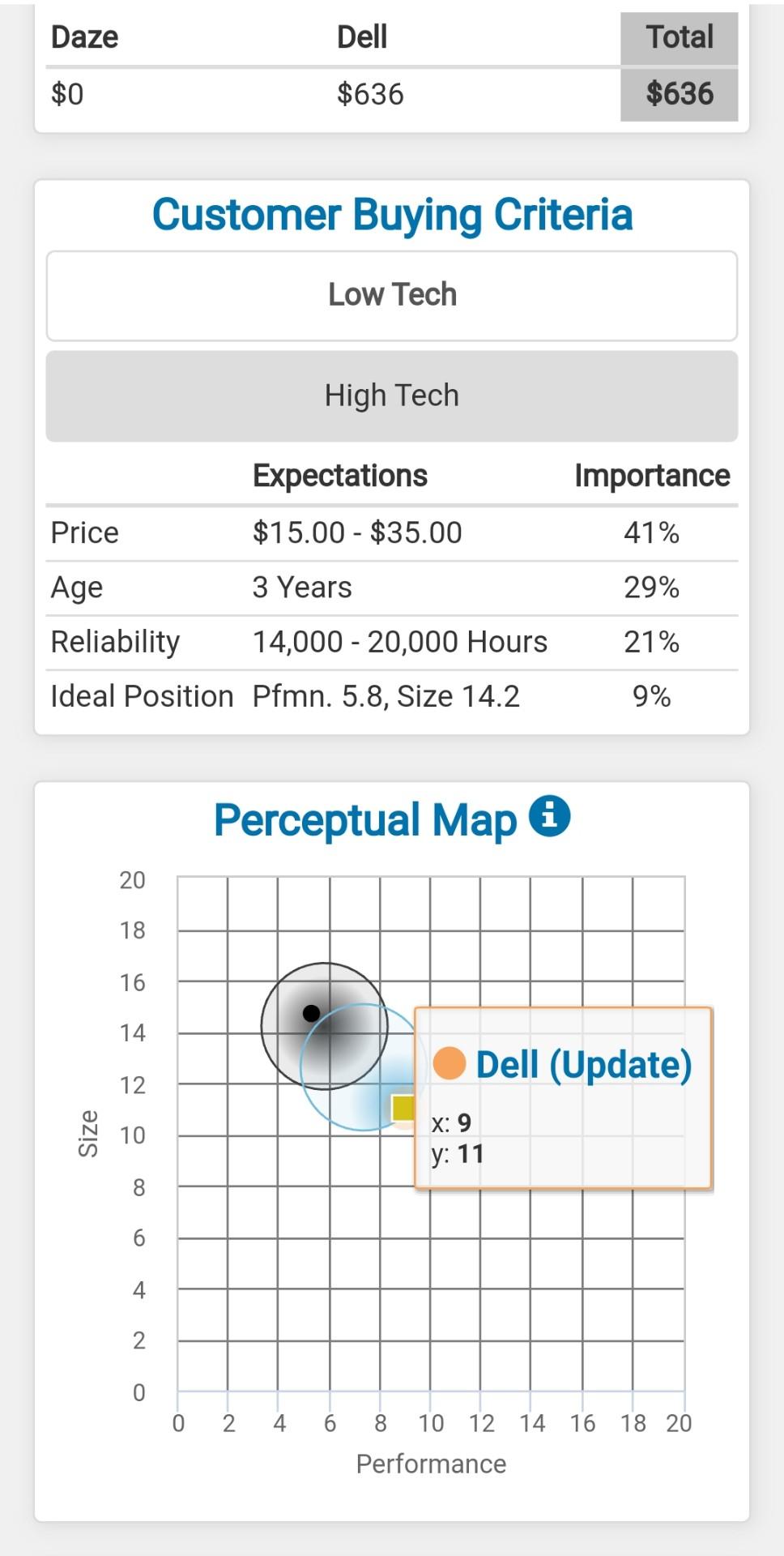

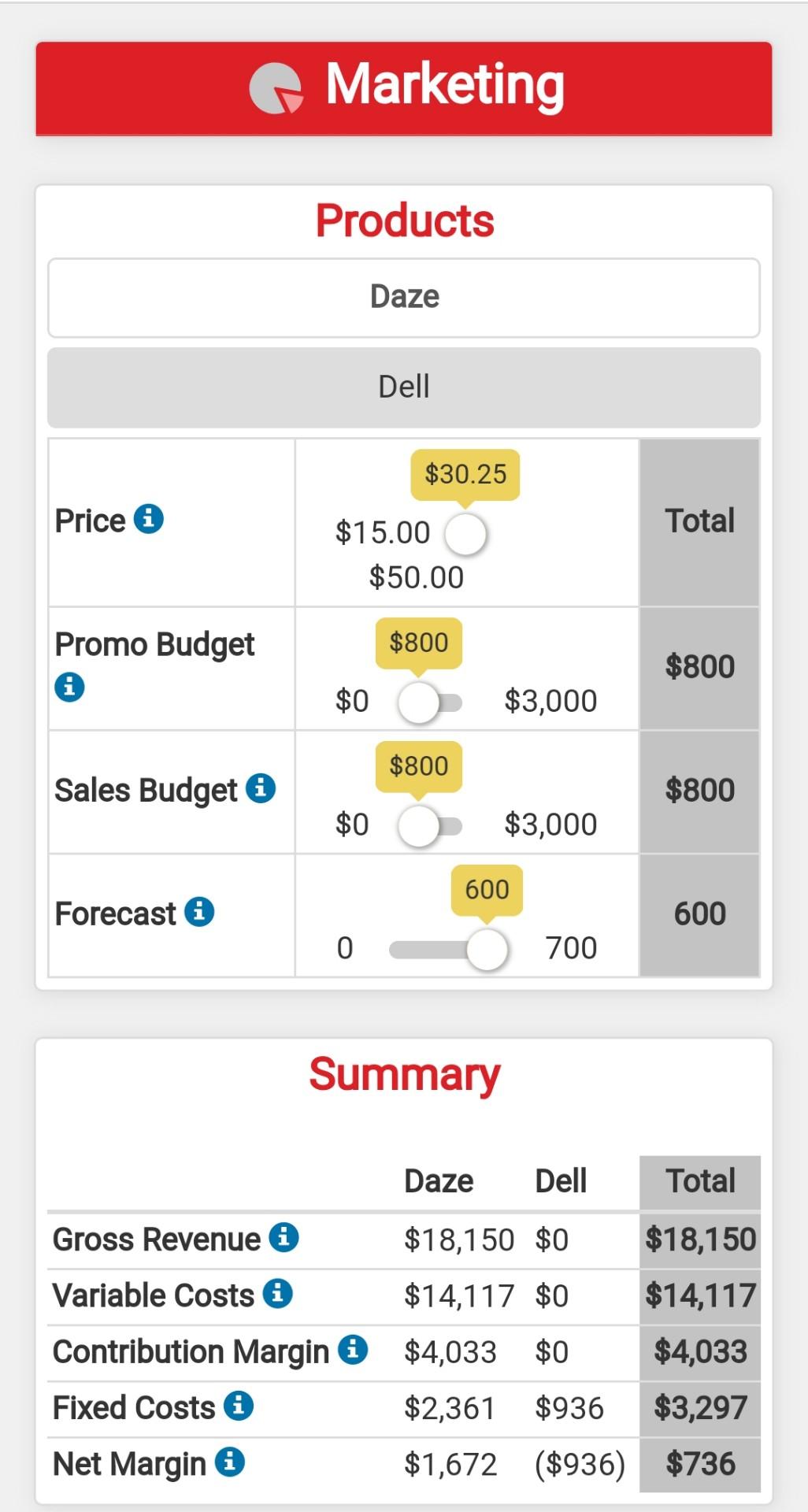

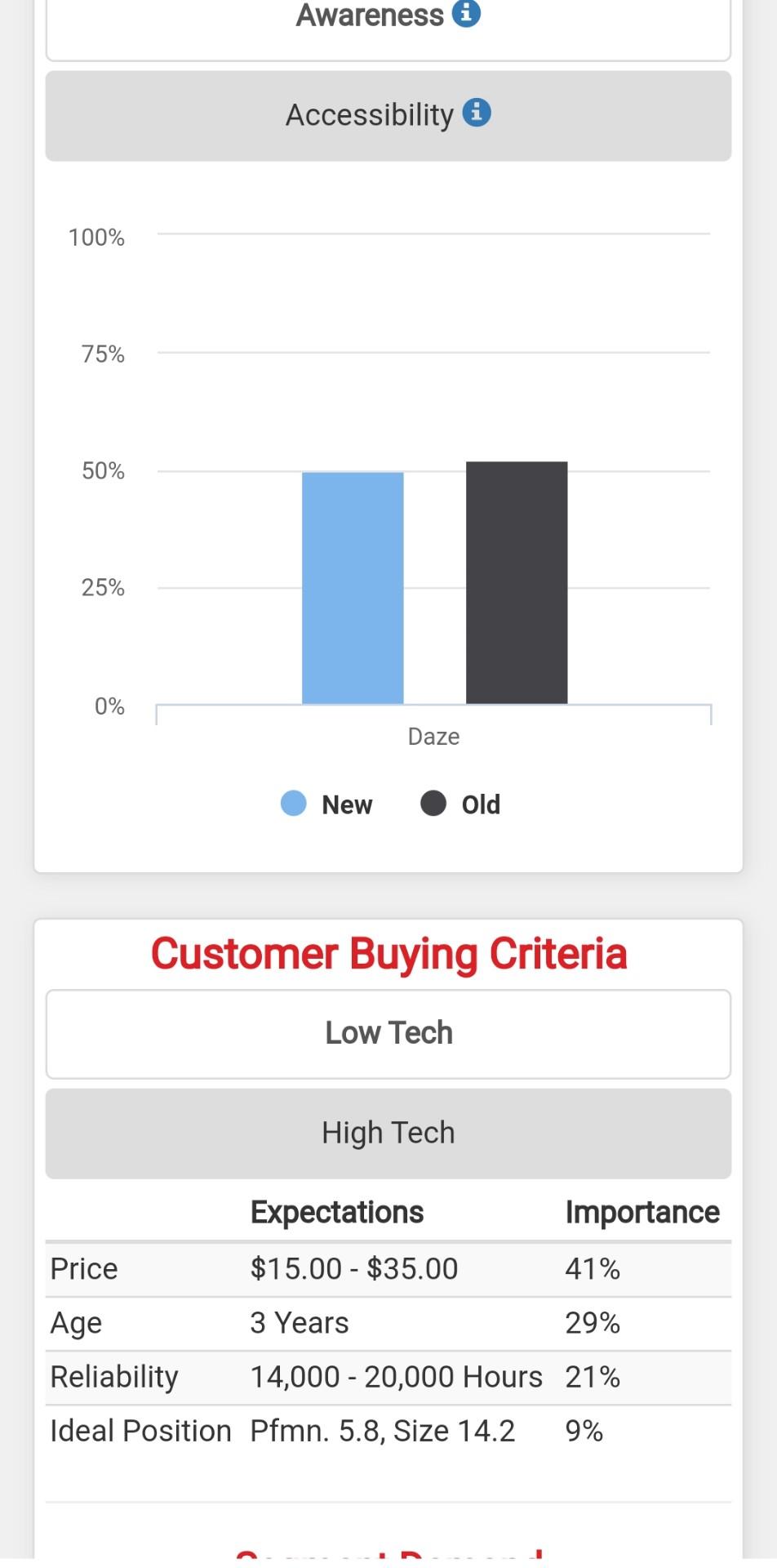

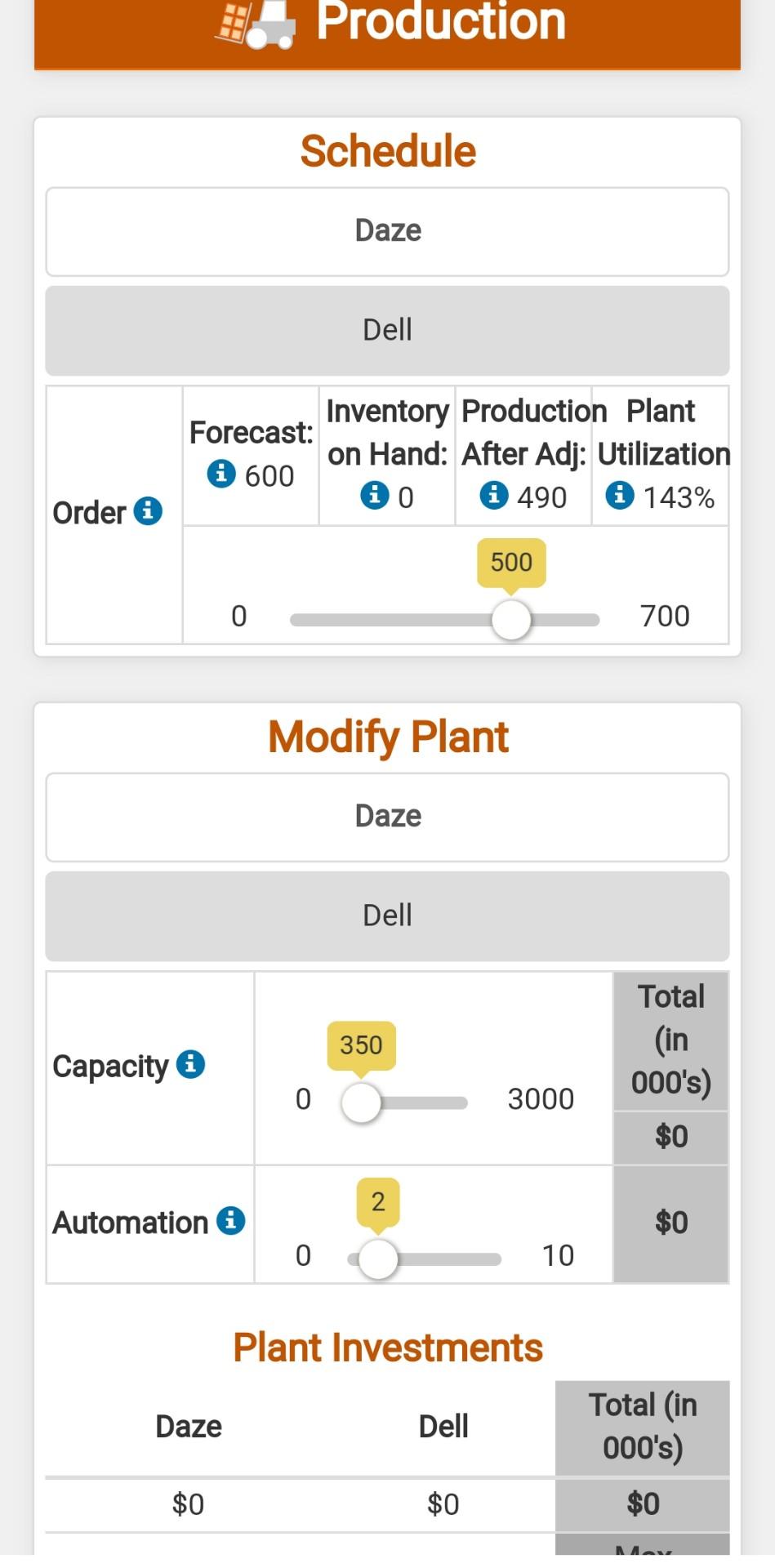

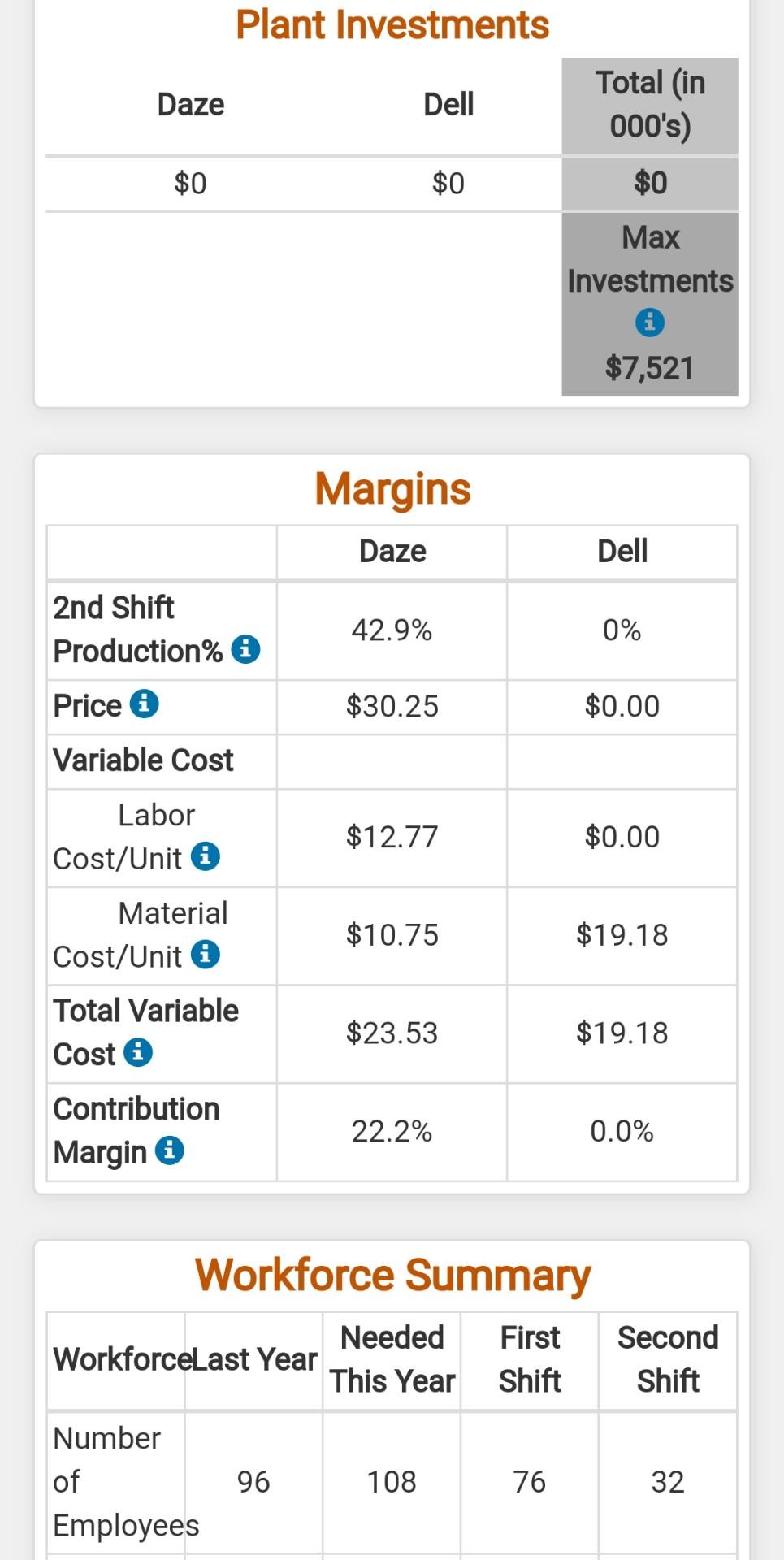

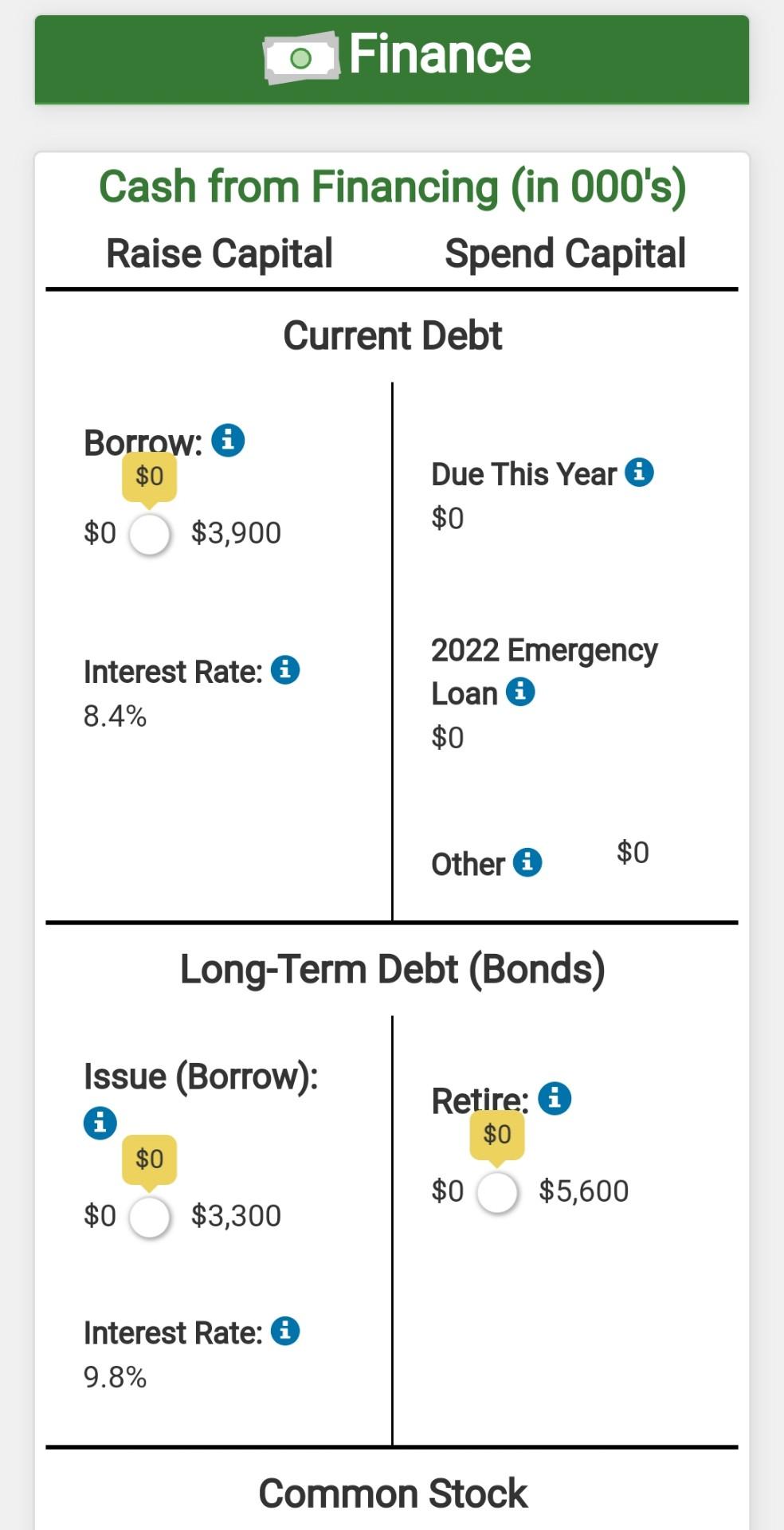

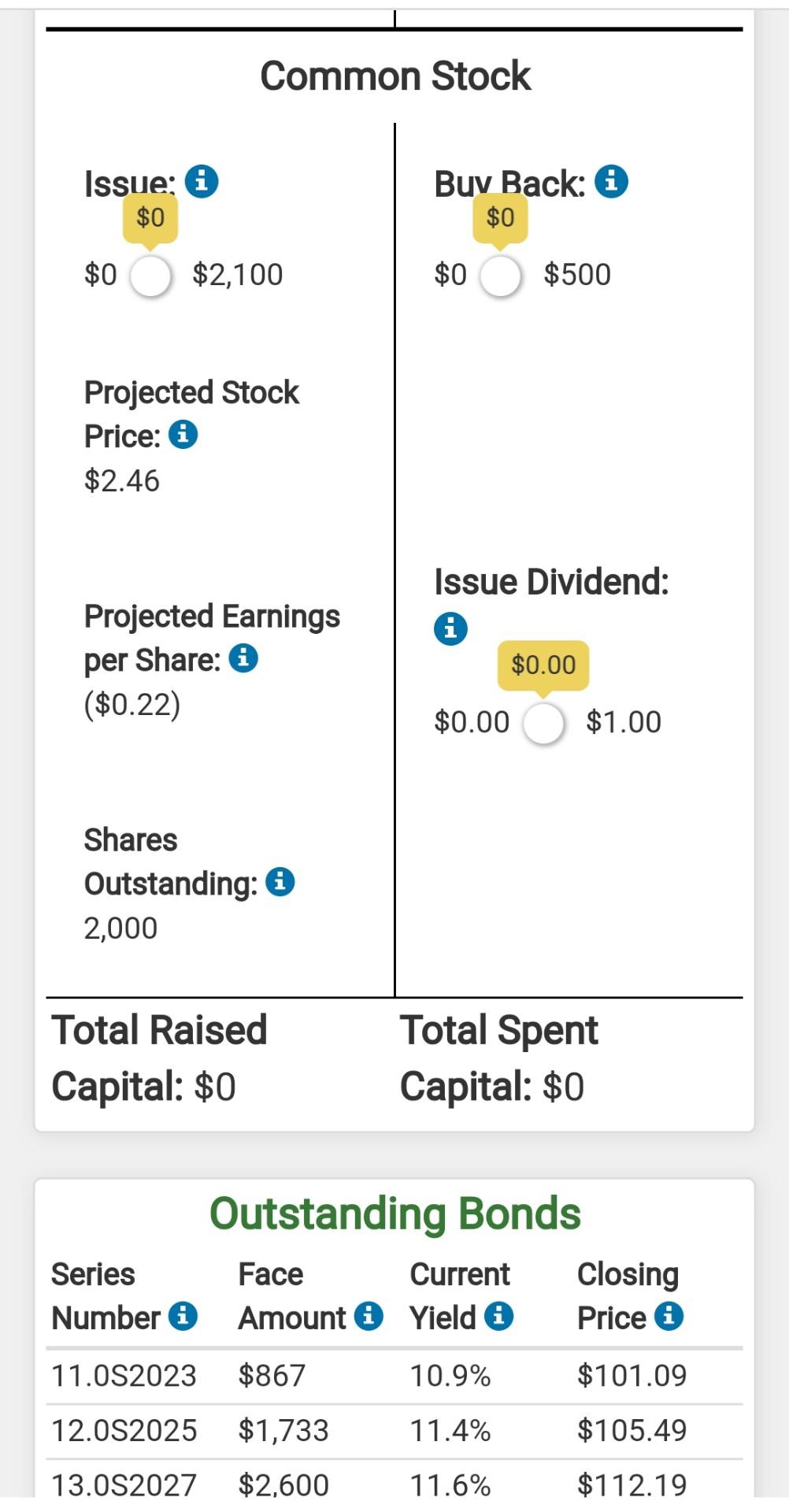

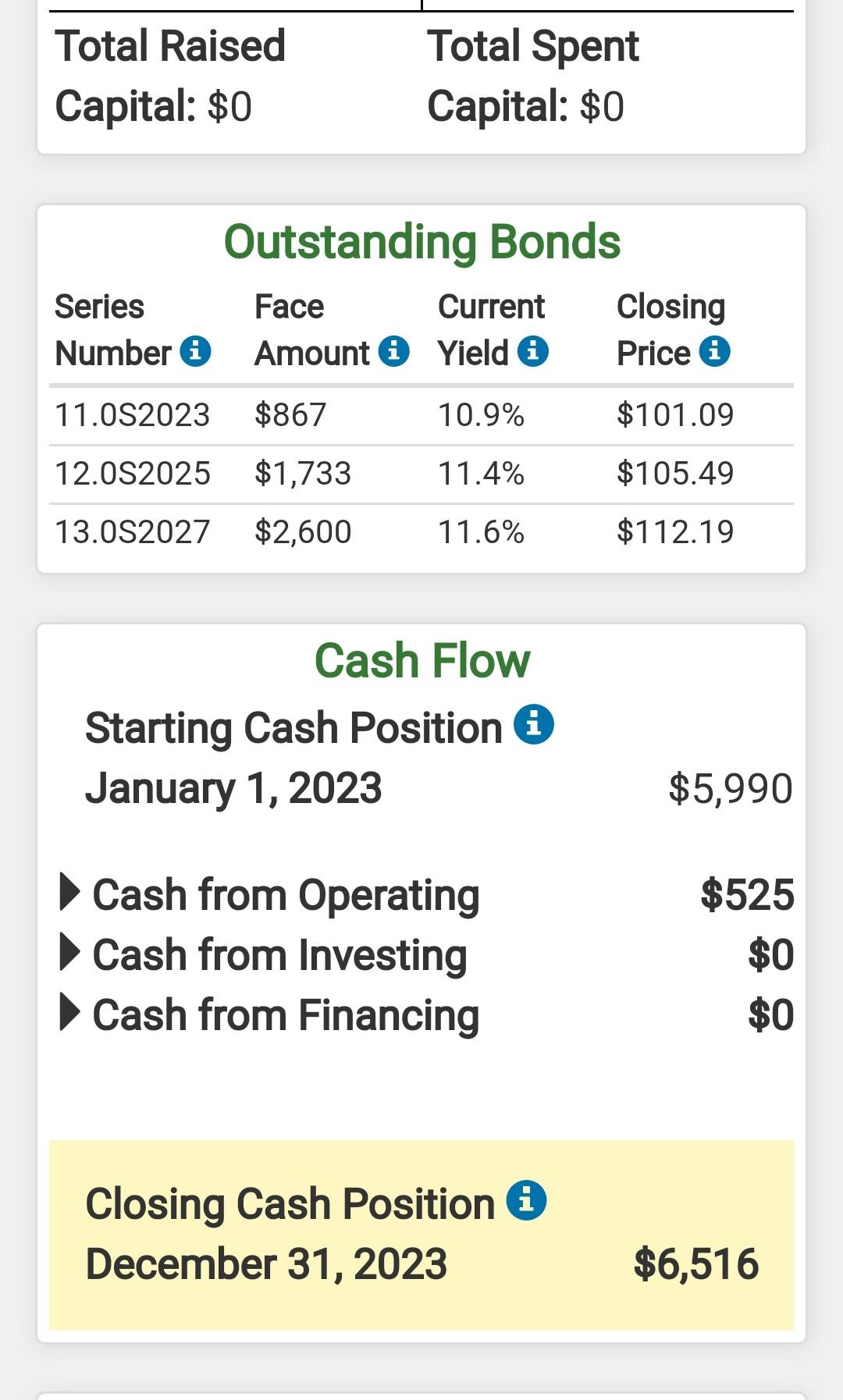

Products Daze Dell New Product 5.3 Performance i 0 20 14.7 Size : 0 20 18,000 Reliability 23,000 10,000 Revision Date 0 Age at Revision 2.1 Material Cost / Unit $10.75 R&D Costs Daze Dell Total $0 $636 $636 Customer Buying Criteria Low Tech High Tech 1 Daze Dell Total $0 $636 $636 Customer Buying Criteria Low Tech High Tech Expectations Importance Price $15.00 - $35.00 41% Age 3 Years 29% 21% Reliability 14,000 - 20,000 Hours Ideal Position Pfmn. 5.8, Size 14.2 9% Perceptual Map i 20 18 16 14 Dell (Update) 12 Size 10 X: 9 y: 11 8 6 4 2 0 0 2 4 6 8 10 12 14 16 18 20 Performance Marketing Products Daze Dell $30.25 Price Total $15.00 $50.00 Promo Budget $800 $800 $0 $3,000 $800 Sales Budget $800 $0 $3,000 600 Forecast A 600 0 700 Summary Daze Dell Total Gross Revenue i $18,150 $0 $18,150 Variable Costs $14,117 $0 $14,117 Contribution Margin 0 $4,033 $0 $4,033 Fixed Costs a $2,361 $936 $3,297 Net Margin 0 $1,672 ($936) $736 Awareness Accessibility 100% 75% 50% 25% 0% Daze New old Customer Buying Criteria Low Tech High Tech Expectations Importance Price $15.00 - $35.00 41% Age 3 Years 29% Reliability 14,000 - 20,000 Hours 21% Ideal Position Pfmn. 5.8, Size 14.2 9% 7 Production Schedule Daze Dell Inventory Production Plant Forecast: on Hand: After Adj: Utilization i 600 00 (490 (143% Order 500 0 700 Modify Plant Daze Dell 350 Total (in 000's) Capacity 0 0 3000 $0 2 Automation A $0 0 10 Plant Investments Daze Dell Total (in 000's) $0 $0 $0 Plant Investments Daze Dell Total (in 000's) $0 $0 $0 Max Investments $7,521 Margins Daze Dell 2nd Shift Production% 1 42.9% 0% Price 0 $30.25 $0.00 Variable Cost Labor Cost/Unit 0 $12.77 $0.00 Material Cost/Unit 0 $10.75 $19.18 Total Variable Cost i $23.53 $19.18 Contribution Margin 0 22.2% 0.0% Workforce Summary Needed WorkforceLast Year This Year First Shift Second Shift Number of Employees 96 108 76 32 o Finance Cash from Financing (in 000's) Raise Capital Spend Capital Current Debt Borrow: 0 $0 Due This Year A $0 $0 $3,900 Interest Rate: 0 8.4% 2022 Emergency Loan ( $0 Other $0 Long-Term Debt (Bonds) Issue (Borrow): Retire: A $0 $0 $0 $5,600 $0 $3,300 Interest Rate: 0 9.8% Common Stock Common Stock Issue: 0 $0 Buy Back: 0 $0 $0 $2.100 $0 $500 Projected Stock Price: 0 $2.46 Projected Earnings per Share: ($0.22) Issue Dividend: i $0.00 $0.00 $1.00 Shares Outstanding: 0 2,000 Total Spent Total Raised Capital: $0 Capital: $0 Outstanding Bonds Series Face Current Closing Number 0 Amount Yield 0 Price 0 11.0S2023 $867 10.9% $101.09 12.0S2025 $1,733 11.4% $105.49 13.0S2027 $2,600 11.6% $112.19 Total Raised Capital: $0 Total Spent Capital: $0 Outstanding Bonds Series Face Current Closing Number 1 Amount i Yield Price i 11.0S2023 $867 10.9% $101.09 12.0S2025 $1,733 11.4% $105.49 13.0S2027 $2,600 11.6% $112.19 Cash Flow Starting Cash Position & January 1, 2023 $5,990 Cash from Operating Cash from Investing Cash from Financing $525 $0 $0 Closing Cash Position 6 December 31, 2023 $6,516 coring Round 1 Scoreboarc Sales Profit Stock Price Contribution Emergen Margin Loan his Year $17,614 ($2,056) $5.30 15.4% $0 hange ($23,186) ($4,545) ($5.86) (4.5%) $0 Products Daze Dell New Product 5.3 Performance i 0 20 14.7 Size : 0 20 18,000 Reliability 23,000 10,000 Revision Date 0 Age at Revision 2.1 Material Cost / Unit $10.75 R&D Costs Daze Dell Total $0 $636 $636 Customer Buying Criteria Low Tech High Tech 1 Daze Dell Total $0 $636 $636 Customer Buying Criteria Low Tech High Tech Expectations Importance Price $15.00 - $35.00 41% Age 3 Years 29% 21% Reliability 14,000 - 20,000 Hours Ideal Position Pfmn. 5.8, Size 14.2 9% Perceptual Map i 20 18 16 14 Dell (Update) 12 Size 10 X: 9 y: 11 8 6 4 2 0 0 2 4 6 8 10 12 14 16 18 20 Performance Marketing Products Daze Dell $30.25 Price Total $15.00 $50.00 Promo Budget $800 $800 $0 $3,000 $800 Sales Budget $800 $0 $3,000 600 Forecast A 600 0 700 Summary Daze Dell Total Gross Revenue i $18,150 $0 $18,150 Variable Costs $14,117 $0 $14,117 Contribution Margin 0 $4,033 $0 $4,033 Fixed Costs a $2,361 $936 $3,297 Net Margin 0 $1,672 ($936) $736 Awareness Accessibility 100% 75% 50% 25% 0% Daze New old Customer Buying Criteria Low Tech High Tech Expectations Importance Price $15.00 - $35.00 41% Age 3 Years 29% Reliability 14,000 - 20,000 Hours 21% Ideal Position Pfmn. 5.8, Size 14.2 9% 7 Production Schedule Daze Dell Inventory Production Plant Forecast: on Hand: After Adj: Utilization i 600 00 (490 (143% Order 500 0 700 Modify Plant Daze Dell 350 Total (in 000's) Capacity 0 0 3000 $0 2 Automation A $0 0 10 Plant Investments Daze Dell Total (in 000's) $0 $0 $0 Plant Investments Daze Dell Total (in 000's) $0 $0 $0 Max Investments $7,521 Margins Daze Dell 2nd Shift Production% 1 42.9% 0% Price 0 $30.25 $0.00 Variable Cost Labor Cost/Unit 0 $12.77 $0.00 Material Cost/Unit 0 $10.75 $19.18 Total Variable Cost i $23.53 $19.18 Contribution Margin 0 22.2% 0.0% Workforce Summary Needed WorkforceLast Year This Year First Shift Second Shift Number of Employees 96 108 76 32 o Finance Cash from Financing (in 000's) Raise Capital Spend Capital Current Debt Borrow: 0 $0 Due This Year A $0 $0 $3,900 Interest Rate: 0 8.4% 2022 Emergency Loan ( $0 Other $0 Long-Term Debt (Bonds) Issue (Borrow): Retire: A $0 $0 $0 $5,600 $0 $3,300 Interest Rate: 0 9.8% Common Stock Common Stock Issue: 0 $0 Buy Back: 0 $0 $0 $2.100 $0 $500 Projected Stock Price: 0 $2.46 Projected Earnings per Share: ($0.22) Issue Dividend: i $0.00 $0.00 $1.00 Shares Outstanding: 0 2,000 Total Spent Total Raised Capital: $0 Capital: $0 Outstanding Bonds Series Face Current Closing Number 0 Amount Yield 0 Price 0 11.0S2023 $867 10.9% $101.09 12.0S2025 $1,733 11.4% $105.49 13.0S2027 $2,600 11.6% $112.19 Total Raised Capital: $0 Total Spent Capital: $0 Outstanding Bonds Series Face Current Closing Number 1 Amount i Yield Price i 11.0S2023 $867 10.9% $101.09 12.0S2025 $1,733 11.4% $105.49 13.0S2027 $2,600 11.6% $112.19 Cash Flow Starting Cash Position & January 1, 2023 $5,990 Cash from Operating Cash from Investing Cash from Financing $525 $0 $0 Closing Cash Position 6 December 31, 2023 $6,516 coring Round 1 Scoreboarc Sales Profit Stock Price Contribution Emergen Margin Loan his Year $17,614 ($2,056) $5.30 15.4% $0 hange ($23,186) ($4,545) ($5.86) (4.5%) $0Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts