Question: can i please get help with this intermediate accounting question its due its due in 12 hours but i am having hard time understanding it

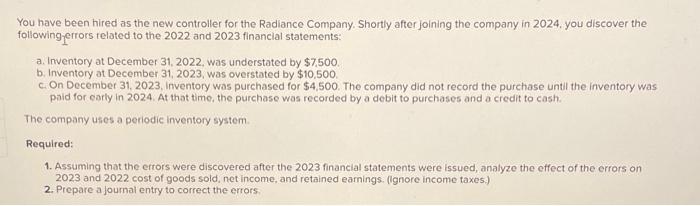

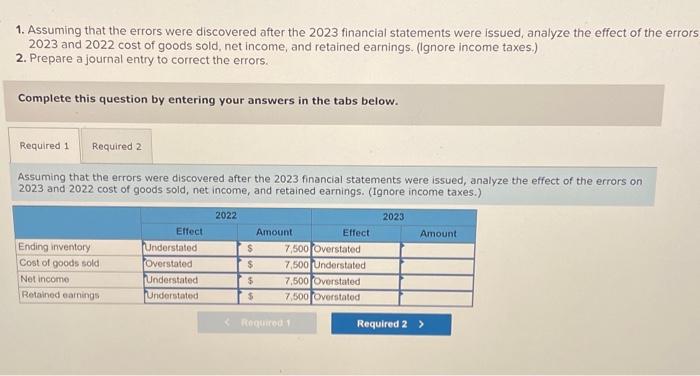

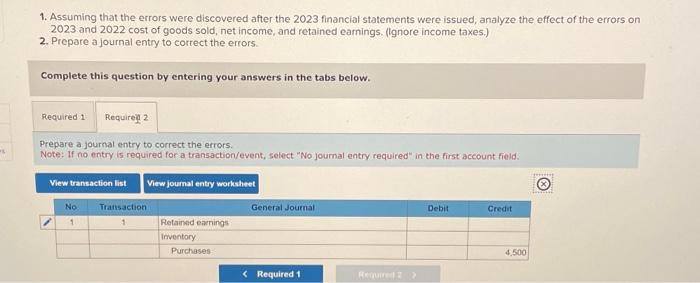

You have been hired as the new controller for the Radiance Company. Shortly after joining the company in 2024, you discover the following errors telated to the 2022 and 2023 financial statements: a. Inventory at December 31, 2022. was understated by $7,500 b. Inventory at December 31, 2023, was overstated by $10,500. c. On December 31, 2023, inventory was purchased for $4,500. The company did not record the purchase until the inventory was paid for early in 2024. At that time, the purchase was recorded by a debit to purchases and a credit to cash. The company uses a periodic inventory system. Required: 1. Assuming that the ertors were discovered after the 2023 financial statements were issued, analyze the effect of the errors on 2023 and 2022 cost of goods sold, net income, and retained earnings. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors 1. Assuming that the errors were discovered after the 2023 financial statements were issued, analyze the effect of the errors 2023 and 2022 cost of goods sold, net income, and retained earnings. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors. Complete this question by entering your answers in the tabs below. Assuming that the errors were discovered after the 2023 financial statements were issued, analyze the effect of the errors on 2023 and 2022 cost of goods sold, net income, and retained earnings. (Ignore income taxes.) 1. Assuming that the errors were discovered after the 2023 financial statements were issued, analyze the effect of the errors on 2023 and 2022 cost of goods sold, net income, and retained earnings. (lgnore income taxes.) 2. Prepare a journal entry to correct the errors. Complete this question by entering your answers in the tabs below. Prepare a journal entry to correct the errors. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts