Question: can I please get help with this multiple choose question. finance related Tax-free withdrawals from an RRSP for the HBP or LLP represent lost contribution

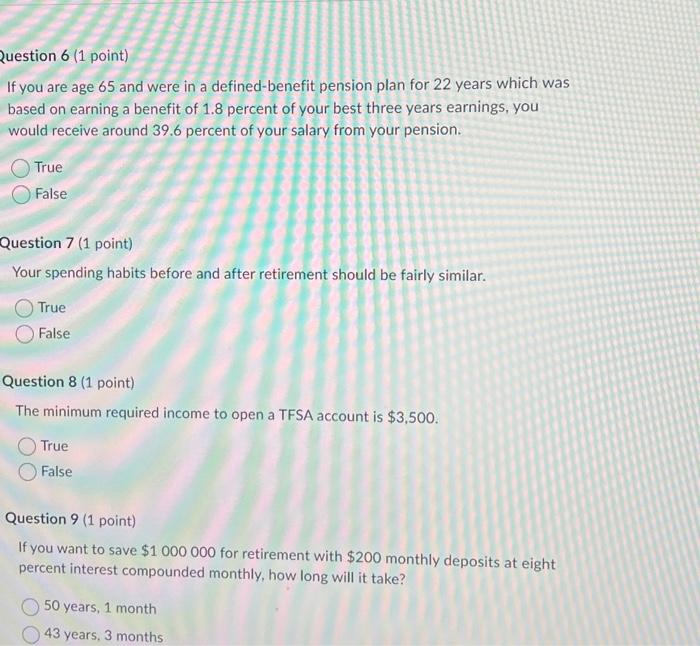

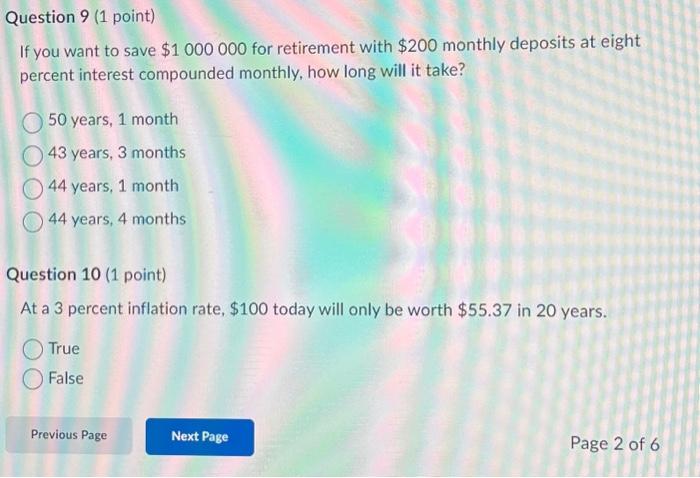

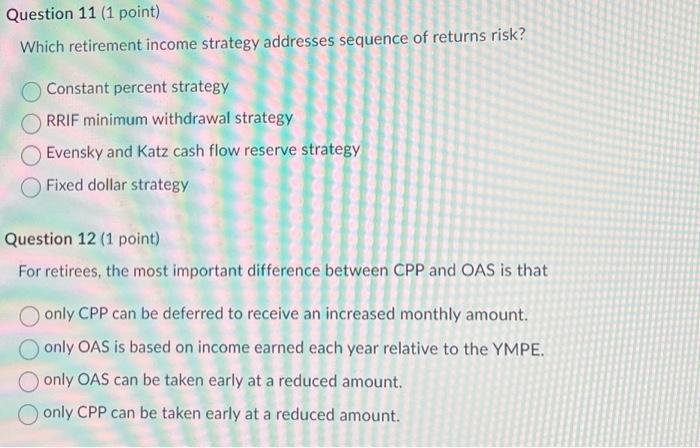

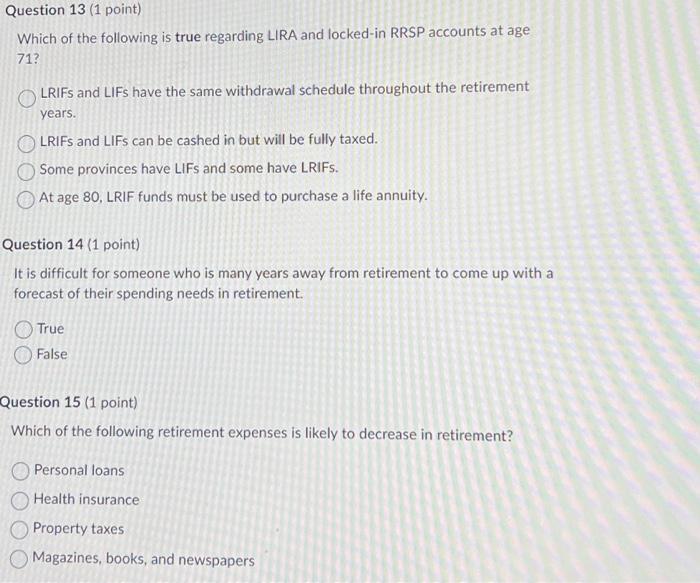

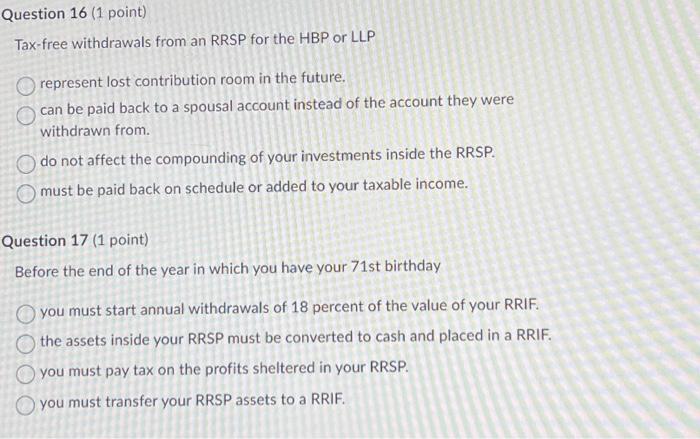

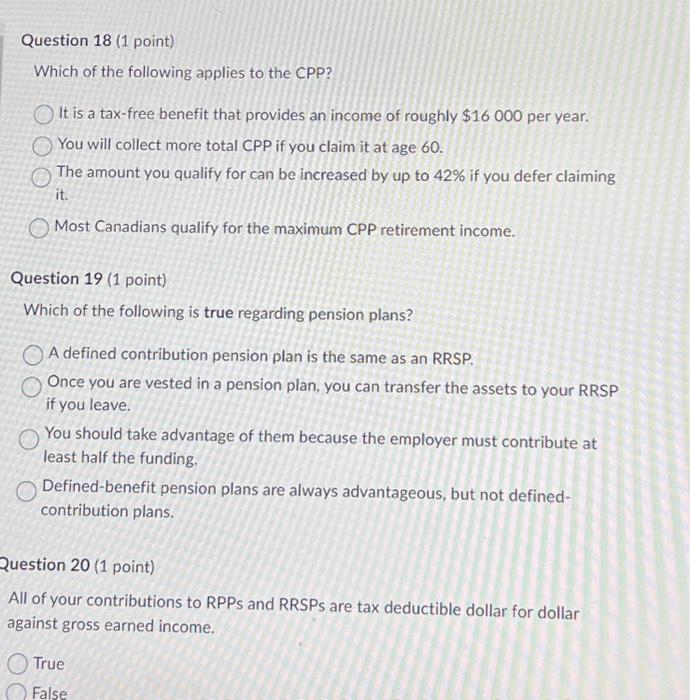

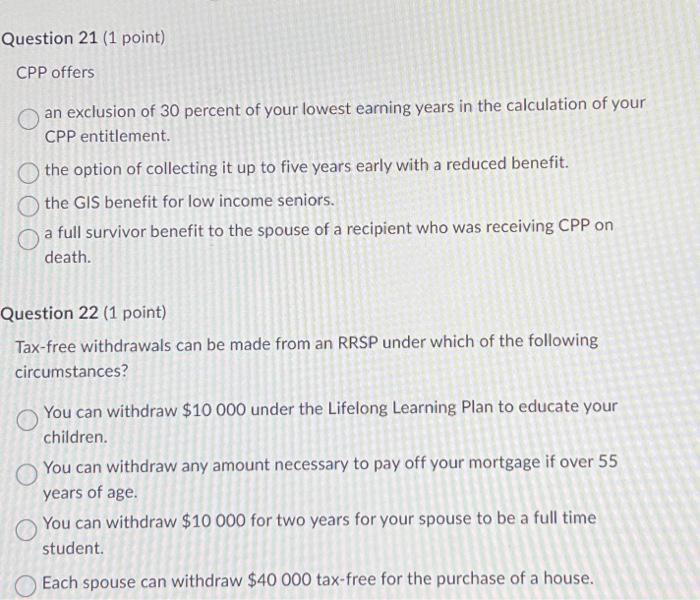

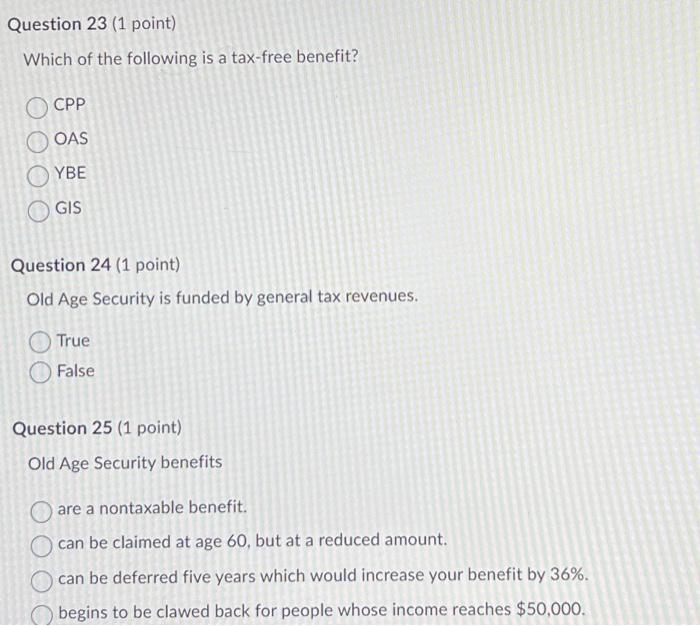

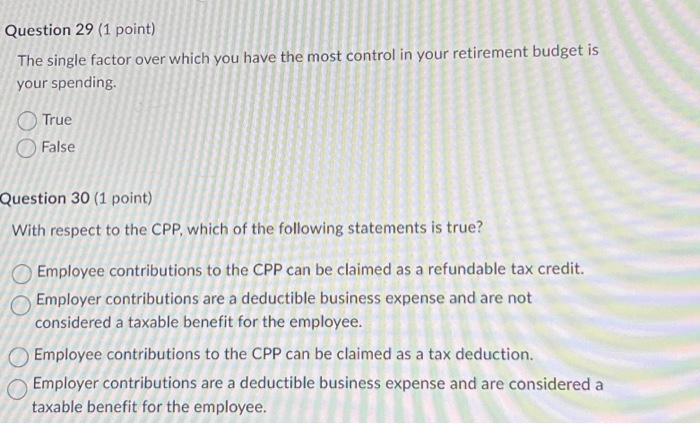

Tax-free withdrawals from an RRSP for the HBP or LLP represent lost contribution room in the future. can be paid back to a spousal account instead of the account they were withdrawn from. do not affect the compounding of your investments inside the RRSP. must be paid back on schedule or added to your taxable income. 2uestion 17 (1 point) Before the end of the year in which you have your 71 st birthday you must start annual withdrawals of 18 percent of the value of your RRIF. the assets inside your RRSP must be converted to cash and placed in a RRIF. you must pay tax on the profits sheltered in your RRSP. you must transfer your RRSP assets to a RRIF. If you are age 65 and were in a defined-benefit pension plan for 22 years which was based on earning a benefit of 1.8 percent of your best three years earnings, you would receive around 39.6 percent of your salary from your pension. True False Question 7 (1 point) Your spending habits before and after retirement should be fairly similar. True False Question 8 (1 point) The minimum required income to open a TFSA account is $3,500. True False Question 9 ( 1 point) If you want to save $1000000 for retirement with $200 monthly deposits at eight percent interest compounded monthly, how long will it take? 50 years, 1 month 43 years, 3 months Which of the following is true regarding LIRA and locked-in RRSP accounts at age 71? LRIFs and LIFs have the same withdrawal schedule throughout the retirement years. LRIFs and LIFs can be cashed in but will be fully taxed. Some provinces have LIFs and some have LRIFs. At age 80 , LRIF funds must be used to purchase a life annuity. Question 14 (1 point) It is difficult for someone who is many years away from retirement to come up with a forecast of their spending needs in retirement. True False Question 15 ( 1 point) Which of the following retirement expenses is likely to decrease in retirement? Personal loans Health insurance Property taxes Magazines, books, and newspapers Question 21 ( 1 point) CPP offers an exclusion of 30 percent of your lowest earning years in the calculation of your CPP entitlement. the option of collecting it up to five years early with a reduced benefit. the GIS benefit for low income seniors. a full survivor benefit to the spouse of a recipient who was receiving CPP on death. uestion 22 ( 1 point) Tax-free withdrawals can be made from an RRSP under which of the following circumstances? You can withdraw $10000 under the Lifelong Learning Plan to educate your children. You can withdraw any amount necessary to pay off your mortgage if over 55 years of age. You can withdraw $10000 for two years for your spouse to be a full time student. Each spouse can withdraw $40000 tax-free for the purchase of a house. Question 18 (1 point) Which of the following applies to the CPP? It is a tax-free benefit that provides an income of roughly $16000 per year. You will collect more total CPP if you claim it at age 60 . The amount you qualify for can be increased by up to 42% if you defer claiming it. Most Canadians qualify for the maximum CPP retirement income. Question 19 (1 point) Which of the following is true regarding pension plans? A defined contribution pension plan is the same as an RRSP. Once you are vested in a pension plan, you can transfer the assets to your RRSP if you leave. You should take advantage of them because the employer must contribute at least half the funding. Defined-benefit pension plans are always advantageous, but not definedcontribution plans. Question 20 ( 1 point) All of your contributions to RPPS and RRSPs are tax deductible dollar for dollar against gross earned income. True False The single factor over which you have the most control in your retirement budget is your spending. True False Question 30 (1 point) With respect to the CPP, which of the following statements is true? Employee contributions to the CPP can be claimed as a refundable tax credit. Employer contributions are a deductible business expense and are not considered a taxable benefit for the employee. Employee contributions to the CPP can be claimed as a tax deduction. Employer contributions are a deductible business expense and are considered a taxable benefit for the employee. Which retirement income strategy addresses sequence of returns risk? Constant percent strategy RRIF minimum withdrawal strategy Evensky and Katz cash flow reserve strategy Fixed dollar strategy Question 12 (1 point) For retirees, the most important difference between CPP and OAS is that only CPP can be deferred to receive an increased monthly amount. only OAS is based on income earned each year relative to the YMPE. only OAS can be taken early at a reduced amount. only CPP can be taken early at a reduced amount. Which of the following is a tax-free benefit? CPP OAS YBE GIS Question 24 (1 point) Old Age Security is funded by general tax revenues. True False Question 25 ( 1 point) Old Age Security benefits are a nontaxable benefit. can be claimed at age 60 , but at a reduced amount. can be deferred five years which would increase your benefit by 36%. begins to be clawed back for people whose income reaches $50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts