Question: can I please have help with this? task 2 is done so I have attached it under this. You just purchased a $1000 par value

can I please have help with this? task 2 is done so I have attached it under this.

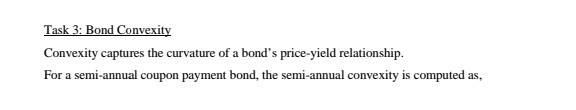

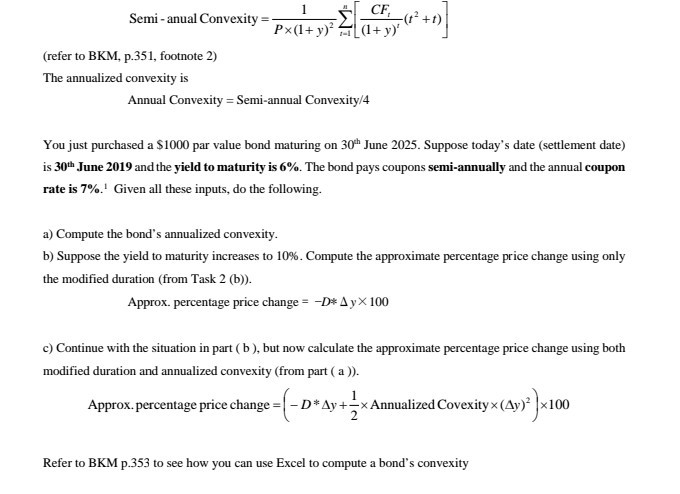

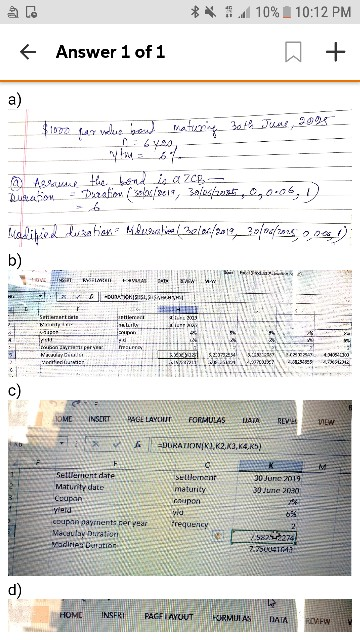

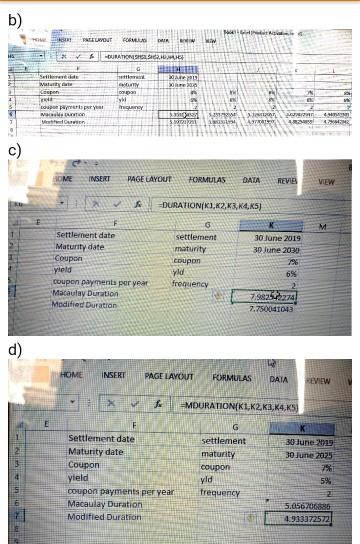

You just purchased a $1000 par value bond maturing on 30th June 2025. Suppose today's date (settlement date) is 30th June 2019 and the yield to maturity is 6%. Given all these inputs, do the following. a) Assume the bond is a zero coupon bond (with annual compounding) Compute the bond's Macaulay duration (using the DURATION function) and modified duration (using the MDURATION function). b) Holding everything else constant, now assume the bond pays coupons semi-annually. Compute the bond's Macaulay and modified durations for the following annual coupon rates: 4%, 5%, 6%, 7% and 8%. c) Continue with the bond in part (b), but now assume (i) the annual coupon rate is 7% and (ii) the maturity date is now 30th June 2030. Compute the bond's Macaulay and modified durations. d) Continue with the bond in part ( b ), but now assume (i) the annual coupon rate is 7%, (ii) the maturity date is again 30th June 2025 and (ii) the yield to maturity is 5%. Compute the bond's Macaulay and modified durations b) Maturity oate coupon payrerb per yeaTY OME INSERI PAGE LAYOUTFORMULASDATA REVBE Settlement date Maturity date Coupon eld coupon payments per yearfregiency Macaulay Duration Modified Duration settlement 30 June 2019 30 June 2030 coupon ldl 6% 7.982-42274 7.750041043 d) HOME INSERT PAGE LAYOUT FORMULAS DAIA ! RevEW MDURATION(KLK2K3,K4,.KS) Settlement date Maturity date Coupon yield coupon payments per yearfrequericy Macaulay Duration Modified Duration settlement 30 Hune 2019 30 Fune 2025 maturity yld 5% 933372572

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts