Question: Can I please have the PESTLE analysis with minimum 2 points in each and recommendations Beta B Surgical The Competitive Bidding Trap Frank was starting

Can I please have the PESTLE analysis with minimum 2 points in each and recommendations

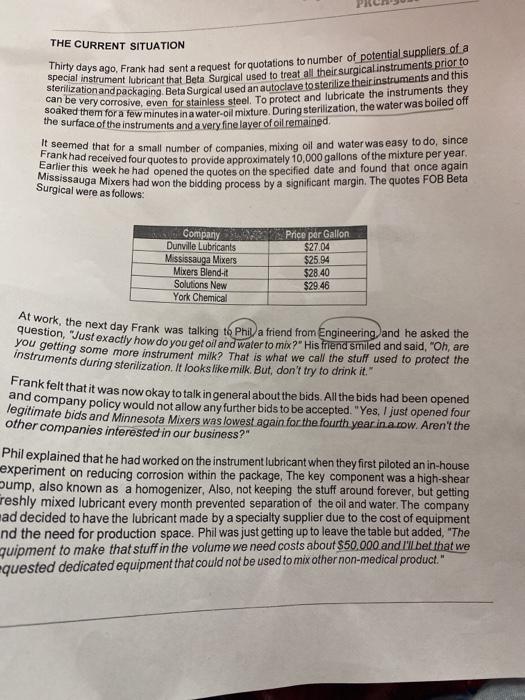

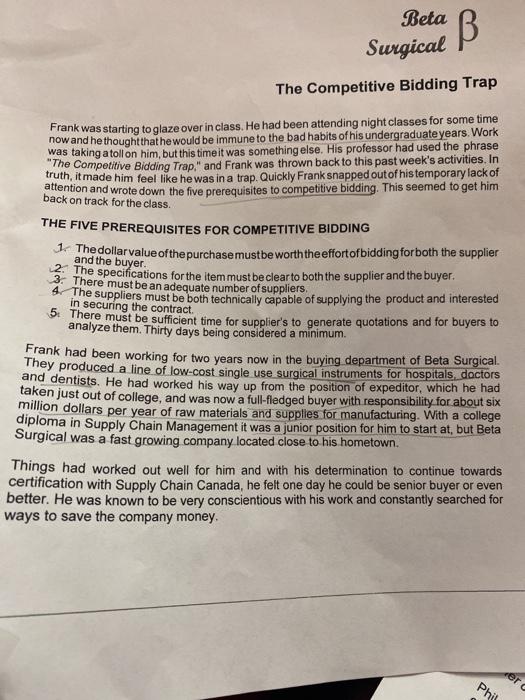

Beta B Surgical The Competitive Bidding Trap Frank was starting to glaze over in class. He had been attending night classes for some time now and he thought that he would be immune to the bad habits of his undergraduate years. Work was taking a toll on him, but this time it was something else. His professor had used the phrase "The Competitive Bidding Trap," and Frank was thrown back to this past week's activities. In truth, it made him feel like he was in a trap. Quickly Frank snapped out of his temporary lack of attention and wrote down the five prerequisites to competitive bidding. This seemed to get him back on track for the class. THE FIVE PREREQUISITES FOR COMPETITIVE BIDDING Jahe dollar value of the purchase mustbe worth the effortofbidding for both the supplier 2. The specifications for the item must be clear to both the supplier and the buyer. 4 The suppliers must be both technically capable of supplying the product and interested 5: There must be sufficient time for supplier's to generate quotations and for buyers to analyze them. Thirty days being considered a minimum Frank had been working for two years now in the buying department of Beta Surgical. They produced a line of low-cost Single use surgical instruments for hospitals doctors and dentists. He had worked his way up from the position of expeditor, which he had taken just out of college, and was now a full-fledged buyer with responsibility for about six million dollars per year of raw materials and supplies for manufacturing. With a college diploma in Supply Chain Management it was a junior position for him to start at, but Beta Surgical was a fast growing company located close to his hometown. Things had worked out well for him and with his determination to continue towards certification with Supply Chain Canada, he felt one day he could be senior buyer or even better. He was known to be very conscientious with his work and constantly searched for ways to save the company money. Phi THE CURRENT SITUATION Thirty days ago, Frank had sent a request for quotations to number of potential suppliers of a Sterilization and packaging. Beta Surgical used an autoclave to sterilize their instruments and this hooked them for a few minutes in a water-oll mixture. During sterilization, the water was boiled off the surface of the instruments and a very fine layer of oil remained. It seemed that for a small number of companies, mixing oil and water was easy to do, since Esank had received four quotes to provide approximately 10,000 gallons of the mixture per year. Scississauga Mixers had won the bidding process by a significant margin. The quotes FOB Beta Surgical were as follows: Company Dunville Lubricants Mississauga Mixers Mixers Blend- Solutions New York Chemical Price per Gallon $27.04 $25.94 $28.40 $29.46 At work, the next day Frank was talking to Phil a friend from Engineering, and he asked the question, "Just exactly how do you get oil and water to mix?" His friend smiled and said, "Oh, are you getting some more instrument milk? That is what we call the stuff used to protect the instruments during sterilization. It looks like milk. But, don't try to drink it." Frank felt that it was now okay to talk in general about the bids. All the bids had been opened and company policy would not allow any further bids to be accepted. "Yes, I just opened four legitimate bids and Minnesota Mixers was lowest again for the fourth year in a row. Aren't the other companies interested in our business?" Phil explained that he had worked on the instrument lubricant when they first piloted an in-house experiment on reducing corrosion within the package, The key component was a high-shear ump, also known as a homogenizer, Also, not keeping the stuff around forever, but getting reshly mixed lubricant every month prevented separation of the oil and water. The company ad decided to have the lubricant made by a specialty supplier due to the cost of equipment nd the need for production space. Phil was just getting up to leave the table but added, "The quipment to make that stuff in the volume we need costs about $50.000 and I'll be that we quested dedicated equipment that could not be used to mix other non-medical product." Supply Chain Management PRCH-3020 When Frank returned to his office, he went to the commodity file on instrument lubricant and found the original quotes for the product. Four years ago, Mississauga Mixers had won the bidding with a quote of $24.57 the next closest bid was $24.63. This seemed reasonable with a factor for slight inflation since then, He did not see any information on setup costs for the original bids, "Yes, we did not separate the setup and per unit costs of the instrument milk. We production and asked the senior buyer, Gerard Sentall, if he could remember anything about the felt it was outside our realm of expertise and left this up to the supplier. Are some of the quotes out of line?" Frank explained that the quotes were all very consistent, perhaps too consistent Next he informed the other bidders of their failure to win the bidding again, and then confirmed again and the effort that he had put into giving his lowest possible price. The Dunville Lubricants representative stated, I'm sorry, but the way you send out for Year write of equipment in my price. We included a set-up of $51,500.00. Perhaps we could renegotiate under different terms. After all, you will probably be using instrument milk for the next few years. Frank informed him of the policies of Beta Surgical that he had to honour regarding competitive bidding and that everyone was treated equally. Frank, however being to wonder about the one-year term for instrument lubricant contracts. He wondered if the competitive bidding trap had something to do with all of this CASE ANALYSIS Questions to consider 1. What condition made competitive bidding not work in this case? 2. Was competitive bidding a good method to use for the first contract for instrument lubricant? 3. What target price should Frank are for the next time he asks for quotations on instrument lubricant? Should he use a method other than price per gallon? 4. Suggest a pricing strategy for Frank to use next time he asks for quotations