Question: can just solve the problem with the information on the paper i do not have nothing else so just do it we what you see

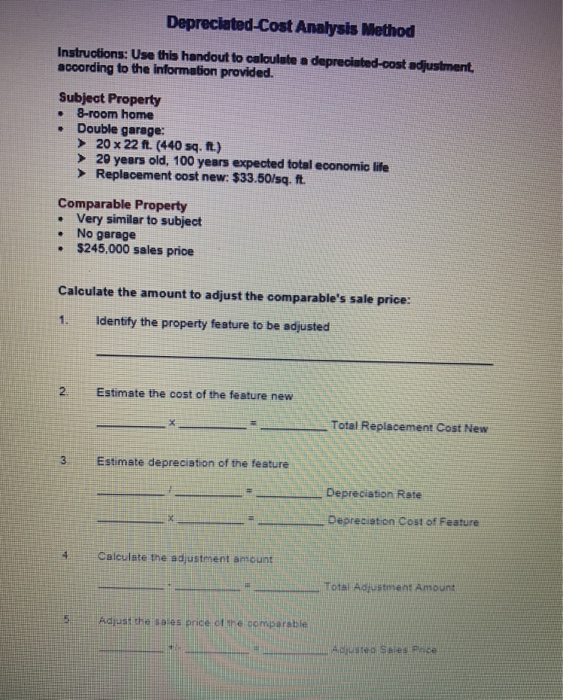

Depreciated-Cost Analysis Method Instructions: Use this handout to calculate a depreciated cost adjustment. according to the information provided. Subject Property 8-room home Double garage: 20 x 22 ft. (440 sq. ft) > 20 years old, 100 years expected total economic life Replacement cost new: $33.50/sq. ft. Comparable Property Very similar to subject No garage $245,000 sales price Calculate the amount to adjust the comparable's sale price: Identify the property feature to be adjusted Estimate the cost of the feature new - Total Replacement Cost New Estimate depreciation of the feature Depreciation Rate Depreciation Cost of Feature Calculate the adjustment amount Total Adjustment Amount Adjust the sales price of the comparable L e Sales Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts