Question: Can some explain how do we get this ? specially borrow funds value and FV values. For a given stock, a European call and put

Can some explain how do we get this ? specially borrow funds value and FV values.

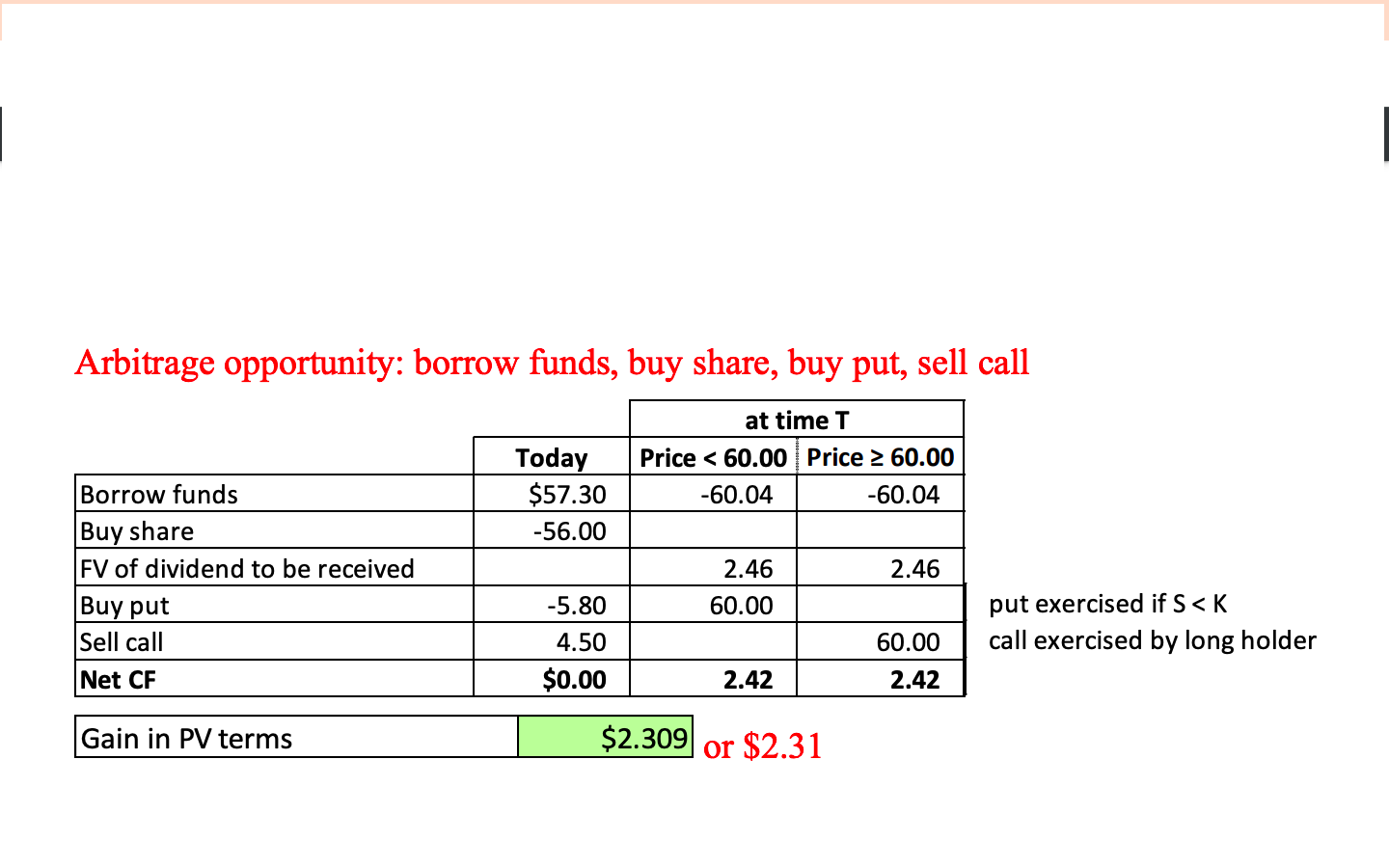

For a given stock, a European call and put option both have a strike price of $60.00. Both also have an expiration date in seven months. The European call option presently costs $4.50 and the European put option costs $5.80. The risk-free interest rate is 8.00% per annum, the current stock price is $56, and a $1.20 dividend is expected in two months, and another $1.20 dividend is expected in five months. Identify the arbitrage opportunity open to a trader and calculate the gains.

Arbitrage opportunity: borrow funds, buy share, buy put, sell call put exercised if S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts