Question: Can some one explain deeply about how to do this part? (it is in the SMART financial goal planning) I would like to know about

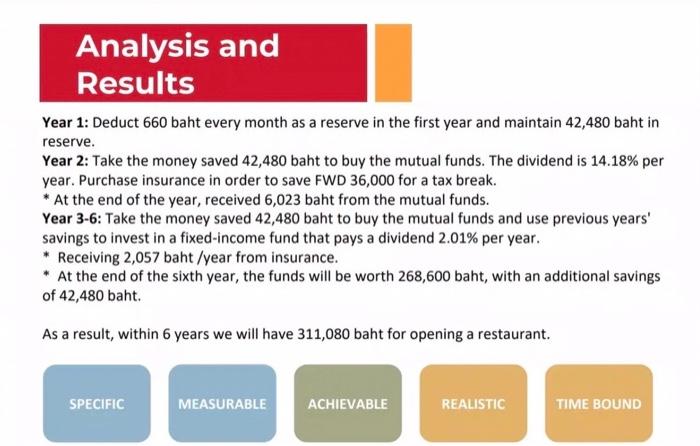

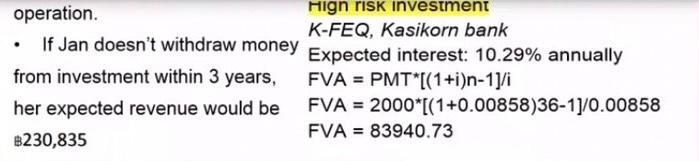

Analysis and Results Year 1: Deduct 660 baht every month as a reserve in the first year and maintain 42,480 baht in reserve. Year 2: Take the money saved 42,480 baht to buy the mutual funds. The dividend is 14.18% per year. Purchase insurance in order to save FWD 36,000 for a tax break. * At the end of the year, received 6,023 baht from the mutual funds. Year 3-6: Take the money saved 42,480 baht to buy the mutual funds and use previous years' savings to invest in a fixed-income fund that pays a dividend 2.01% per year. * Receiving 2,057 baht/year from insurance. * At the end of the sixth year, the funds will be worth 268,600 baht, with an additional savings of 42,480 baht. As a result, within 6 years we will have 311,080 baht for opening a restaurant. SPECIFIC MEASURABLE ACHIEVABLE REALISTIC TIME BOUND operation. High risk investment K-FEQ, Kasikorn bank If Jan doesn't withdraw money Expected interest: 10.29% annually from investment within 3 years, FVA = PMT*((1+i)n-1]/i her expected revenue would be FVA = 2000*((1+0.00858)36-1)/0.00858 FVA = 83940.73 B230,835

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts