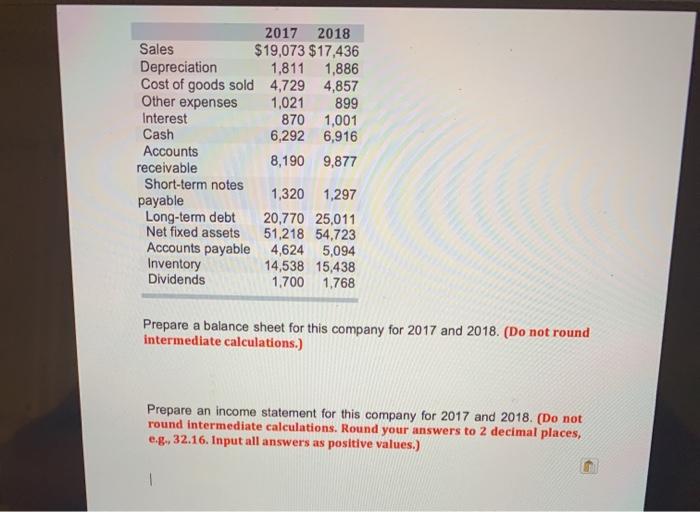

Question: Can somebody help me with this one please Sorry I did not post the tax rate which is 23% 2017 2018 Sales $19,073 $17,436 Depreciation

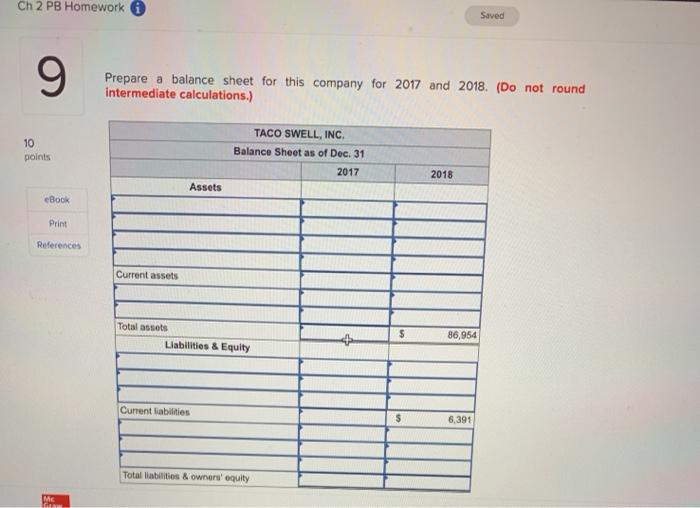

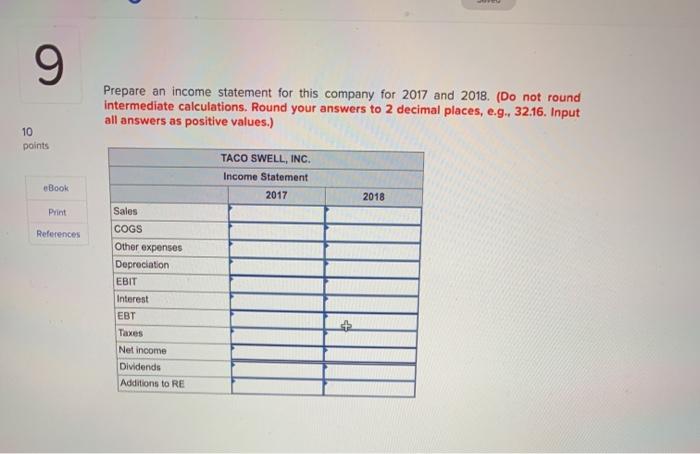

2017 2018 Sales $19,073 $17,436 Depreciation 1,811 1,886 Cost of goods sold 4,729 4,857 Other expenses 1,021 899 Interest 870 1,001 Cash 6,292 6,916 Accounts 8,190 9,877 receivable Short-term notes 1,320 1,297 payable Long-term debt 20.770 25,011 Net fixed assets 51,218 54.723 Accounts payable 4,624 5,094 Inventory 14,538 15,438 Dividends 1.700 1.768 Prepare a balance sheet for this company for 2017 and 2018. (Do not round intermediate calculations.) Prepare an income statement for this company for 2017 and 2018. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g., 32.16. Input all answers as positive values.) 1 Ch 2 PB Homework i Saved 9 Prepare a balance sheet for this company for 2017 and 2018. (Do not round intermediate calculations.) 10 points TACO SWELL, INC. Balance Sheet as of Dec. 31 2017 2018 Assets eBook Print References Current assets Total assets Liabilities & Equity $ 86,954 Current liabilities $ 6,391 Total liabilities & owners' equity ME 9 Prepare an income statement for this company for 2017 and 2018. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g., 32.16. Input all answers as positive values.) 10 points TACO SWELL, INC. Income Statement 2017 eBook 2018 Print References Sales COGS Other expenses Depreciation EBIT Interest EBT Taxes Net Income Dividends Additions to RE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts