Question: can somebody help me with this problem. I don't understand. The first and second photo are given.From the MARCS caluculations down, needs to be completed,

can somebody help me with this problem. I don't understand. The first and second photo are given.From the MARCS caluculations down, needs to be completed, but I don't understand how to approach it. can somebody guide me through this and show me the calculations used .. please and thank you.

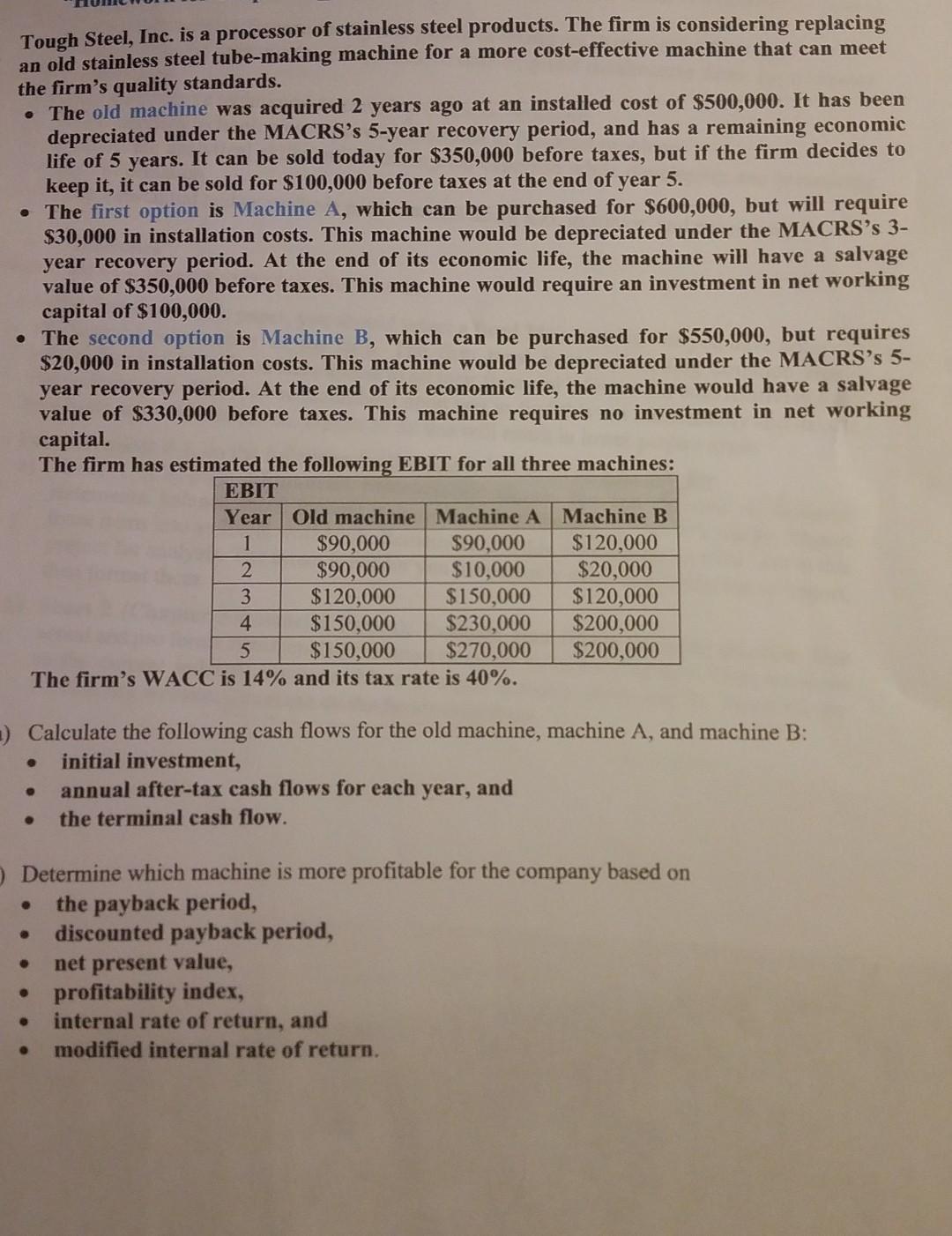

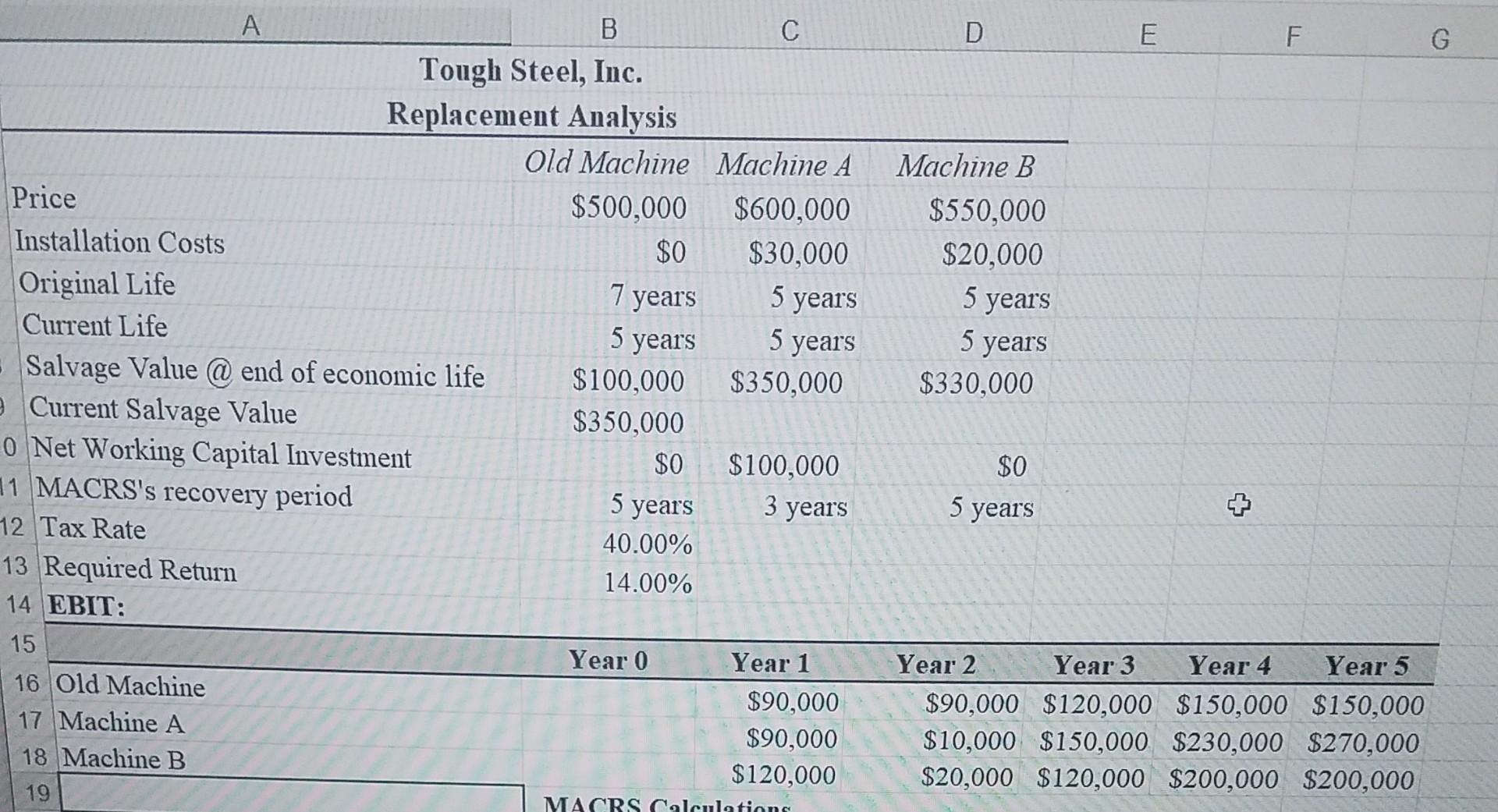

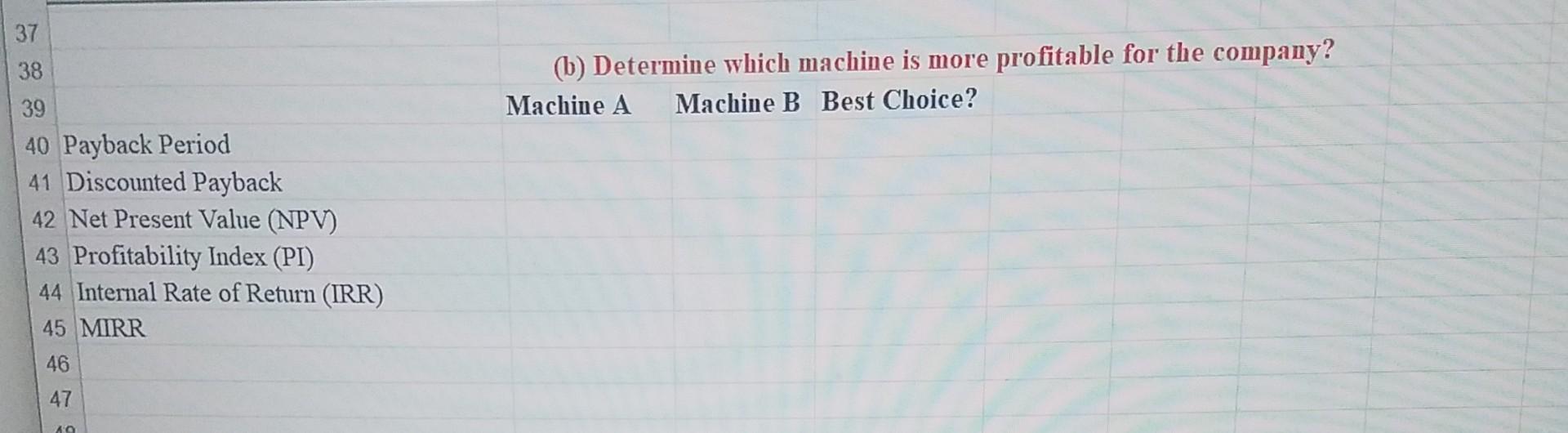

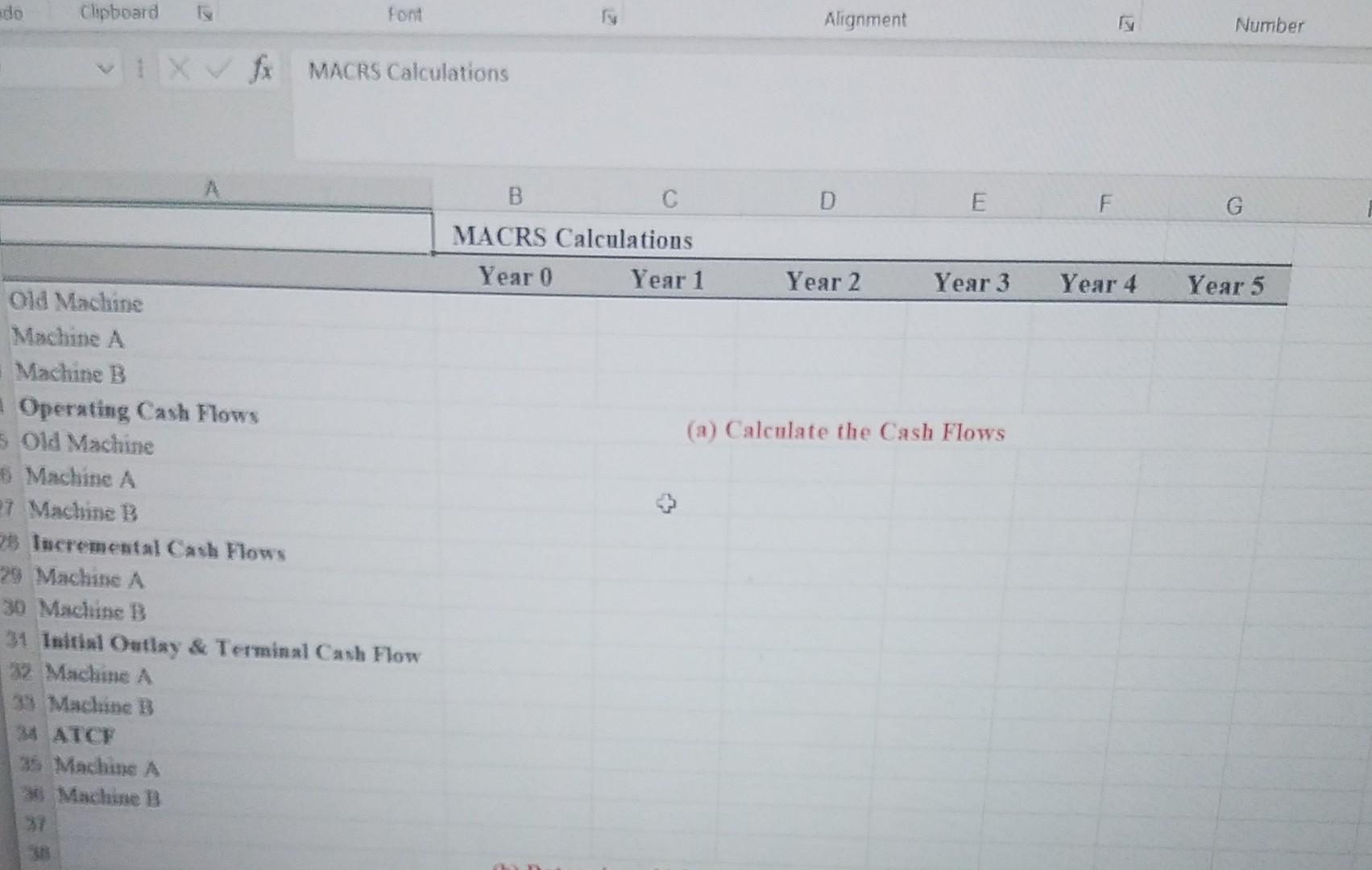

Tough Steel, Inc. is a processor of stainless steel products. The firm is considering replacing an old stainless steel tube-making machine for a more cost-effective machine that can meet the firm's quality standards. - The oId machine was acquired 2 years ago at an installed cost of $500,000. It has been depreciated under the MACRS's 5-year recovery period, and has a remaining economic life of 5 years. It can be sold today for $350,000 before taxes, but if the firm decides to keep it, it can be sold for $100,000 before taxes at the end of year 5 . - The first option is Machine A, which can be purchased for $600,000, but will require $30,000 in installation costs. This machine would be depreciated under the MACRS's 3year recovery period. At the end of its economic life, the machine will have a salvage value of $350,000 before taxes. This machine would require an investment in net working capital of $100,000. - The second option is Machine B, which can be purchased for $550,000, but requires $20,000 in installation costs. This machine would be depreciated under the MACRS's 5 year recovery period. At the end of its economic life, the machine would have a salvage value of $330,000 before taxes. This machine requires no investment in net working capital. The firm has estimated the following EBIT for all three machines: The firm's WACC is 14% and its tax rate is 40%. Calculate the following cash flows for the old machine, machine A, and machine B : - initial investment, - annual after-tax cash flows for each year, and - the terminal cash flow. Determine which machine is more profitable for the company based on - the payback period, - discounted payback period, - net present value, - profitability index, - internal rate of return, and - modified internal rate of return. (b) Determine which machine is more profitable for the company? Machine A Machine B Best Choice? 40 Payback Period 41 Discounted Payback 42 Net Present Value (NPV) 43 Profitability Index (PI) 44 Internal Rate of Return (IRR) 45 MIRR 46 Machine A Mactine B Operating Cash Flows (a) Calculate the Cash Flows Old Machine Machine A Mactine B thcremental Cach Flows Machine A 30 Machine B 31 Initinl Outlay \& Terminal Cash Flow 32. Machine A 33 Machine B 34. ATCF 35 Machine A 30 Machine 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts