Question: Can somebody please help me fill out this chart with cell references? All information needed is present, it's just very confusing to me. The MAVI

Can somebody please help me fill out this chart with cell references? All information needed is present, it's just very confusing to me.

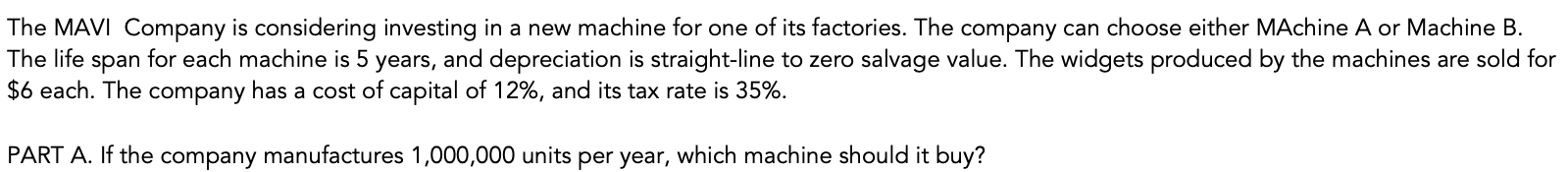

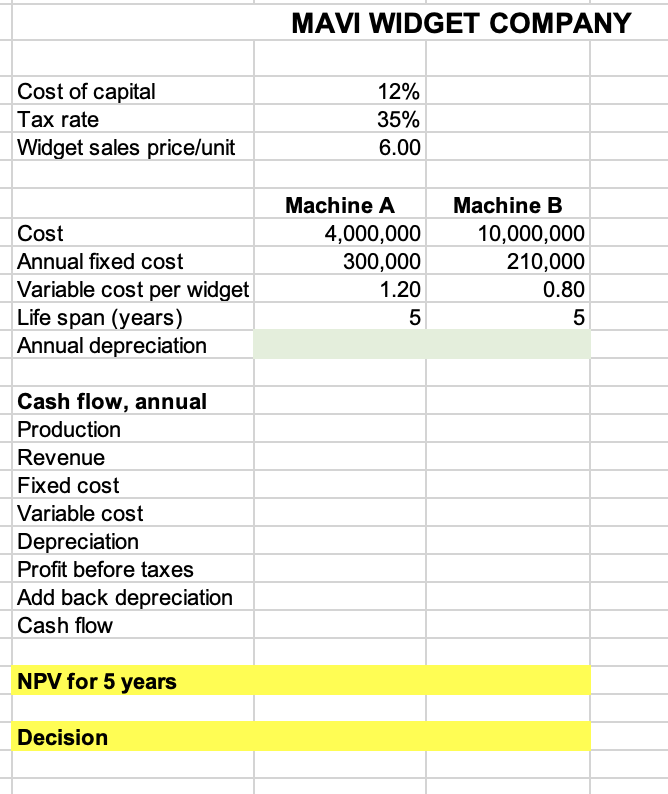

The MAVI Company is considering investing in a new machine for one of its factories. The company can choose either MAchine A or Machine B. The life span for each machine is 5 years, and depreciation is straight-line to zero salvage value. The widgets produced by the machines are sold for $6 each. The company has a cost of capital of 12%, and its tax rate is 35%. PART A. If the company manufactures 1,000,000 units per year, which machine should it buy? MAVI WIDGET COMPANY \begin{tabular}{|l|r|r|} \hline Cost of capital & 12% \\ \hline Tax rate & 35% & \\ \hline Widget sales price/unit & 6.00 & \\ \hline & & \\ \hline Cost & Machine A & Machine B \\ \hline Annual fixed cost & 4,000,000 & 10,000,000 \\ \hline Variable cost per widget & 300,000 & 210,000 \\ \hline Life span (years) & 1.20 & 0.80 \\ \hline A & 5 & 5 \\ \hline \end{tabular} Annual depreciation Cash flow, annual Production Revenue Fixed cost Variable cost Depreciation Profit before taxes Add back depreciation Cash flow NPV for 5 years Decision The MAVI Company is considering investing in a new machine for one of its factories. The company can choose either MAchine A or Machine B. The life span for each machine is 5 years, and depreciation is straight-line to zero salvage value. The widgets produced by the machines are sold for $6 each. The company has a cost of capital of 12%, and its tax rate is 35%. PART A. If the company manufactures 1,000,000 units per year, which machine should it buy? MAVI WIDGET COMPANY \begin{tabular}{|l|r|r|} \hline Cost of capital & 12% \\ \hline Tax rate & 35% & \\ \hline Widget sales price/unit & 6.00 & \\ \hline & & \\ \hline Cost & Machine A & Machine B \\ \hline Annual fixed cost & 4,000,000 & 10,000,000 \\ \hline Variable cost per widget & 300,000 & 210,000 \\ \hline Life span (years) & 1.20 & 0.80 \\ \hline A & 5 & 5 \\ \hline \end{tabular} Annual depreciation Cash flow, annual Production Revenue Fixed cost Variable cost Depreciation Profit before taxes Add back depreciation Cash flow NPV for 5 years Decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts