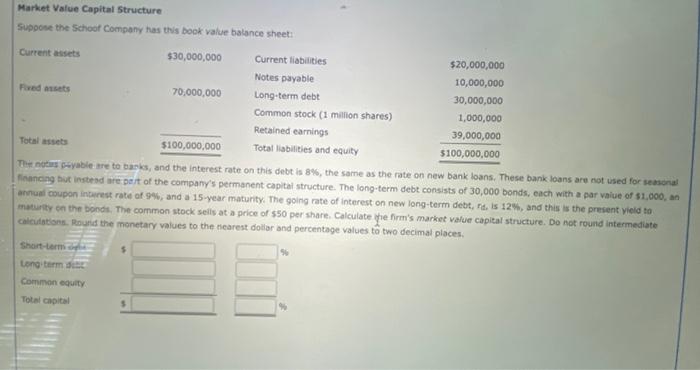

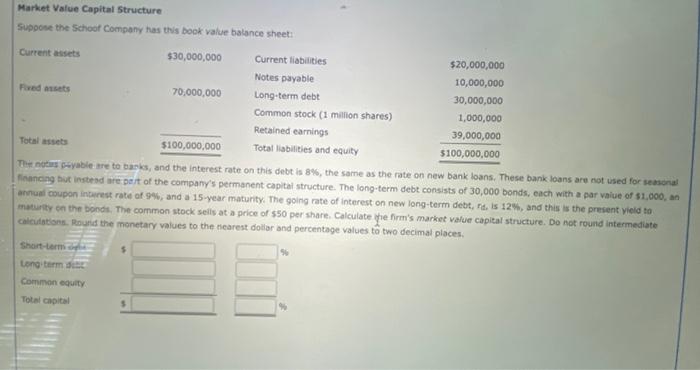

Question: Can someone answer asap please! Market Value Capital Structure Suppose the Schoor Company has this book value balance sheet: annual coupon intarest rate of 9%,

Can someone answer asap please!

Market Value Capital Structure Suppose the Schoor Company has this book value balance sheet: annual coupon intarest rate of 9%, and a 15 -year maturity. The going rate of interest on new long-term debt, nd, is 12%, and this is the present vieid to maturey in the bonds. The common stock seils at a price of $50 per share. Calculate yne firm's market vafue capital structure. Do not round intermediate calculationa. Rouris the monetary values to the nearest dollar and percentage values to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock