Question: can someone answer these? 6,5 Problems 1. Consider a European call option on Stock A that expires on December 21 and has a strike price

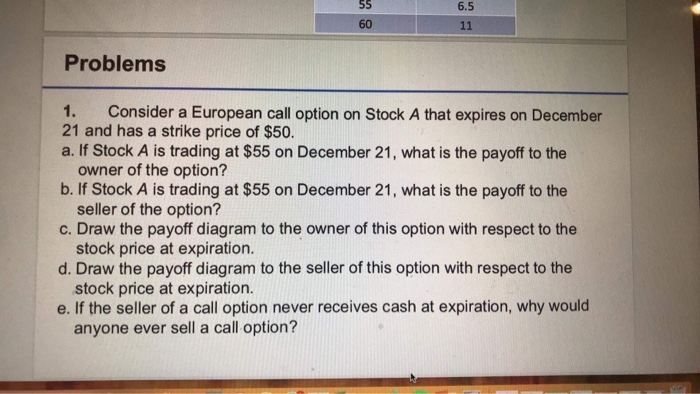

6,5 Problems 1. Consider a European call option on Stock A that expires on December 21 and has a strike price of $50. a. If Stock A is trading at $55 on December 21, what is the payoff to the owner of the option? b. If Stock A is trading at $55 on December 21, what is the payoff to the seller of the option? c. Draw the payoff diagram to the owner of this option with respect to the stock price at expiration. d. Draw the payoff diagram to the seller of this option with respect to the stock price at expiration. e. If the seller of a call option never receives cash at expiration, why would anyone ever sell a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts