Question: Problem 1.2. (12.5) pl Do following problems 1. Consider an European call option with strike price 60, time to maturity is month, currently selling for

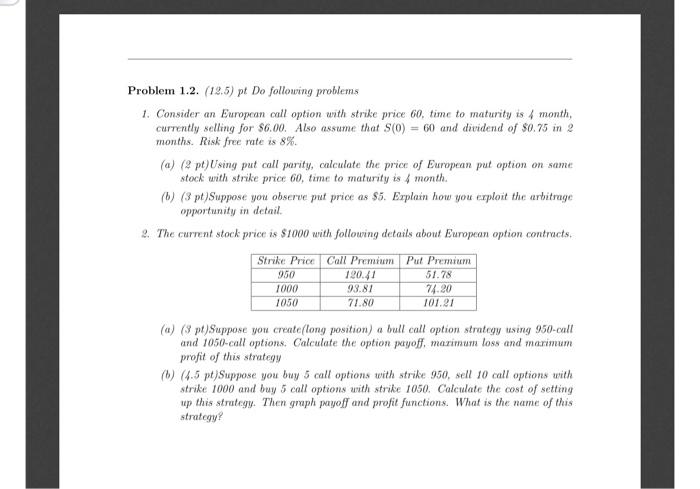

Problem 1.2. (12.5) pl Do following problems 1. Consider an European call option with strike price 60, time to maturity is month, currently selling for $6.00. Also assume that S(O) = 60 and dividend of $0.75 in 2 months. Risk free rate is 8% (a) (pt)Using put call parity, calculate the price of European put option on same stock with strike price 60, time to maturity is 4 month. (W) (3 pt)Suppose you observe put price as $5. Explain how you exploit the arbitrage opportunity in detail. 2. The current stock price is $1000 with following details about European option contracts. Strike Price Call Premium Pul Premium 950 120.41 51.78 1000 93.81 74.20 1050 71.80 101.91 (a) (3 pt)Suppose you create(long position) a bull call option strategy using 950-call and 1050-call options. Calculate the option puryoff, marimum loss and maximum profit of this strategy (O) (4.5 pt)Suppose you buy 5 call options with strike 950, sell 10 call options urith strike 1000 and buy 5 call options with strike 1050. Calculate the cost of setting up this strategy. Then graph payoff and profit functions. What is the name of this strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts