Question: Can someone answer these two questions using the excel template listed below. Thanks! 1. Walton Enterprises, Inc. is considering a proposal for a joint venture

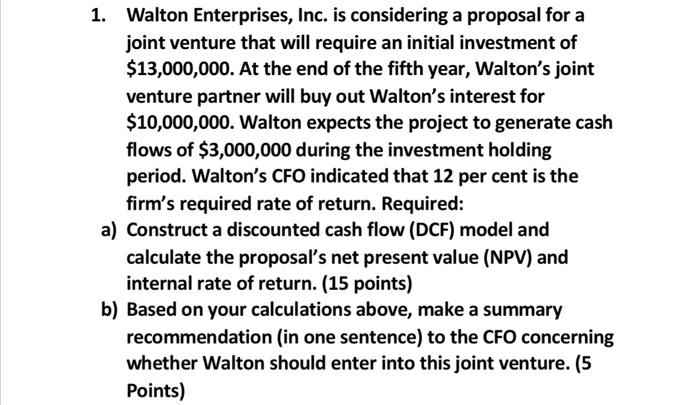

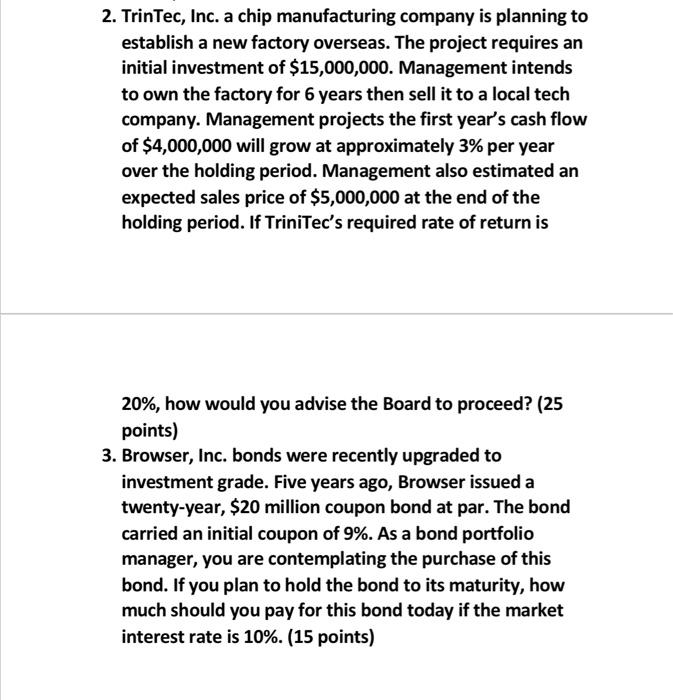

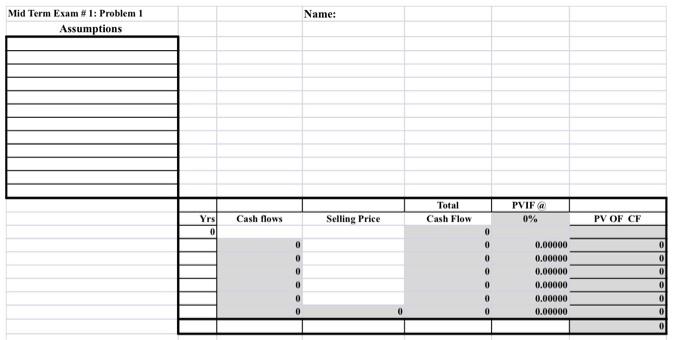

1. Walton Enterprises, Inc. is considering a proposal for a joint venture that will require an initial investment of $$13,000,000. At the end of the fifth year, Walton's joint venture partner will buy out Walton's interest for $10,000,000. Walton expects the project to generate cash flows of $3,000,000 during the investment holding period. Walton's CFO indicated that 12 per cent is the firm's required rate of return. Required: a) Construct a discounted cash flow (DCF) model and calculate the proposal's net present value (NPV) and internal rate of return. (15 points) b) Based on your calculations above, make a summary recommendation (in one sentence) to the CFO concerning whether Walton should enter into this joint venture. (5 Points) 2. TrinTec, Inc. a chip manufacturing company is planning to establish a new factory overseas. The project requires an initial investment of $15,000,000. Management intends to own the factory for 6 years then sell it to a local tech company. Management projects the first year's cash flow of $4,000,000 will grow at approximately 3% per year over the holding period. Management also estimated an expected sales price of $5,000,000 at the end of the holding period. If TriniTec's required rate of return is 20%, how would you advise the Board to proceed? ( 25 points) 3. Browser, Inc. bonds were recently upgraded to investment grade. Five years ago, Browser issued a twenty-year, $20 million coupon bond at par. The bond carried an initial coupon of 9%. As a bond portfolio manager, you are contemplating the purchase of this bond. If you plan to hold the bond to its maturity, how much should you pay for this bond today if the market interest rate is 10%. (15 points) Mid Term Exam \# 1: Problem 1 Name

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts